- United States

- /

- Oil and Gas

- /

- NYSE:KMI

How Investors Are Reacting To Kinder Morgan (KMI) Q2 Earnings Beat and Dividend Increase

Reviewed by Simply Wall St

- Kinder Morgan recently reported higher sales and net income for the second quarter of 2025, alongside a 2% increase in its quarterly dividend, which will be paid in August 2025 to shareholders of record at the end of July.

- This combination of earnings growth and dividend increase signals management’s confidence in both the company’s operational performance and its ongoing cash flow strength.

- We'll examine how Kinder Morgan's stronger quarterly earnings and dividend boost impact its overall investment outlook and risk profile.

Kinder Morgan Investment Narrative Recap

To be a Kinder Morgan shareholder, you need to believe in the ongoing importance of U.S. pipeline and LNG assets for natural gas exports and domestic power demand, against a backdrop of rising clean energy competition. The latest earnings and dividend hike reinforce management’s confidence in steady cash flows, but high leverage remains the critical near-term risk, limiting flexibility if operating conditions tighten. This quarter’s strong results don’t fundamentally alter the company’s sensitivity to debt levels or structural shifts in energy demand.

Among the recent announcements, Kinder Morgan’s 2% dividend increase stands out as a signal of confidence amid evolving market trends and policy headwinds facing the fossil fuels sector. The growing dividend is a welcome sign for income-focused shareholders, but it does not fully address the underlying tension between solid quarterly performance and the continuing risk of long-term contract roll-offs and overbuild in key pipeline regions.

On the other hand, Kinder Morgan’s persistently high leverage, over US$32 billion in net debt, is a financial fact investors should always keep in mind as...

Read the full narrative on Kinder Morgan (it's free!)

Kinder Morgan's outlook anticipates $20.2 billion in revenue and $3.7 billion in earnings by 2028. This scenario assumes an 8.1% annual revenue growth rate and a $1.0 billion increase in earnings from the current $2.7 billion.

Uncover how Kinder Morgan's forecasts yield a $30.80 fair value, a 12% upside to its current price.

Exploring Other Perspectives

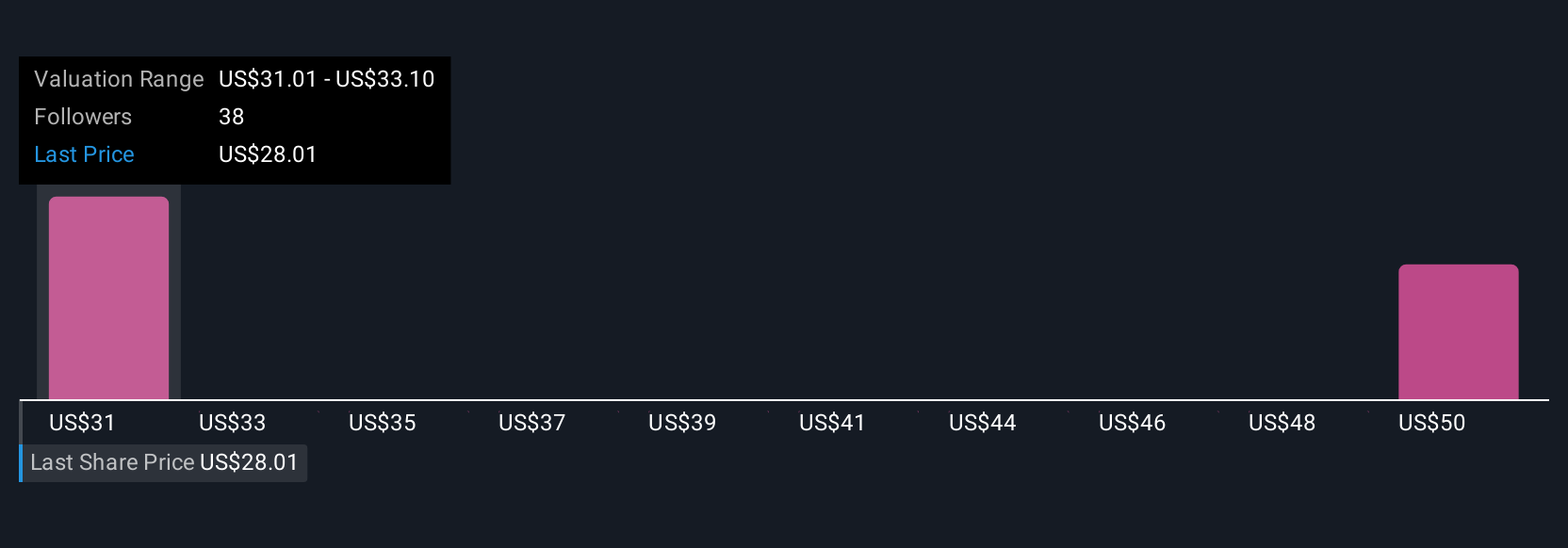

Two Simply Wall St Community members peg Kinder Morgan’s fair value between US$30.80 and US$54.44 per share. Market optimism driven by LNG export growth contrasts sharply with concerns about debt pressure affecting future cash flows.

Build Your Own Kinder Morgan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kinder Morgan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinder Morgan's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives