Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that NACCO Industries, Inc. (NYSE:NC) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does NACCO Industries Carry?

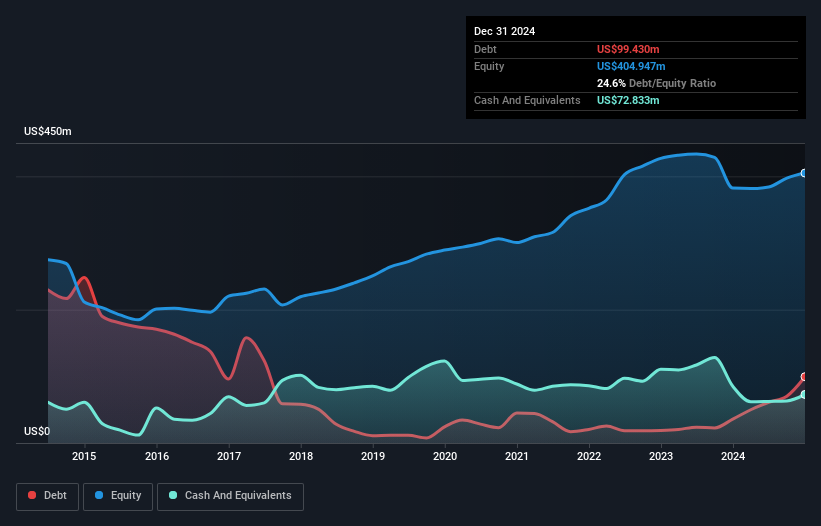

You can click the graphic below for the historical numbers, but it shows that as of December 2024 NACCO Industries had US$99.4m of debt, an increase on US$35.8m, over one year. On the flip side, it has US$72.8m in cash leading to net debt of about US$26.6m.

How Strong Is NACCO Industries' Balance Sheet?

According to the last reported balance sheet, NACCO Industries had liabilities of US$64.9m due within 12 months, and liabilities of US$161.9m due beyond 12 months. Offsetting these obligations, it had cash of US$72.8m as well as receivables valued at US$55.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$98.4m.

This deficit isn't so bad because NACCO Industries is worth US$272.2m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But it is NACCO Industries's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot .

View our latest analysis for NACCO Industries

Over 12 months, NACCO Industries reported revenue of US$238m, which is a gain of 11%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months NACCO Industries produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable US$43m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled US$33m in negative free cash flow over the last twelve months. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example NACCO Industries has 3 warning signs (and 1 which is concerning) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if NACCO Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NC

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives