- United States

- /

- Energy Services

- /

- NYSE:INVX

Innovex International (INVX) Is Up 6.4% After Strong Q3 Sales But Lower Earnings – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Innovex International, Inc. reported third quarter 2025 earnings, showing very large year-over-year sales growth to US$240 million, but net income fell to US$39.23 million from US$82.59 million a year earlier.

- The company also issued fourth quarter revenue guidance in the US$235 million to US$245 million range, reflecting its outlook in light of changing profitability trends.

- We'll explore how Innovex International's rising revenues and declining earnings shape the company's current investment narrative and prospects.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Innovex International's Investment Narrative?

To be a confident long-term shareholder of Innovex International, you need to believe in the company’s ability to convert robust revenue growth into sustained profitability, despite recent margin pressure. The latest third quarter results revealed strong sales momentum but a sharp decline in net income, placing near-term focus on underlying operational costs and margin recovery. Board turnover, highlighted by Carri Lockhart’s resignation announcement, does not appear to introduce immediate risk given there was no reported disagreement with company policy or operations, and board independence remains high. However, the combination of a relatively new management team and board with lower average tenures still represents an ongoing risk, especially as profitability fluctuates. The Q4 revenue guidance signals management’s awareness of these shifting dynamics. For now, core catalysts remain centered on delivering improved earnings quality as revenue continues to outpace the wider market’s expectations.

Yet, the relatively inexperienced board is something investors should watch closely.

Exploring Other Perspectives

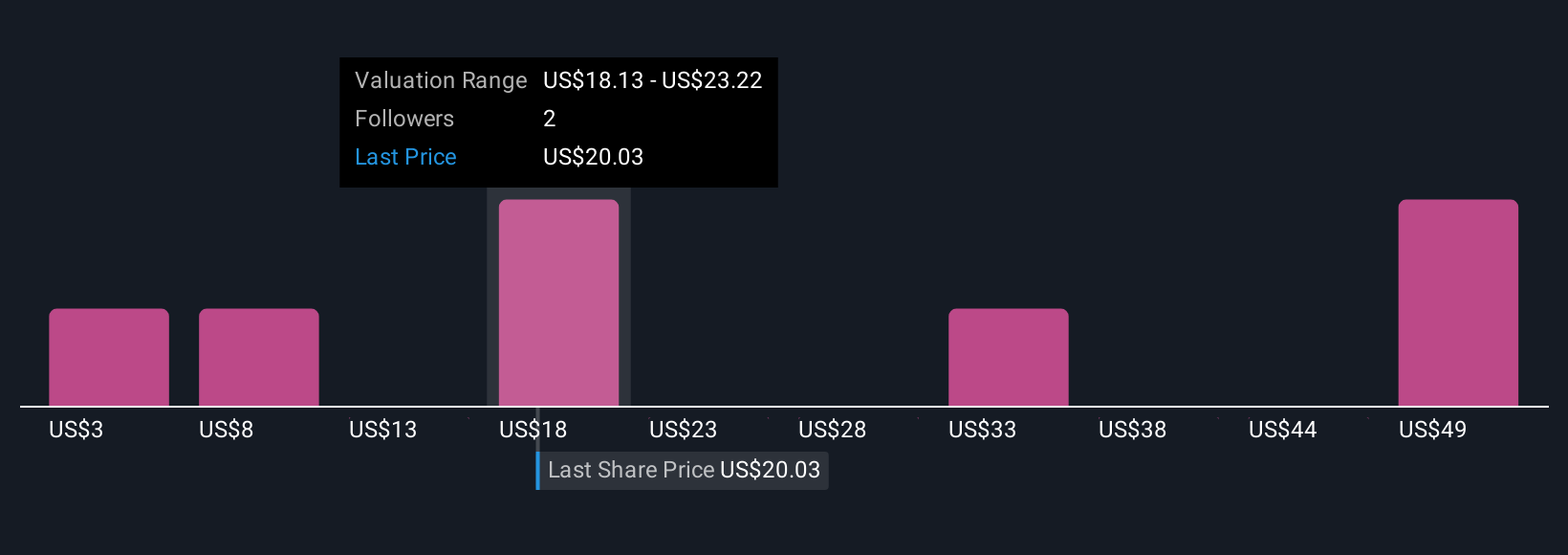

Explore 6 other fair value estimates on Innovex International - why the stock might be a potential multi-bagger!

Build Your Own Innovex International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovex International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Innovex International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovex International's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVX

Innovex International

Designs, manufactures, sells, and rents mission critical engineered products to the oil and natural gas industry worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives