- United States

- /

- Energy Services

- /

- NYSE:HP

Is There Now an Opportunity in Helmerich & Payne After Its Recent Share Price Rebound?

Reviewed by Bailey Pemberton

If you are watching Helmerich & Payne and wondering what your next move should be, you are definitely not alone. This stock has put investors on a roller coaster, especially in the past year. After sliding more than 30% year-to-date, and nearly the same amount over the past twelve months, it's only natural to ask whether the worst is over or if hidden value is yet to be unlocked. Interestingly, over the past month, Helmerich & Payne bounced back with a 14.1% gain. This hints that some investors may be shifting their outlook, perhaps in response to evolving market dynamics in the energy and drilling sector.

What stands out even more is its value score: 5 out of 6. That means Helmerich & Payne is currently considered undervalued in almost every key check analysts use. For anyone who wants to separate hype from reality, that number alone should catch your attention. Of course, valuation is never a one-size-fits-all story. In the sections that follow, we will break down the most important ways investors and analysts check for value, and explore whether these methods are really enough to capture the whole picture. Stay tuned, because at the end, we will dig into a perspective that goes beyond the usual numbers.

Why Helmerich & Payne is lagging behind its peers

Approach 1: Helmerich & Payne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those flows back to today's value. This provides an analytical approach to understanding what the business could be worth, based purely on its own ability to generate cash over time.

For Helmerich & Payne, the DCF model starts with its current Free Cash Flow (FCF), which stands at -$2.94 million. Despite its negative recent FCF, analysts project that by 2030, the company's annual FCF could reach $364 million. For the next five years, analyst estimates form the foundation for these cash flow projections. After this period, Simply Wall St extrapolates them to span a full ten-year view.

Based on this forward-looking approach, the estimated intrinsic value for Helmerich & Payne is $49.45 per share. Compared to the current market price, this figure suggests that the stock is trading at a remarkable 53.4% discount to its fair value. DCF-based models, like this one, indicate that the market may be underestimating the company’s true future earnings potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Helmerich & Payne is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

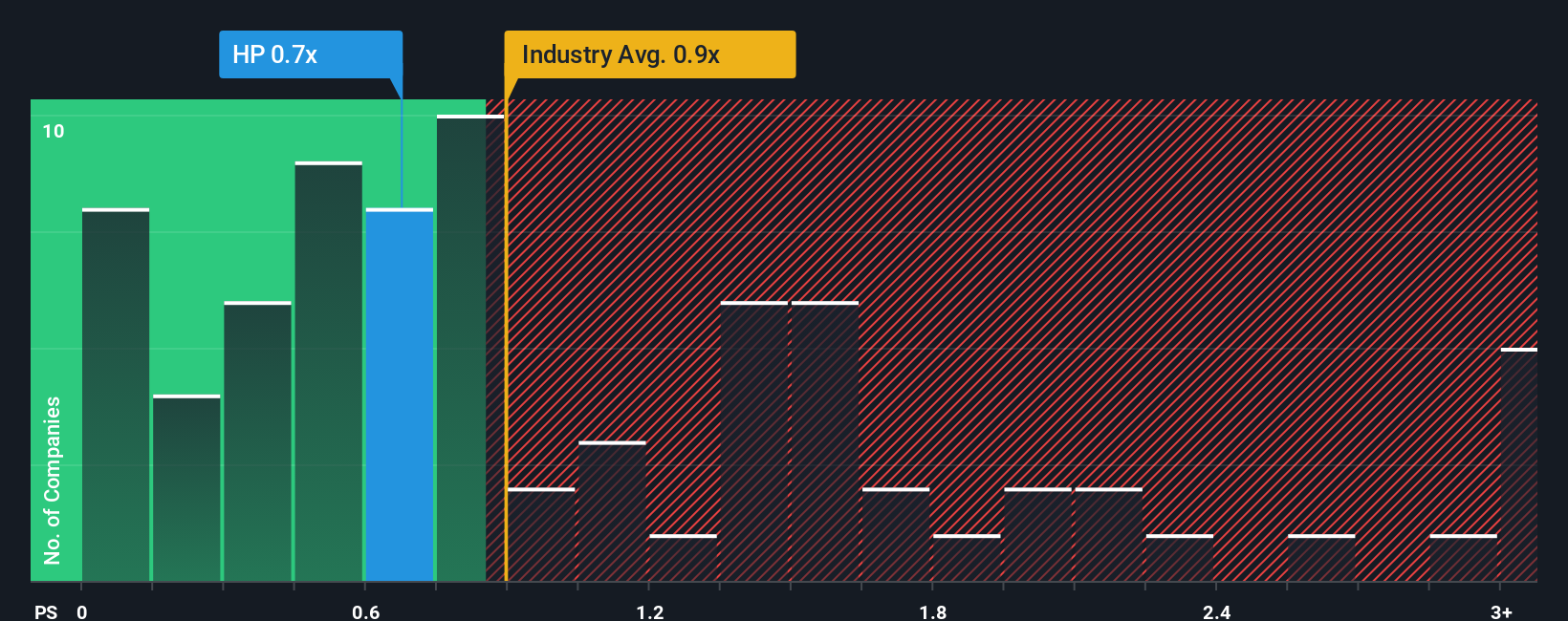

Approach 2: Helmerich & Payne Price vs Sales

For companies like Helmerich & Payne, the Price-to-Sales (P/S) ratio is a preferred valuation metric, particularly when earnings are negative or volatile but revenue remains steady and meaningful. The P/S ratio makes it easier to compare companies in capital-intensive industries where traditional profits may fluctuate, providing a more stable view of underlying business performance.

The “right” P/S multiple depends on several factors, including how fast a company is expected to grow sales, the risks of its core business, and the market’s wider appetite for the sector. Typically, higher expected growth or lower risk commands a higher P/S ratio, while slower growth or increased risk brings it down.

Currently, Helmerich & Payne trades at a P/S of 0.67x. This is notably lower than the Energy Services industry average of 0.87x and also below the peer average of 1.10x. At first glance, this might signal that the stock is undervalued relative to its peers.

However, Simply Wall St’s “Fair Ratio” takes a more comprehensive approach, weighing Helmerich & Payne’s growth profile, profit margins, industry, market cap, and risk levels. This metric aims to provide a tailored benchmark rather than a broad-brush industry or peer comparison, offering a more nuanced, company-specific assessment.

The Fair Ratio for Helmerich & Payne is 0.94x, which is not far from its current multiple of 0.67x. Because the difference is less than 0.10, this suggests the stock is valued about right based on its P/S ratio and underlying fundamentals.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Helmerich & Payne Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a straightforward, powerful tool that lets you combine your unique perspective on a company with the data that underpins its story. This ties together the numbers for fair value, future revenue, earnings, and profit margins with your personal outlook on the business.

Instead of relying only on ratios or analyst models, Narratives connect the company's real-world journey to a financial forecast and a logical estimate of fair value, helping you see whether the stock's price makes sense in light of the story you believe in.

On Simply Wall St, Narratives are easily accessible within the Community page, where millions of investors are already building and sharing their stories about where Helmerich & Payne is headed next.

This approach empowers you to decide when it might be time to buy, sell, or hold, by clearly comparing your own Fair Value to the current Price. Since Narratives are updated automatically whenever relevant news or earnings are released, you'll always be working with the latest view.

For example, some investors see Helmerich & Payne's digital growth and global expansion as reasons to predict a fair value near $27.0, while others, concerned about industry overcapacity and cost pressures, set a low target around $17.0.

Do you think there's more to the story for Helmerich & Payne? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helmerich & Payne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HP

Helmerich & Payne

Provides drilling solutions and technologies for oil and gas exploration and production companies.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives