- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Marathon Petroleum (NYSE:MPC) Has Affirmed Its Dividend Of US$0.58

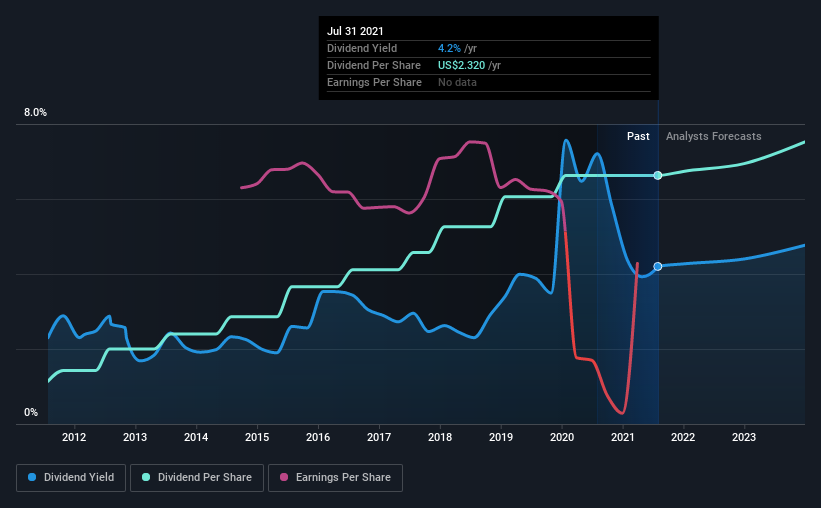

Marathon Petroleum Corporation (NYSE:MPC) has announced that it will pay a dividend of US$0.58 per share on the 10th of September. Based on this payment, the dividend yield will be 4.2%, which is fairly typical for the industry.

Check out our latest analysis for Marathon Petroleum

Marathon Petroleum Might Find It Hard To Continue The Dividend

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Marathon Petroleum isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Looking forward, earnings per share could 50.1% over the next year if the trend of the last few years can't be broken. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Marathon Petroleum Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2011, the first annual payment was US$0.40, compared to the most recent full-year payment of US$2.32. This implies that the company grew its distributions at a yearly rate of about 19% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Marathon Petroleum's EPS has fallen by approximately 50% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Marathon Petroleum's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for Marathon Petroleum you should be aware of, and 1 of them shouldn't be ignored. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade Marathon Petroleum, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives