- United States

- /

- Energy Services

- /

- NYSE:OII

How Investors May Respond To Oceaneering International (OII) Record Q3 Earnings and Defense Segment Growth

Reviewed by Sasha Jovanovic

- Oceaneering International recently reported third-quarter results, highlighting a 9% revenue increase year-over-year to US$742.9 million and a 73% rise in net income to US$71.29 million, with continued share repurchase activity and growing strength in its Aerospace and Defense Technologies segment.

- This performance was supported by major contract wins, robust cash generation, and the company achieving its highest quarterly adjusted EBITDA since 2015, signaling a shift toward greater earnings diversification beyond traditional offshore oil and gas.

- We'll examine how Oceaneering’s record Q3 operating results and defense growth influence its long-term investment narrative and future earnings potential.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Oceaneering International Investment Narrative Recap

To invest in Oceaneering International, you need to believe in the company’s ability to diversify beyond traditional offshore oil and gas, especially as its Aerospace and Defense Technologies segment grows and new contract wins suggest broadening revenue streams. The recent third-quarter earnings beat and ongoing share buybacks reinforce this narrative, but the biggest near-term catalyst remains sustained growth in defense and robotics, while the principal risk centers on declining long-term demand for offshore services. Short-term, the earnings beat does not materially alter the exposure to sector cyclicality or the risk of reduced offshore oil and gas spending.

Among recent announcements, the completed share repurchase of over 4.2 million shares for US$150.77 million underlines management’s focus on returning value to shareholders, even as the company ramps up in new markets. This supports the catalyst of earnings stability through diversified end-markets, particularly if the ADTech segment continues to capture defense-related opportunities.

However, even with this progress, investors should also be aware that ongoing energy transition pressures may still affect…

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's narrative projects $3.1 billion in revenue and $185.9 million in earnings by 2028. This requires 4.2% yearly revenue growth and a decrease of $16.3 million in earnings from $202.2 million today.

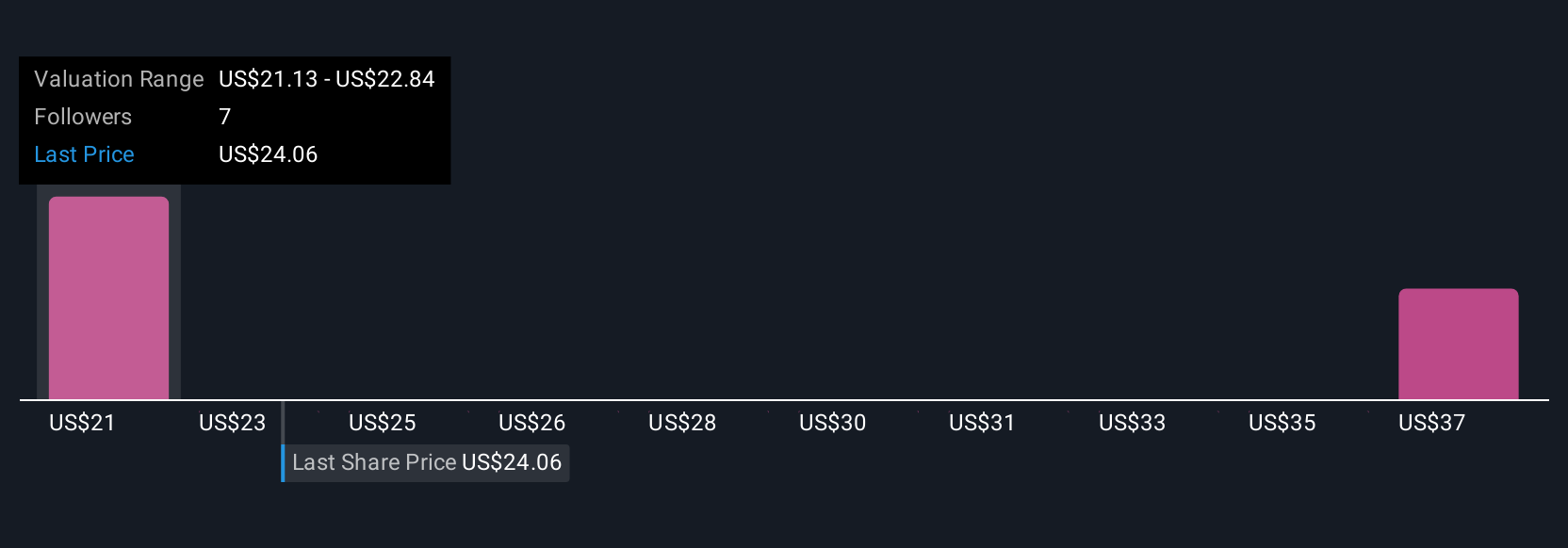

Uncover how Oceaneering International's forecasts yield a $22.38 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Oceaneering International’s fair value in a tight range from US$20.92 to US$22.38, with three independent views. While market participants differ, the company’s growing exposure to less-cyclical defense contracts could have broader implications for long-term earnings profiles.

Explore 3 other fair value estimates on Oceaneering International - why the stock might be worth as much as $22.38!

Build Your Own Oceaneering International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives