- United States

- /

- Energy Services

- /

- NYSE:NINE

A Piece Of The Puzzle Missing From Nine Energy Service, Inc.'s (NYSE:NINE) Share Price

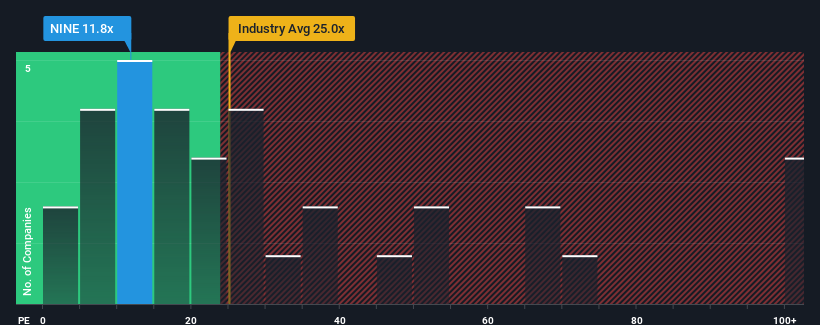

Nine Energy Service, Inc.'s (NYSE:NINE) price-to-earnings (or "P/E") ratio of 11.8x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 15x and even P/E's above 30x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Nine Energy Service could be doing better as it's been growing earnings less than most other companies lately. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

Check out our latest analysis for Nine Energy Service

Is There Any Growth For Nine Energy Service?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nine Energy Service's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Turning to the outlook, the next three years should generate growth of 44% per year as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 9.8% per annum growth forecast for the broader market.

In light of this, it's peculiar that Nine Energy Service's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Nine Energy Service's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nine Energy Service currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 5 warning signs for Nine Energy Service (2 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Nine Energy Service, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nine Energy Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NINE

Nine Energy Service

Operates as an onshore completion services provider that targets unconventional oil and gas resource development in North American basins and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives