- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Assessing Kinetik Holdings (KNTK) Valuation After 2025 EBITDA Guidance Cut and Kings Landing Project Delays

Reviewed by Simply Wall St

Kinetik Holdings (KNTK) is back in focus after disappointing third quarter 2025 results led management to cut 2025 EBITDA guidance, citing operational hiccups and delays at the key Kings Landing project.

See our latest analysis for Kinetik Holdings.

The guidance cut helps explain why Kinetik’s 1 year total shareholder return is down sharply. The stock has bounced with a 7 day share price return of 9.27 percent, suggesting near term sentiment is stabilising but longer term momentum has faded.

If this kind of volatility has you reconsidering your exposure to energy infrastructure, it could be a good moment to explore discovery ideas like fast growing stocks with high insider ownership for fresh opportunities.

So with Kinetik now trading well below consensus targets but facing real execution risk on Kings Landing, is the recent sell off setting up a value entry point, or is the market rightly discounting future growth?

Most Popular Narrative: 20.1% Undervalued

Compared to the last close at $37, the most popular narrative suggests Kinetik’s long term fair value sits meaningfully higher, anchored by major growth projects and structural demand tailwinds.

Kinetik's upcoming and recently completed infrastructure projects in the Northern Delaware Basin, especially Kings Landing and the associated acid gas injection capacity, are expected to unlock significant incremental volumes of treated sour gas, supporting multiyear revenue and earnings growth as producers ramp up drilling and send higher volumes through Kinetik's systems.

Want to see how aggressive volume ramp assumptions, margin expansion, and a richer future earnings multiple combine to justify that upside, and what has to go right to get there? Read on to unpack the full narrative behind this valuation call.

Result: Fair Value of $46.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity price volatility and execution risk at Kings Landing could derail margin expansion and delay the earnings ramp embedded in this valuation.

Find out about the key risks to this Kinetik Holdings narrative.

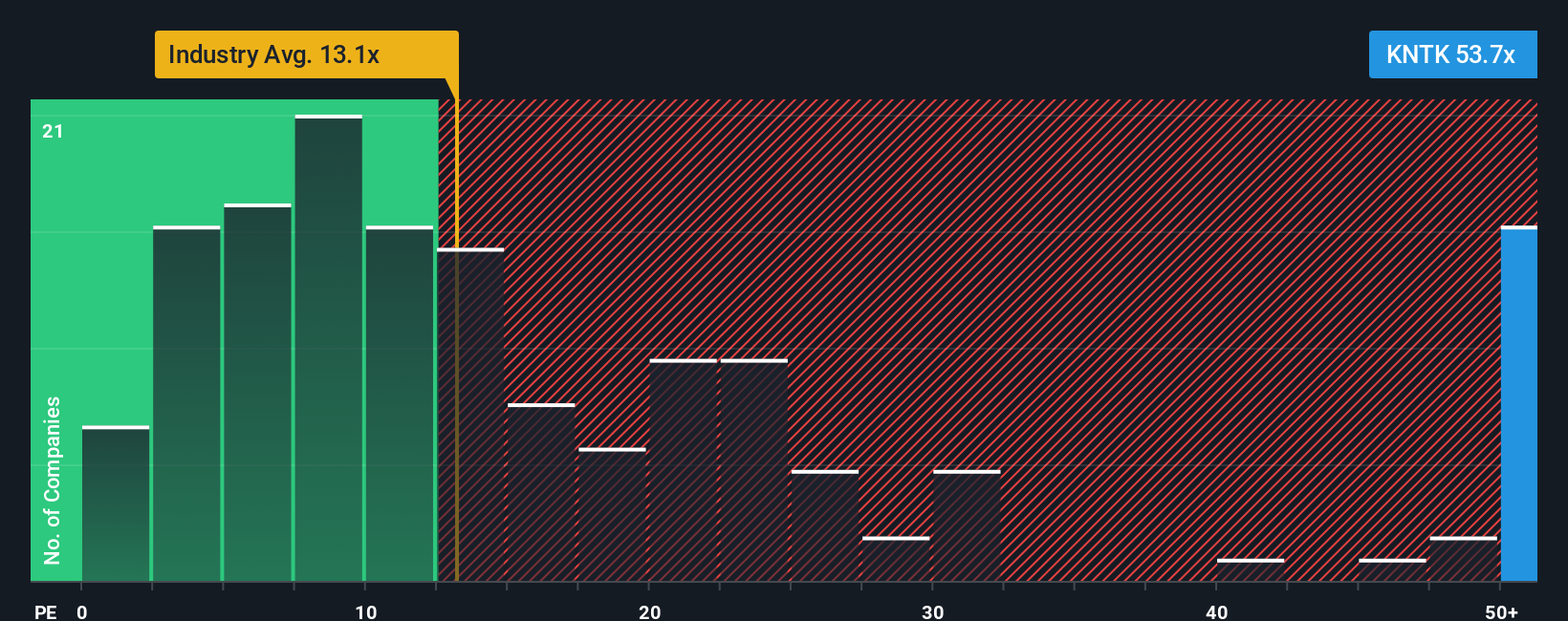

Another View, Market Ratio Risks

While the narrative points to upside, Kinetik’s current price to earnings ratio of 92.8 times is far richer than both its peer average of 30.5 times and a fair ratio of 23.5 times. If sentiment cools, a shift toward that lower fair ratio could mean painful multiple compression for shareholders.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinetik Holdings Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more market beating ideas?

Before you move on, lock in a few fresh angles using the Simply Wall St Screener so you are not relying on just one opportunity.

- Target reliable income streams by checking out these 15 dividend stocks with yields > 3% that can help anchor your portfolio through changing market cycles.

- Ride the next wave of technology gains by focusing on these 26 AI penny stocks reshaping everything from automation to data driven decision making.

- Hunt for potential bargains early with these 912 undervalued stocks based on cash flows that may be priced below their long term cash flow power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNTK

Kinetik Holdings

Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026