- United States

- /

- Energy Services

- /

- NYSE:NINE

Imagine Owning Nine Energy Service (NYSE:NINE) And Wondering If The 20% Share Price Slide Is Justified

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Nine Energy Service, Inc. (NYSE:NINE) shareholders over the last year, as the share price declined 20%. That's disappointing when you consider the market returned 0.9%. Nine Energy Service may have better days ahead, of course; we've only looked at a one year period. The last week also saw the share price slip down another 18%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Nine Energy Service

Given that Nine Energy Service didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Nine Energy Service grew its revenue by 52% over the last year. That's well above most other pre-profit companies. The share price drop of 20% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

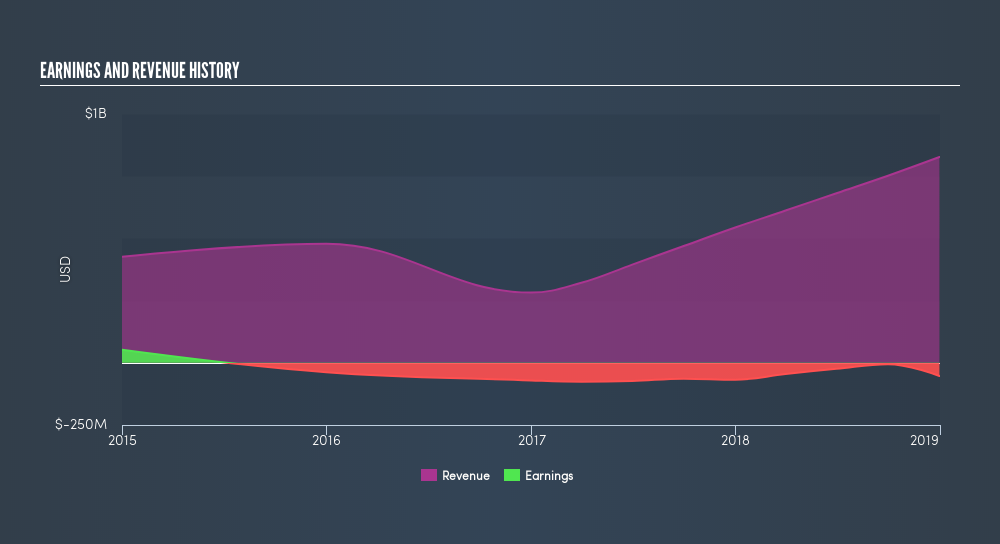

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Nine Energy Service's financial health with this freereport on its balance sheet.

A Different Perspective

While Nine Energy Service shareholders are down 20% for the year, the market itself is up 0.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 15% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Nine Energy Service better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:NINE

Nine Energy Service

Operates as an onshore completion services provider that targets unconventional oil and gas resource development in North American basins and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives