- United States

- /

- Energy Services

- /

- NYSE:KGS

The Bull Case For Kodiak Gas Services (KGS) Could Change Following $344M Equity and $200M Debt Raise

Reviewed by Simply Wall St

- Earlier this month, Kodiak Gas Services, Inc. completed a follow-on equity offering of 10,000,000 shares of common stock at US$34.40 per share, raising approximately US$344 million, while also announcing a private offering of US$200 million in 6.5% senior unsecured notes due 2033 to repay part of its revolving credit facility.

- These moves signal a concerted effort by the company to strengthen its balance sheet and boost financial flexibility amid sector-wide capital needs.

- We'll explore how Kodiak's decision to refinance debt with a new senior notes offering could influence its longer-term investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kodiak Gas Services Investment Narrative Recap

Owning Kodiak Gas Services stock means believing in ongoing growth in large horsepower gas compression demand, especially as Permian Basin production ramps up. The recently completed US$344 million equity offering and US$200 million notes issue boost financial flexibility, but these fundraises do not meaningfully address the near-term catalyst of fleet utilization or the immediate risk that ongoing Permian labor shortages could pressure margins. Among recent announcements, Kodiak’s earlier 10% dividend increase stands out, underlining the company’s focus on returning cash to shareholders. This capital allocation approach is particularly relevant now that Kodiak is strengthening its balance sheet, which could help support dividend sustainability as the company’s financial profile evolves. In contrast, investors should be aware that persistent labor tightness in the Permian Basin could still impact Kodiak’s ability to scale operations, potentially leading to…

Read the full narrative on Kodiak Gas Services (it's free!)

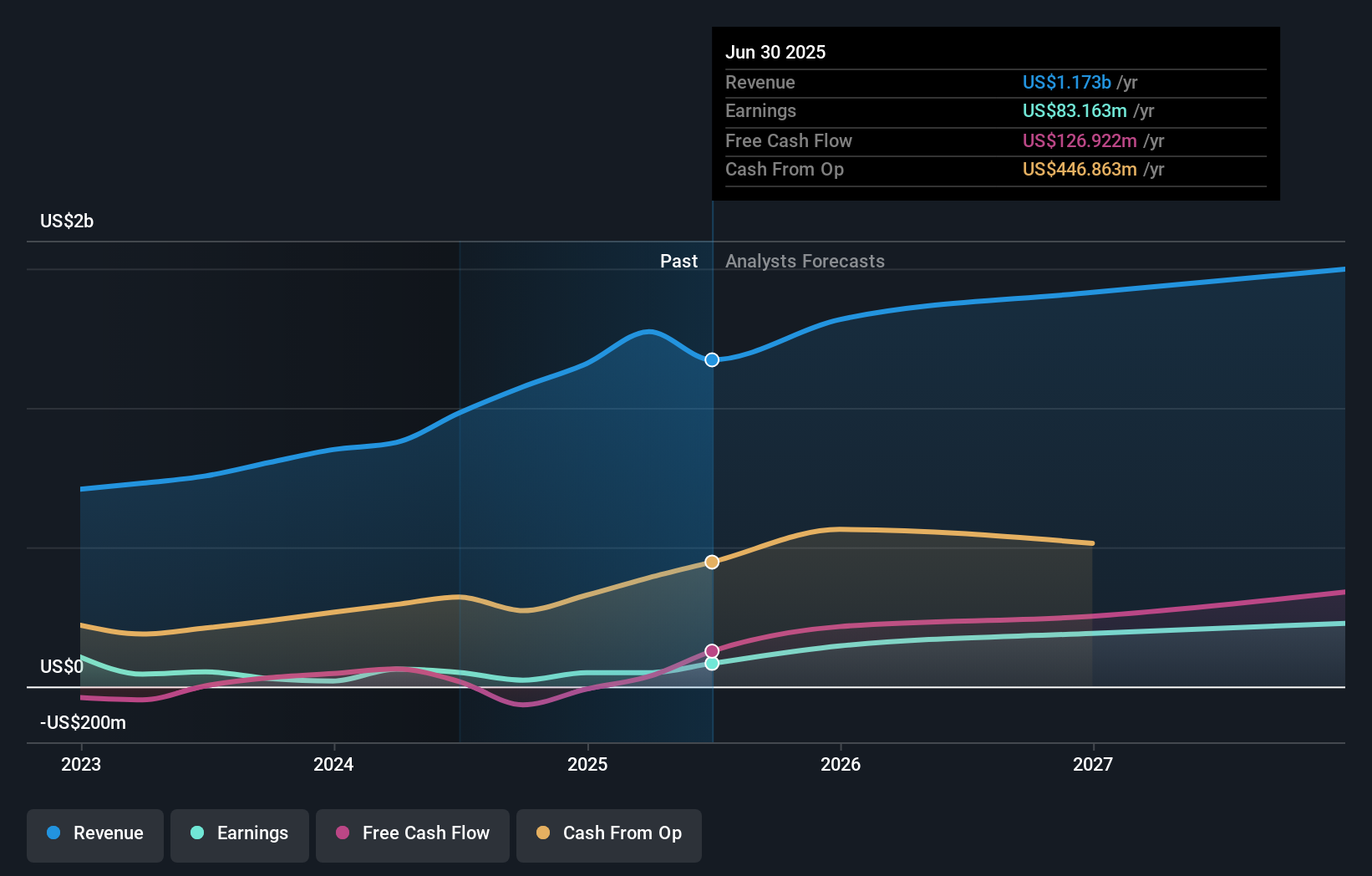

Kodiak Gas Services' narrative projects $1.5 billion in revenue and $293.4 million in earnings by 2028. This requires 5.8% yearly revenue growth and a $210.2 million earnings increase from $83.2 million today.

Uncover how Kodiak Gas Services' forecasts yield a $44.20 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Kodiak Gas Services, ranging from US$44.20 to US$54.28 per share. While these varied outlooks reflect individual forecasts, many also point to the importance of strong utilization and margin protection as key profitability drivers for the company going forward; consider these differing views when weighing your own outlook.

Explore 2 other fair value estimates on Kodiak Gas Services - why the stock might be worth just $44.20!

Build Your Own Kodiak Gas Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak Gas Services research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kodiak Gas Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak Gas Services' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Gas Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KGS

Kodiak Gas Services

Operates contract compression infrastructure for customers in the oil and gas industry in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives