- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Is There More Upside Ahead for Marathon Petroleum After Its 35.8% Rally in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Marathon Petroleum right now, you are not alone. After a stellar 35.8% run-up year-to-date and a jaw-dropping 593% five-year return, it is only natural to wonder what comes next. Is there still more road left to run, or is the check engine light about to come on? Over just the last week, the stock has jumped 5.1% after a softer 30-day patch, hinting at renewed optimism among investors despite some turbulence.

Much of this movement is tied to increased refinery utilization rates and upbeat demand forecasts, both of which have benefitted the entire refining space. Marathon Petroleum has also been making headlines for its recent divestitures and acceleration of share buybacks, sending a clear signal to the market about its confidence in long-term value creation. These strategic moves have added fuel to the fire for bullish investors, while also changing the risk calculus for the more cautious crowd.

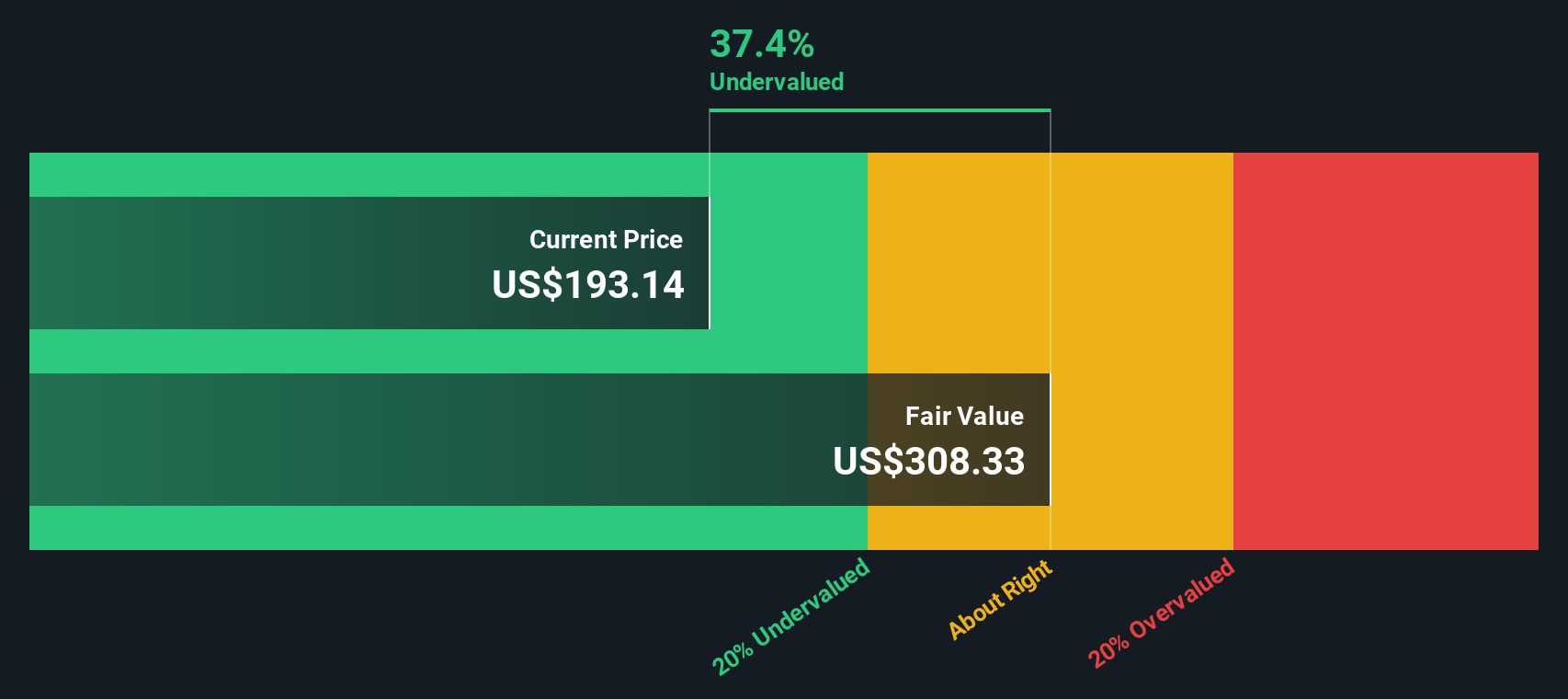

Looking beneath the surface, Marathon Petroleum’s valuation story is a bit of a mixed bag. According to our six-point undervaluation framework, the company checks just two boxes, giving it a value score of 2. That is not necessarily a red flag, but it does mean a deeper dive is essential before making a move.

Let’s unpack how Marathon Petroleum stacks up using the usual valuation playbook. Then, stick around, because there is an even more insightful angle on value you will not want to miss at the end.

Marathon Petroleum scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Marathon Petroleum Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and then discounting those figures back to today’s dollars. This reflects both projected growth and the time value of money.

For Marathon Petroleum, the DCF model starts with its latest twelve-month free cash flow, which stands at approximately $4.27 billion. Analysts offer annual estimates for the next five years, and Simply Wall St extends these projections for a full decade. By 2028, free cash flow is forecasted to reach around $7.09 billion, with further expected increases to over $9.9 billion by 2035 based on trend extrapolation.

Based on these projections and the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Marathon Petroleum stands at $553.61 per share. This figure is notable because it implies the stock is trading at a 65.3% discount to its calculated fair value.

If accurate, this sizable gap suggests Marathon Petroleum is considerably undervalued in the market based on its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marathon Petroleum is undervalued by 65.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

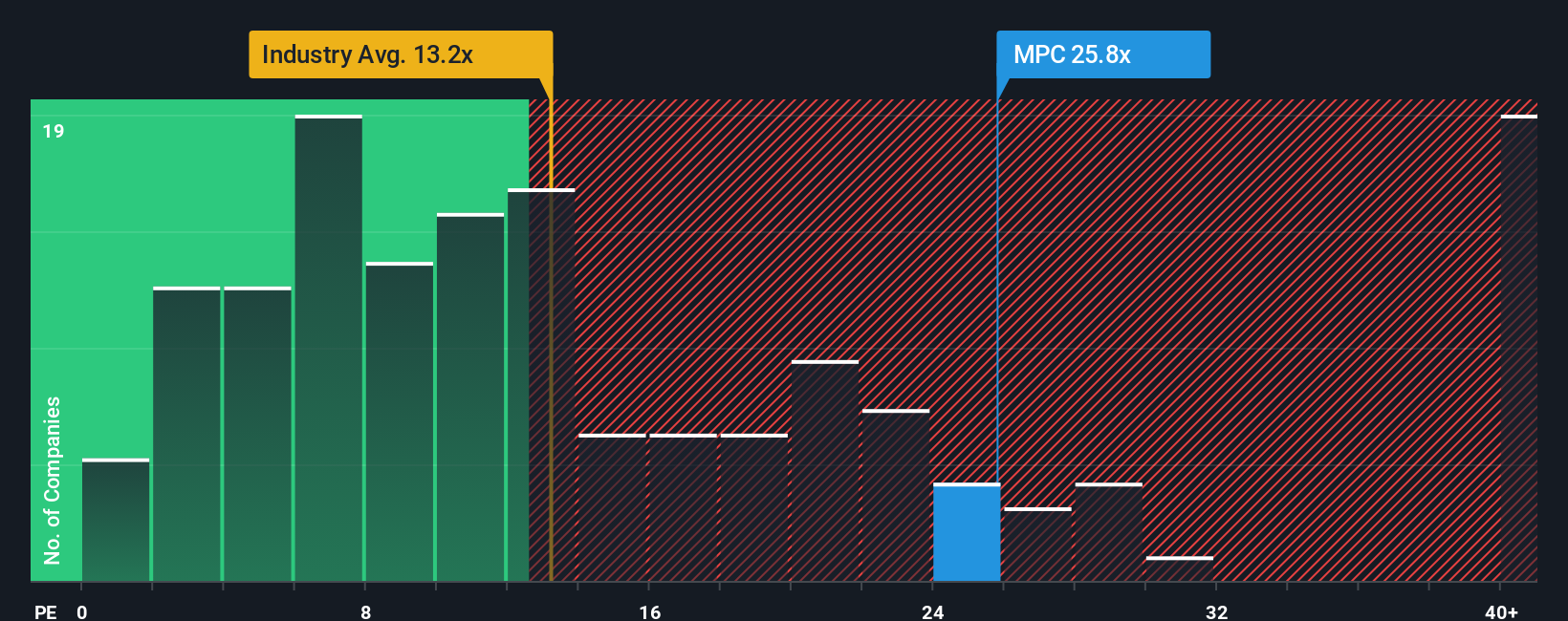

Approach 2: Marathon Petroleum Price vs Earnings

The Price-to-Earnings (PE) ratio is a fundamental valuation tool, especially useful for profitable companies like Marathon Petroleum. It helps investors gauge how much they are paying for each dollar of earnings, giving a window into both current profitability and market expectations for future growth.

What qualifies as a "normal" or "fair" PE ratio depends on the company’s growth outlook, risk profile, and overall market sentiment. A higher expected earnings growth or lower risk can justify a higher PE, while stagnant growth or uncertainties tend to bring valuations down.

Marathon Petroleum is currently trading at a PE of 27.4x. For context, the average PE across peers is 25.6x, while the broader oil and gas industry average sits much lower, at 13.1x. The Simply Wall St "Fair Ratio" comes in at 20.7x. This figure factors in not just the peer group and industry but also Marathon’s specific growth prospects, profit margins, market cap, and risk profile, giving a more customized benchmark for fair value.

Comparing PE ratios to only industry or peer averages can be misleading, since it misses key company-specific factors. The Fair Ratio goes further, weighing precisely what makes Marathon Petroleum unique in its sector and market, so the valuation comparison is far more meaningful.

Since the current PE of 27.4x is meaningfully higher than the Fair Ratio of 20.7x, this suggests the stock may be priced above its fair value based on earnings fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

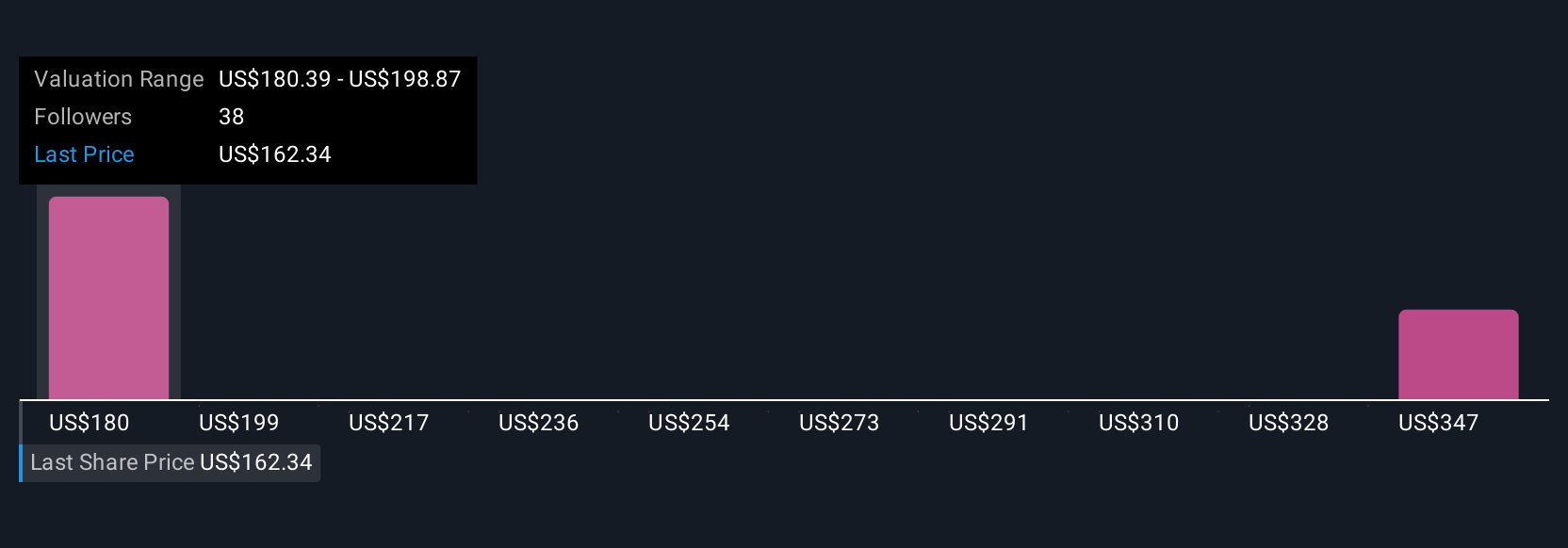

Upgrade Your Decision Making: Choose your Marathon Petroleum Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful story that you build about a company with your unique perspective on where it is headed. This connects key financial assumptions, such as fair value, revenue growth, and profit margins, to the latest numbers and forecasts.

With Narratives, you do more than just look at the data. You link Marathon Petroleum’s business story directly to your financial view, then see how this translates into a fair value estimate. Narratives are easy to create and access on Simply Wall St’s Community page, where millions of investors share and update their perspectives in real time as news breaks or earnings are announced.

This empowers you to make smarter decisions. You can instantly compare your Narrative’s Fair Value to the current share price and decide if the stock aligns with your goals. For example, some investors see strong refining margins and capital returns and set a bullish Narrative with a high fair value of $206.00. Others, wary of fossil fuel risks and stricter regulations, assign a more cautious fair value of just $142.00. Narratives make it straightforward to see which story you believe and to act with confidence as new data emerges.

Do you think there's more to the story for Marathon Petroleum? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives