- United States

- /

- Energy Services

- /

- NYSE:HP

Here is why Warren Buffett did not Buy Helmerich & Payne (NYSE:HP)

Flying on the favorable non-secular winds, Helmerich & Payne, Inc. (NYSE: HP) stock rose almost 90% year-to-date. While the company's balance sheet improved, it remains unprofitable.

Yet, the current geopolitical environment might benefit the company in the short term.

Efficient Market Hypothesis and Ticker Confusion

The efficient market hypothesis (EMH) states that share prices reflect all information. Yet, HP is currently trending in the news for little other reason than that Warren Buffett just took a stake in Hewlett-Packard (NYSE: HPQ). Ticker confusion is prevalent with one of the most famous examples in 2020 when Zoom Video Communications (NasdaqGS: ZM) caused a trading halt of a penny stock Zoom Technologies (OTC: ZOOM). Similarly, in 2013, when Twitter announced going public, the stock of Tweeter Home Entertainment (a retailer in bankruptcy) soared 2,200% before the halt.

Overview of Helmerich & Payne's

Helmrich & Payne, Inc. provides drilling services and solutions for oil exploration and production. The company operates in 3 segments: North America, Offshore Gulf of Mexico, and International Solutions. The company was founded in 1920 and is headquartered in Tulsa, Oklahoma.

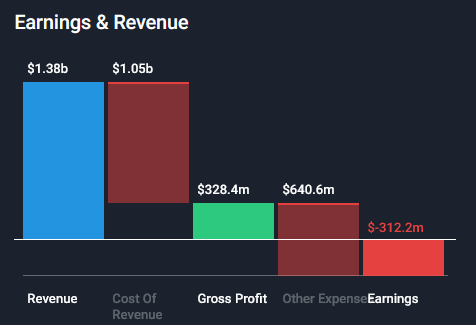

The following data shows that the company is unprofitable despite high oil prices. The net profit margin sits at a negative 22.59%, likely due to significant expenses.

Yet, it is important to notice their business model is not directly tied up to the oil price, it is rather tied up to oil demand. The company makes money by drilling the wells which lag the oil price. Yet, after such a strong run in the first quarter, it seems that possibility is already baked in the stock price.

According to our valuation model, the stock seems to be trading around its fair value price, which is US$41. We have calculated this value using a 2 stage discounted cash flow (DCF) model. We update DCF valuations for stocks every 6 hours, so keep that in mind when analyzing stocks in the near future.

Institutions Dominate the Ownership

Looking into the share registry, we notice that institutional investors make up almost 91% of all the shareholders. This is unusual, but not strange for a company over a century old, operating in an energy sector.

See our latest analysis for Helmerich & Payne

BlackRock, Inc. is currently the company's largest shareholder with 17% of shares outstanding. The Vanguard Group, Inc. is the second-largest shareholder owning 11% of common stock, and State Farm Insurance Companies, Asset Management Arm holds about 7.8% of the company stock.

Furthermore, insiders have a meaningful stake worth US$153m, and you can click here to see whether they have been buying or selling. On the other hand, the general public owns just 6% of shares and makes a minor group of shareholders. If their interests are not prioritized, there is not much they can do.

Conclusion

After going parabolic and doubling up in 4 months, it is hard to see any further positive catalysts for the stock, unless the company comes out with something big in 3 weeks, as it announces the next earnings on April 28.

Meanwhile, by looking into the ownership structure, we found many institutional advisors but no signs of Berkshire Hathaway.

Ticker confusion might lead many eyes to check out Helmerich & Payne these days, but what they find is likely not good enough to keep their attention there. To that end, you should learn about the 3 warning signs we've spotted with Helmerich & Payne (including 1 which is potentially serious).

If you're looking to trade Helmerich & Payne, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helmerich & Payne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:HP

Helmerich & Payne

Provides drilling solutions and technologies for oil and gas exploration and production companies.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives