- United States

- /

- Oil and Gas

- /

- NYSE:MUR

Evaluating Murphy Oil's (MUR) Valuation as Analyst Optimism Rises on Stronger Results and Dividend Commitment

Reviewed by Kshitija Bhandaru

Murphy Oil (NYSE:MUR) has declared a quarterly dividend of $0.325 per share, affirming its commitment to shareholder returns. This announcement comes as the company reports higher-than-expected oil production and improved cash flow.

See our latest analysis for Murphy Oil.

Murphy Oil’s steadier operational performance and renewed optimism around its international prospects have kept sentiment constructive, even as the stock’s recent share price returns are little changed. In the bigger picture, the company’s 1-year total shareholder return has been flat and long-term gains remain modest. However, improved cash flow and efficient capital allocation suggest real momentum could be building just below the surface.

If you’re curious about what other energy names are showing strength, now’s an excellent time to discover fast growing stocks with high insider ownership.

With recent operational improvements and positive analyst commentary, investors may be wondering if Murphy Oil is currently undervalued and ripe for opportunity, or if the market has already factored in its next chapter of growth.

Most Popular Narrative: 10.6% Overvalued

Murphy Oil's most popular narrative suggests the stock is priced above its estimated fair value, with the calculation pointing below the current closing price. Investors are weighing robust operating trends against questions about long-term upside at these levels.

Significant exploration and appraisal activity across the Gulf of Mexico, Vietnam, and Côte d'Ivoire is poised to potentially add substantial new reserves and long-lived, high-margin production. This is expected to support long-term revenue growth and future cash flows as global energy demand rises.

Wondering what’s fueling such a bold valuation despite recent flat returns? The key factors are the projected pace of profit expansion and earnings quality. Ever seen consensus this split over major offshore projects and financial discipline? The numbers driving this fair value might catch you off guard.

Result: Fair Value of $27.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in deepwater projects or a sudden drop in oil prices could quickly challenge the outlook for Murphy Oil’s earnings momentum.

Find out about the key risks to this Murphy Oil narrative.

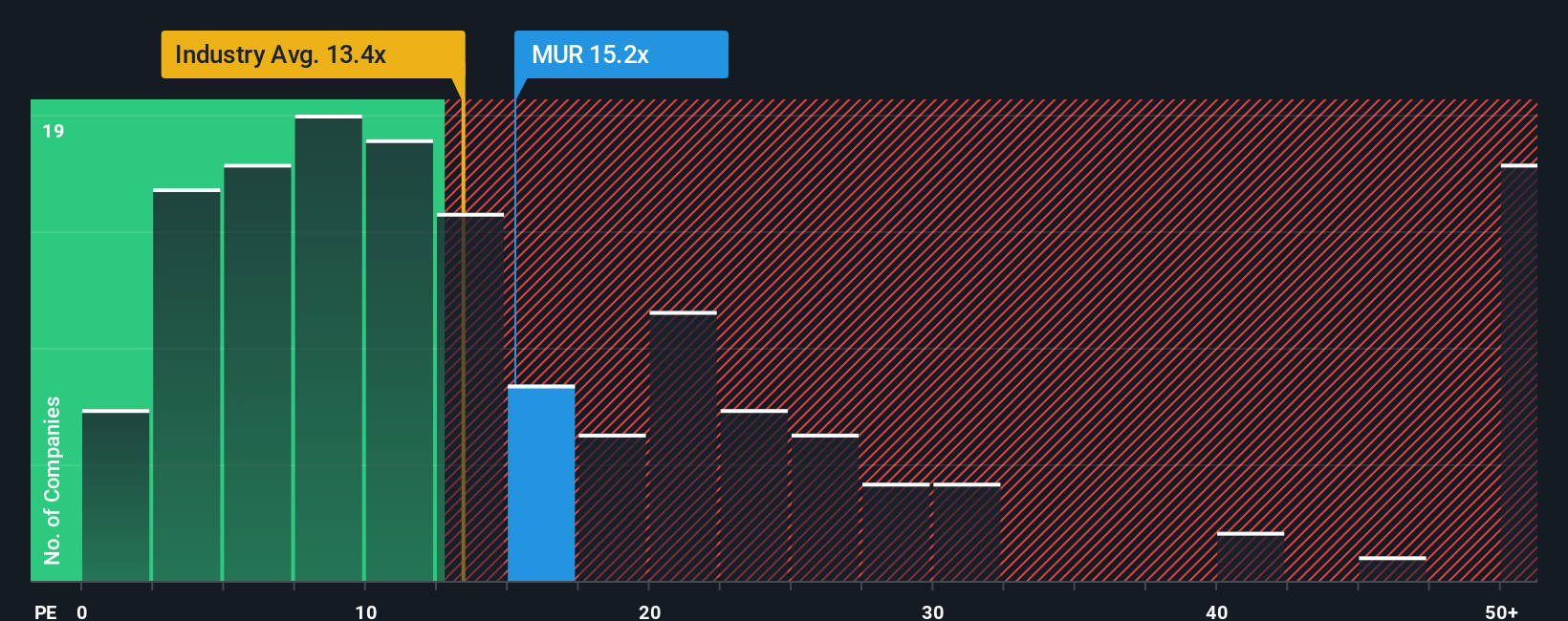

Another View: The Multiples Approach

Looking through another lens, Murphy Oil's price-to-earnings ratio stands at 15.2x. This is higher than both its industry peers (8.5x) and the broader US Oil and Gas average (13.1x). Meanwhile, the fair ratio, where the market could eventually settle, is estimated at 18.5x. The current premium suggests investors have higher expectations for Murphy Oil. The question remains whether this optimism reflects true opportunity or introduces valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Murphy Oil Narrative

If you find yourself with a different take or want to dig deeper into the numbers, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Murphy Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one company. The Simply Wall Street Screener is your shortcut to fresh opportunities that could give your portfolio an advantage over the crowd.

- Unlock higher potential returns by scanning these 896 undervalued stocks based on cash flows, which may be trading below their true worth and could be ready for a re-rating.

- Capitalize on growing health tech trends with these 31 healthcare AI stocks, which is positioned to reshape patient care and medical breakthroughs.

- Tap into powerful tech momentum with these 24 AI penny stocks, leading the way in artificial intelligence innovation and transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives