- United States

- /

- Energy Services

- /

- NYSE:NINE

Nine Energy Service, Inc.'s (NYSE:NINE) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Those holding Nine Energy Service, Inc. (NYSE:NINE) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 81% share price drop in the last twelve months.

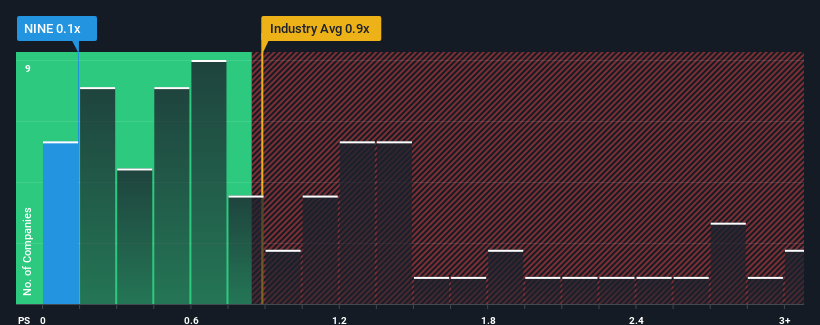

In spite of the firm bounce in price, given about half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider Nine Energy Service as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nine Energy Service

What Does Nine Energy Service's Recent Performance Look Like?

Nine Energy Service could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nine Energy Service.Do Revenue Forecasts Match The Low P/S Ratio?

Nine Energy Service's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 1.5% per annum over the next three years. That's shaping up to be materially lower than the 9.4% each year growth forecast for the broader industry.

In light of this, it's understandable that Nine Energy Service's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Nine Energy Service's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Nine Energy Service maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 5 warning signs for Nine Energy Service (1 is concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nine Energy Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NINE

Nine Energy Service

Operates as an onshore completion services provider that targets unconventional oil and gas resource development in North American basins and internationally.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives