- United States

- /

- Energy Services

- /

- NYSE:LBRT

Do Liberty Energy’s (LBRT) Dividend Hike and Board Shakeup Reveal Shifting Priorities in Power Strategy?

Reviewed by Sasha Jovanovic

- Liberty Energy Inc. recently reported third quarter 2025 earnings, highlighting a year-over-year decrease in sales to US$947.4 million and net income to US$43.06 million, while also announcing a 13% increase in its quarterly dividend and the addition of Alice Yake to its Board of Directors.

- The company's decision to boost its dividend and appoint a board member with deep expertise in power and grid transformation signals a focus on long-term stability and energy innovation despite industry headwinds.

- We will consider how Liberty's dividend increase and board appointment could influence its long-term investment outlook amid evolving power generation ambitions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Liberty Energy Investment Narrative Recap

Liberty Energy’s current investment case rests on belief in ongoing demand for its core completion services and successful power-generation expansion, even as oilfield activity softens. The recent Q3 2025 results, highlighting lower sales, earnings, and profit margins, do not materially shift the immediate risk: weakening completions activity and service pricing, which could further pressure performance and slow growth in the near term.

Of the latest announcements, the company’s 13% dividend increase stands out, as it comes during a period of falling earnings. While higher dividends may appeal to shareholders, the sustainability of such payouts could be challenged if revenue and margins remain under pressure from industry headwinds.

However, investors should also consider that, despite the increased dividend, ongoing declines in completions activity could push management to further limit future investment and growth initiatives if conditions worsen, meaning ...

Read the full narrative on Liberty Energy (it's free!)

Liberty Energy's narrative projects $4.3 billion revenue and $41.3 million earnings by 2028. This requires 1.8% yearly revenue growth and a $175.5 million earnings decrease from $216.8 million today.

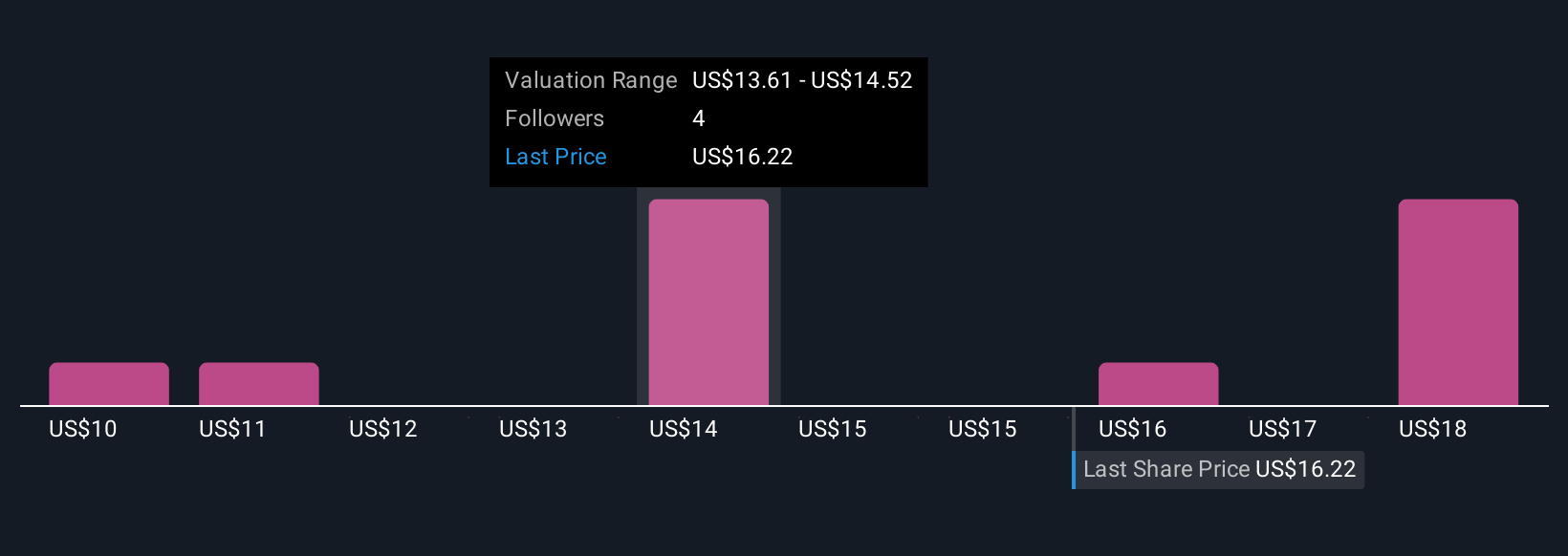

Uncover how Liberty Energy's forecasts yield a $14.61 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Five member fair value estimates from the Simply Wall St Community range between US$10 and US$23.91 per share. With current earnings expected to decline and sector risks persisting, investors should weigh the wide range of value opinions before deciding on Liberty Energy’s prospects.

Explore 5 other fair value estimates on Liberty Energy - why the stock might be worth 35% less than the current price!

Build Your Own Liberty Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liberty Energy research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Liberty Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liberty Energy's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LBRT

Liberty Energy

Provides hydraulic fracturing services and related technologies to onshore oil and natural gas exploration, and production companies in North America.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives