- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Is There Now an Opportunity in Kinetik Holdings After Recent Double-Digit Share Price Drop?

Reviewed by Bailey Pemberton

If you are watching Kinetik Holdings and wondering whether now is the right moment to act, you are definitely not alone. The stock has driven quite a debate this year, down 34.4% since January and recently sliding another 15.4% this past week. Despite these short-term headwinds, it is striking to note that investors who have held on for three years are still up by 40.7%. With a last close at $38.56, Kinetik’s price chart has been anything but boring.

These moves have not come out of nowhere. Broader market volatility and shifting investor appetite for energy infrastructure companies have clearly played a role, sparking new questions about whether past risks are finally coming home to roost or, conversely, if the market might be underappreciating Kinetik’s potential. If you are sensing there might be an opportunity hiding in all this drama, you are in good company.

Let’s get straight to the numbers. Out of six key valuation checks, Kinetik scores a 3, so it passes half of our undervaluation measures. That is not a slam dunk, but it is a signal worth a closer look, especially for investors eager to spot value before the crowd does.

We are about to break down three major approaches to valuing Kinetik Holdings and look at what the numbers are really telling us. Stick around, though, because after that we will cover how you can go beyond formulas for an even richer perspective on what the stock is truly worth.

Why Kinetik Holdings is lagging behind its peers

Approach 1: Kinetik Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollar value. This method aims to capture what Kinetik Holdings is really worth based on its ability to generate cash in the years ahead.

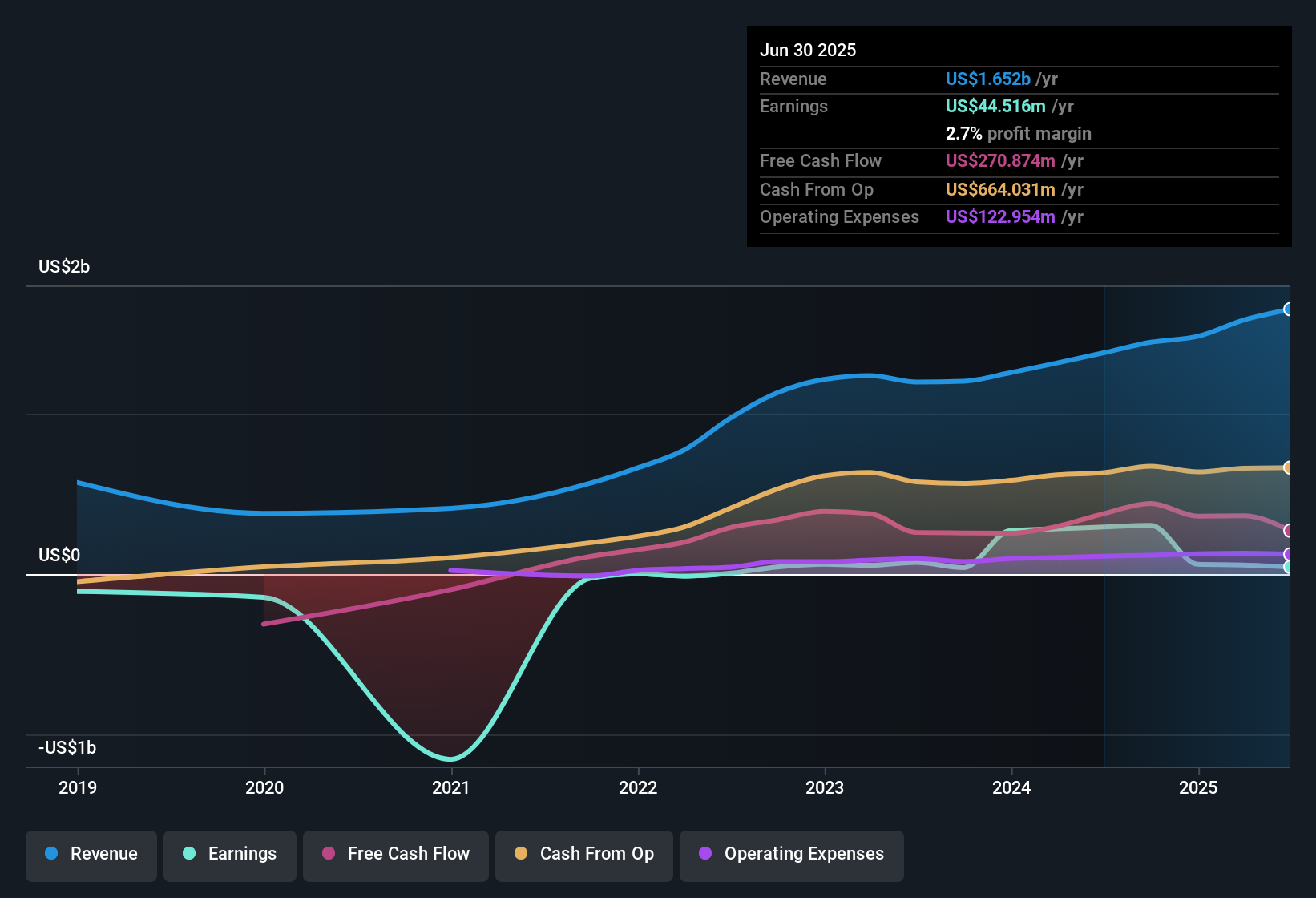

Currently, Kinetik Holdings reports a Free Cash Flow of $287.35 million. Analyst estimates expect that by 2029, annual Free Cash Flow could reach $905 million. The forecasted figures for the next decade, combining both direct analyst estimates and further extrapolations, suggest steady growth in Kinetik's cash-generating power.

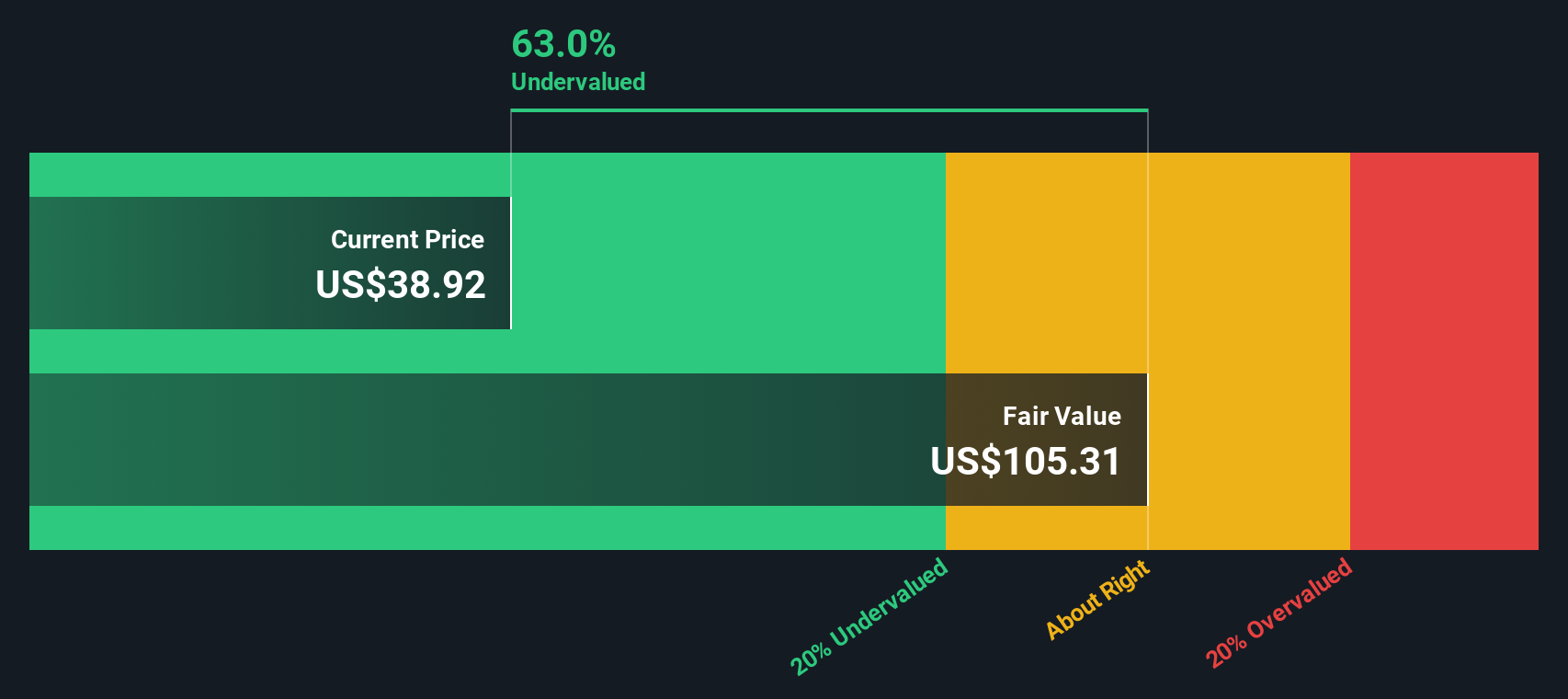

Based on these projections and factoring in the standard DCF discounting, the estimated intrinsic value per share stands at $105.31. This is considerably higher than the current market price of $38.56, implying the stock is trading at a 63.4 percent discount to its DCF-based fair value.

In other words, according to the DCF analysis, Kinetik Holdings appears significantly undervalued at today’s price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kinetik Holdings is undervalued by 63.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kinetik Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies because it tells us how much investors are willing to pay per dollar of current earnings. For profitable businesses like Kinetik Holdings, the PE ratio can quickly highlight whether the market’s expectations are running high or low relative to the company’s actual results.

A "normal" or "fair" PE ratio for a stock depends on a blend of factors, mainly its growth prospects and risk profile. Higher expected growth and lower risk typically justify a higher PE, while companies with slower growth or greater uncertainty often trade at lower multiples.

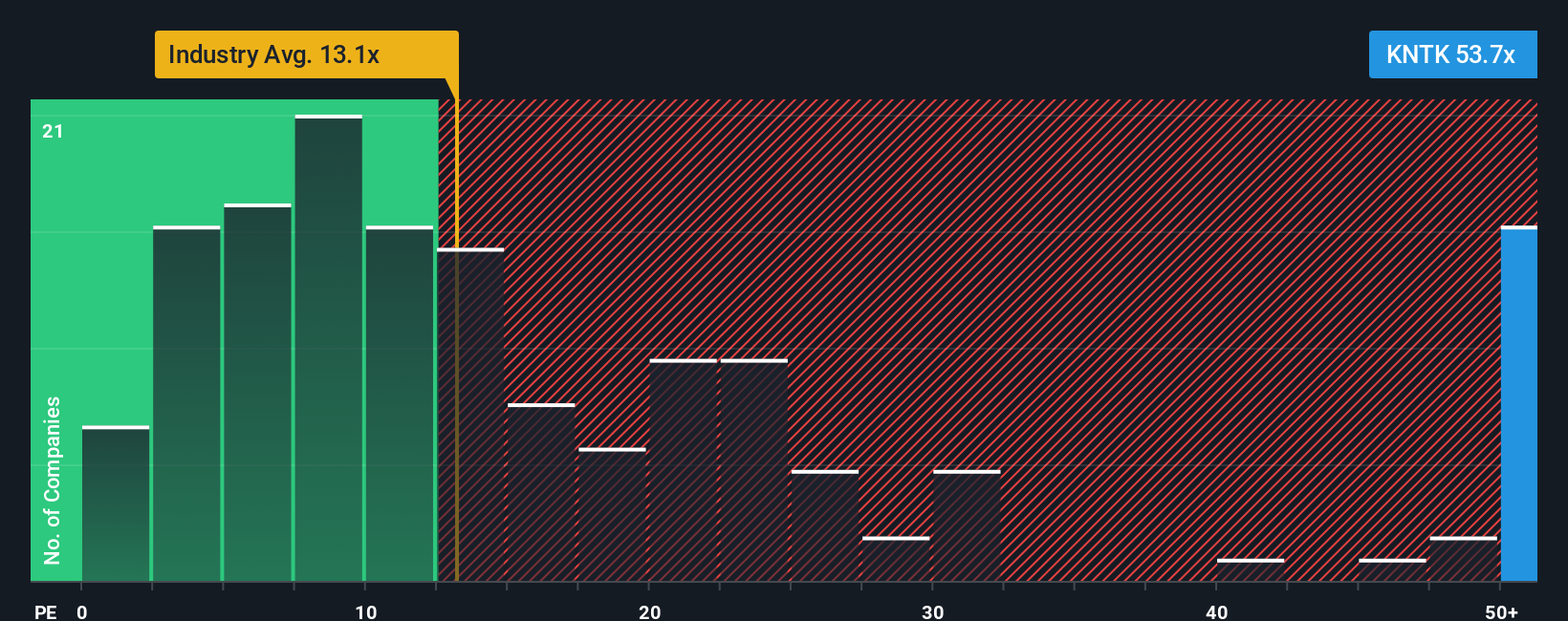

Kinetik Holdings currently trades at a PE of 53.25x. This is much higher than the Oil and Gas industry average of 13.37x, and also substantially above the peer group average of 22.04x. At first glance, this suggests that the market is pricing in high future earnings growth or perhaps extra confidence in Kinetik’s business model.

However, looking beyond simple comparisons, Simply Wall St’s proprietary "Fair Ratio" pegs a suitable PE for Kinetik at 22.06x. This measure actively accounts for its growth rate, risk, profit margins, market cap, and the nature of its industry. It offers a more nuanced view than just comparing Kinetik to its peers or the wider sector, as it reflects the company’s individual strengths and risks.

Comparing Kinetik’s current PE of 53.25x to its Fair Ratio of 22.06x suggests the stock is trading well above its fundamentally justified valuation. By this approach, the market appears to be pricing in more optimism and potential than Simply Wall St’s model indicates as warranted.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinetik Holdings Narrative

Earlier we mentioned that there is a better way to understand valuation, so let’s introduce you to Narratives. Narratives are Simply Wall St's easy and intuitive tool that lets you anchor your investment decision around a story, a set of assumptions, forecasts, and fair value that reflect your view of Kinetik Holdings, rather than just static formulas.

With Narratives, you can tell your perspective on the numbers: what you think future revenue, profit margins, and fair value should be, then see those ideas translated into a clear, defensible valuation. More than just posting your opinion, Narratives tie a company’s story to its financial outlook and current price, so you can instantly see if there could be an opportunity or a risk. Compare this fair value against the live market price to help you determine if it is time to buy, hold, or sell.

Best of all, Narratives on Simply Wall St’s Community page adjust dynamically as new news, earnings, or analyst outlooks come in, ensuring your thesis is always up to date. For example, in Kinetik Holdings’ case, some investors see upside with a fair value as high as $57.00 thanks to infrastructure growth and market tailwinds, while others are more cautious with a value as low as $43.00, emphasizing basin risks and capital needs. Narratives make it easy to explore, share, and stress-test your perspective alongside a community of millions.

Do you think there's more to the story for Kinetik Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNTK

Kinetik Holdings

Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives