- United States

- /

- Energy Services

- /

- NYSE:NBR

Investors Give Nabors Industries Ltd. (NYSE:NBR) Shares A 26% Hiding

Nabors Industries Ltd. (NYSE:NBR) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

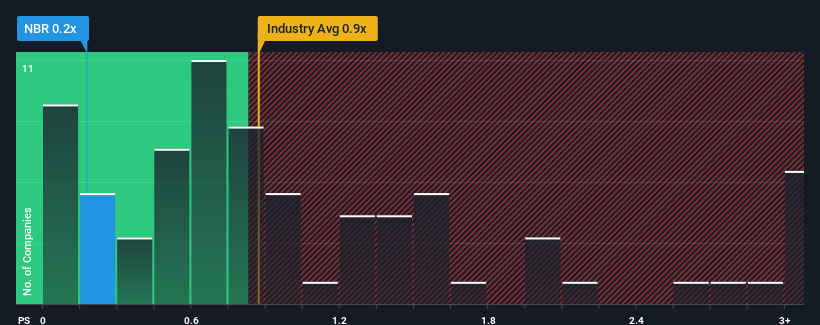

Since its price has dipped substantially, it would be understandable if you think Nabors Industries is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United States' Energy Services industry have P/S ratios above 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nabors Industries

What Does Nabors Industries' Recent Performance Look Like?

Nabors Industries could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Nabors Industries will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Nabors Industries would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.8%. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.0% each year during the coming three years according to the seven analysts following the company. That's shaping up to be similar to the 3.8% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Nabors Industries' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Nabors Industries' P/S?

The southerly movements of Nabors Industries' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Nabors Industries currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Nabors Industries with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Nabors Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nabors Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NBR

Nabors Industries

Provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives