- United States

- /

- Oil and Gas

- /

- NYSE:MTDR

Is Matador Resources a Bargain After 23% Drop Amid Oil Price Volatility in 2025?

Reviewed by Bailey Pemberton

If you have Matador Resources on your radar, you are hardly alone. The stock is one of those rare energy names that often prompts spirited debate. Is it an overlooked gem, or a case of opportunity already realized? With shares closing recently at $44.83, investors might be wondering if the tide is about to turn after a bumpy spell. Over the past week, Matador slipped 1.8%, capping off a 7.1% decline in the last month. The year-to-date picture shows a decline of 22.8%. Those numbers may appear rough, but it is worth noting that over five years, Matador has risen an impressive 429.5%, reminding us of this company’s long-term potential.

Some of these short-term declines reflect a broader recalibration across energy names as the market digests shifting oil prices and macroeconomic uncertainty. While there has not been a singular dramatic event influencing Matador’s stock lately, the price moves appear to capture changing investor risk appetite and evolving industry sentiment.

Digging into the metrics that matter, Matador boasts a pristine value score of 6 out of 6, indicating that it appears undervalued based on all six major valuation checks. That is a rare feat and one that sets the stage for a much closer look at exactly how the company is stacking up using different valuation methods. Up next, let us break down these approaches and, just as importantly, touch on a smarter way to assess Matador’s true potential before you make your next move.

Why Matador Resources is lagging behind its peers

Approach 1: Matador Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This method helps investors gauge what a business is truly worth today, based on its ability to generate future cash flow.

For Matador Resources, the latest twelve months’ Free Cash Flow (FCF) stands at $464.43 million. Analyst forecasts suggest this figure is set to climb in the coming years, with projected FCF reaching $925.36 million by 2029. Over the next decade, projections point to FCF remaining below the billion-dollar mark, with annual estimates ranging from about $817.75 million (2026) to roughly $891.64 million (2035). Importantly, only the first five years are driven by analyst models, and all longer-term projections are systematic extrapolations.

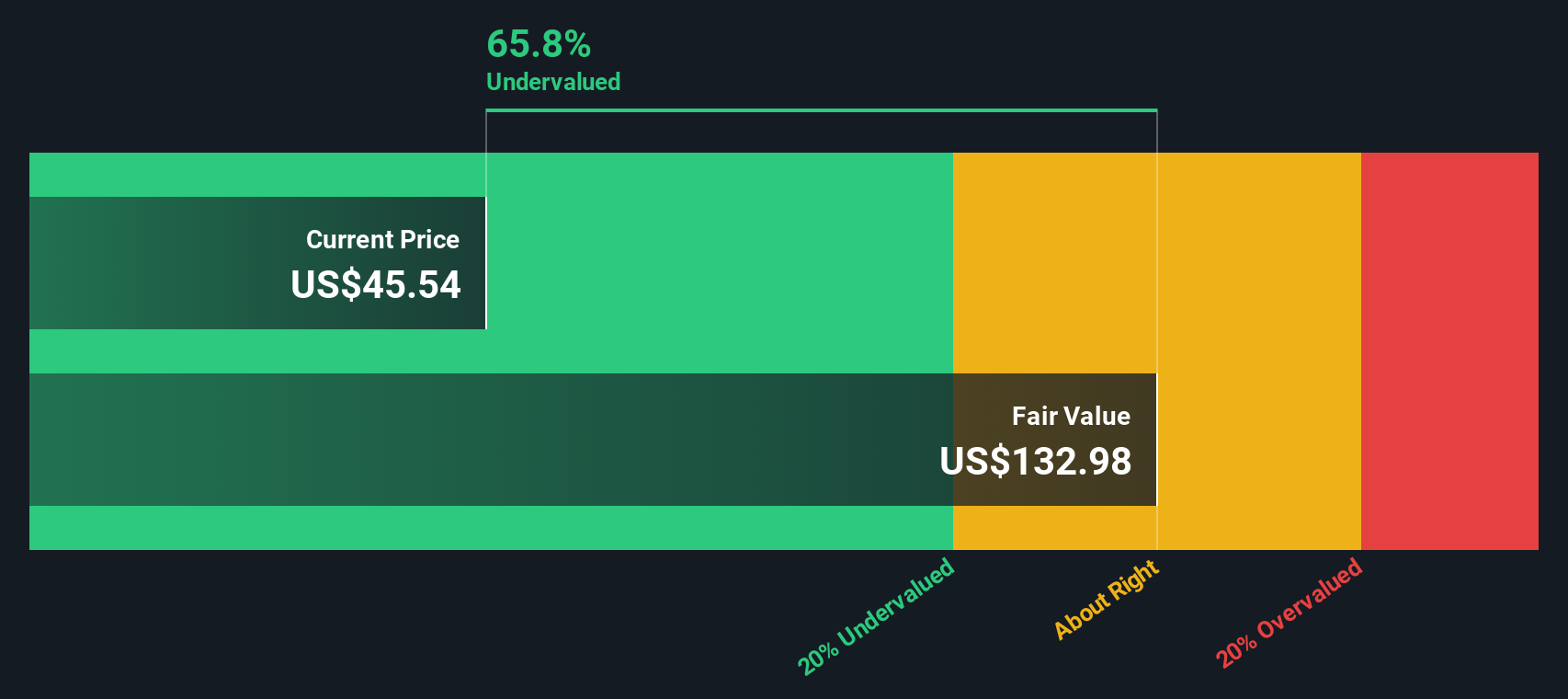

Applying the DCF approach results in an estimated intrinsic value of $128.45 per share. With shares recently closing at $44.83, this suggests that Matador Resources is trading at a substantial 65.1% discount to its calculated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Matador Resources is undervalued by 65.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Matador Resources Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred valuation metric for profitable companies because it directly relates a company’s market price to its current earnings power. For companies with steady or growing profits, the PE ratio helps investors compare how much they are paying for each dollar of earnings. This is a vital tool in evaluating whether a stock is cheap or expensive relative to its underlying performance.

It is important to remember that what makes for a “normal” or “fair” PE ratio is shaped by growth expectations and the risks associated with a business. Companies with higher anticipated earnings growth or lower risk profiles tend to trade at higher PE multiples, while those facing more volatility or uncertainty usually see lower valuations.

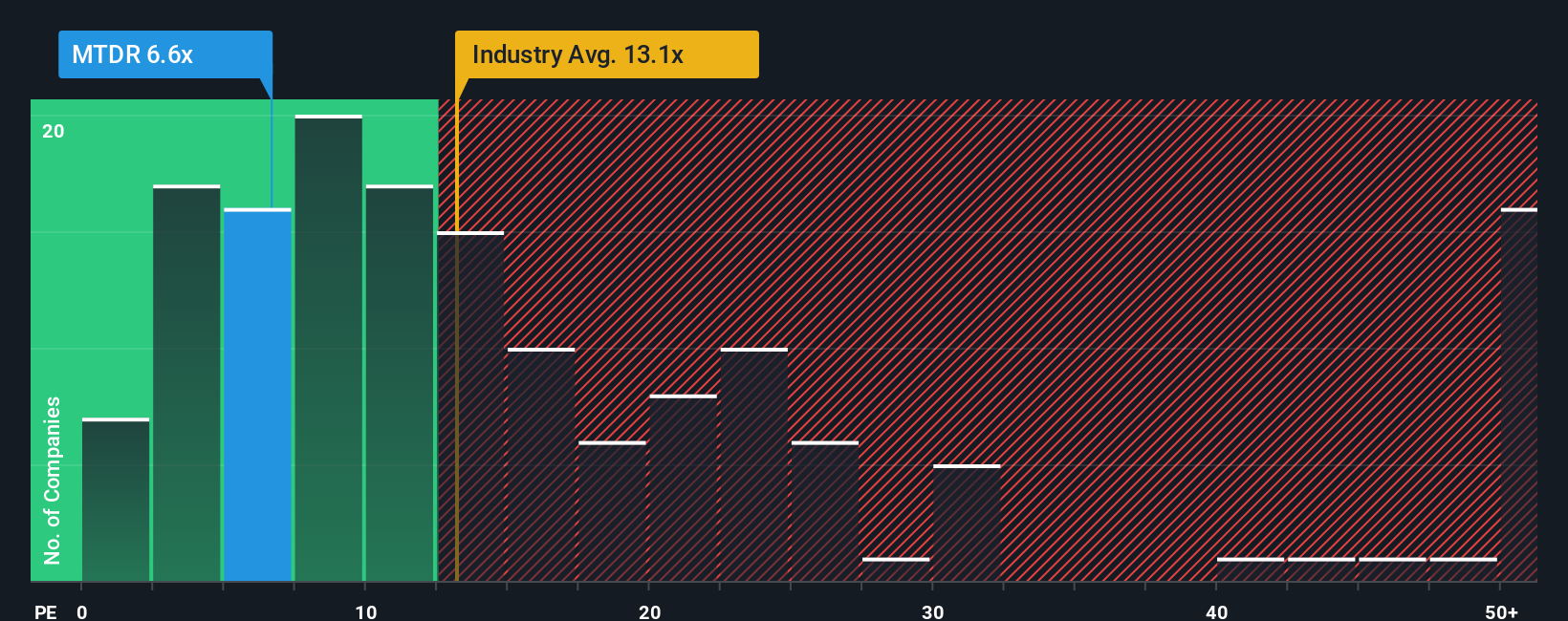

Matador Resources currently boasts a PE ratio of 6.54x. That is noticeably lower than both the industry average of 13.14x and the peer group average of 13.88x, suggesting the stock trades at a considerable discount to similar companies in the oil and gas sector. However, instead of looking only at simple averages, Simply Wall St introduces the “Fair Ratio,” a tailored metric that factors in Matador’s earnings outlook, profit margins, industry peer set, market capitalization, and risk profile. With a Fair Ratio of 14.09x, the analysis accounts for a broader set of company-specific characteristics, going beyond broad industry or peer group numbers.

This approach is more robust than comparing plain averages because it recognizes the reality that each business’s growth path and risks are unique. When we compare Matador’s current 6.54x PE ratio to its Fair Ratio of 14.09x, it is clear the stock is trading well below where it arguably should be, pointing to attractive relative value for investors considering its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Matador Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives go beyond the numbers by allowing you to build a story around your expectations for a company, tying your view of its future prospects directly to your own estimates of fair value, revenue, earnings, and profit margins.

A Narrative links a company’s real-world story to a financial forecast and ultimately to a tailored fair value calculation, helping you see not just what the business is worth, but why. Narratives are an easy-to-use tool available for free to everyone on Simply Wall St's Community page, where millions of investors build, share, and update their own perspectives as new news or earnings results come in.

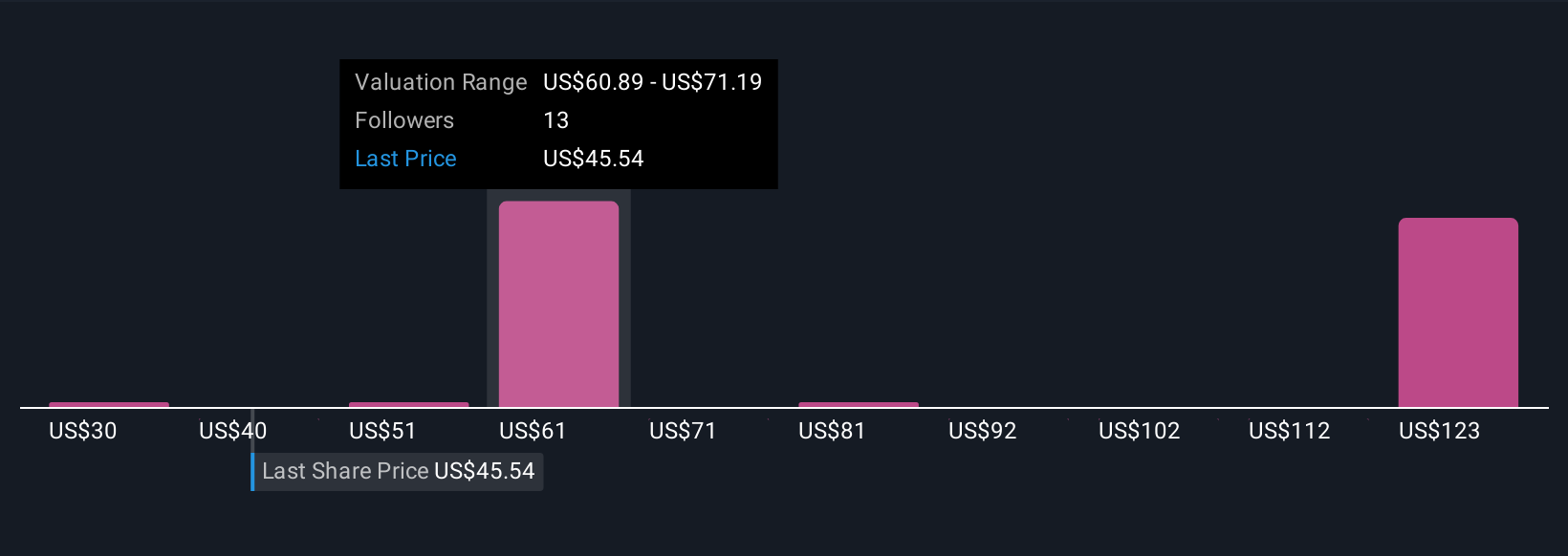

With Narratives, you can make smarter investment decisions by comparing your calculated fair value to the current share price, deciding when to buy, hold, or sell based on your unique assumptions. For Matador Resources, for example, some investors might be bullish and see a fair value as high as $89.00 per share, while the most cautious might set it as low as $48.00, depending on how they interpret future growth, risks, and industry trends.

Do you think there's more to the story for Matador Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTDR

Matador Resources

An independent energy company, engages in the acquisition, exploration, development, and production of oil and natural gas resources in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives