- United States

- /

- Energy Services

- /

- NYSE:HP

Assessing Helmerich & Payne’s Valuation After Recent 15.2% Share Price Rebound

Reviewed by Bailey Pemberton

- Wondering if Helmerich & Payne at around $30 a share is a bargain or a value trap? You are not alone, and this is exactly the kind of setup where a closer valuation look can really pay off.

- Despite being down about 9.6% over the last year and 9.2% year to date, the stock has bounced 8.4% in the last week and 15.2% over the past month, a sharp move that hints at shifting sentiment and renewed interest in the name.

- Those swings have come as investors refocus on onshore drilling demand, with rigs coming back to work as energy producers gradually increase activity, and as Helmerich & Payne continues to position itself as a leading contract driller in the US shale patch. At the same time, the broader energy sector backdrop, from commodity price volatility to capital discipline trends, is shaping how the market is re pricing drilling names like HP.

- On our checklist of six valuation tests, Helmerich & Payne scores a solid 5 out of 6, which suggests the stock may be trading below its intrinsic value. Next we will unpack what that means across different valuation methods and why there might be an even smarter way to interpret those signals by the end of this article.

Find out why Helmerich & Payne's -9.6% return over the last year is lagging behind its peers.

Approach 1: Helmerich & Payne Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return.

For Helmerich & Payne, the model uses a 2 Stage Free Cash Flow to Equity approach. The company has generated about $16.75 million of free cash flow over the last twelve months, and analysts expect this to rise into the mid to high $300 million range over the next decade. For example, projected free cash flow in 2030 is around $378 million, with intermediate years, such as 2026 and 2027, also sitting near the high $300 million level as activity in onshore drilling improves.

When all of those projected cash flows in dollars are discounted back to today, the model arrives at an intrinsic value of roughly $64.43 per share. Compared with a current share price near $30, the DCF suggests the stock is about 53.3% undervalued, indicating a wide margin of safety if cash flow forecasts prove broadly accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Helmerich & Payne is undervalued by 53.3%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

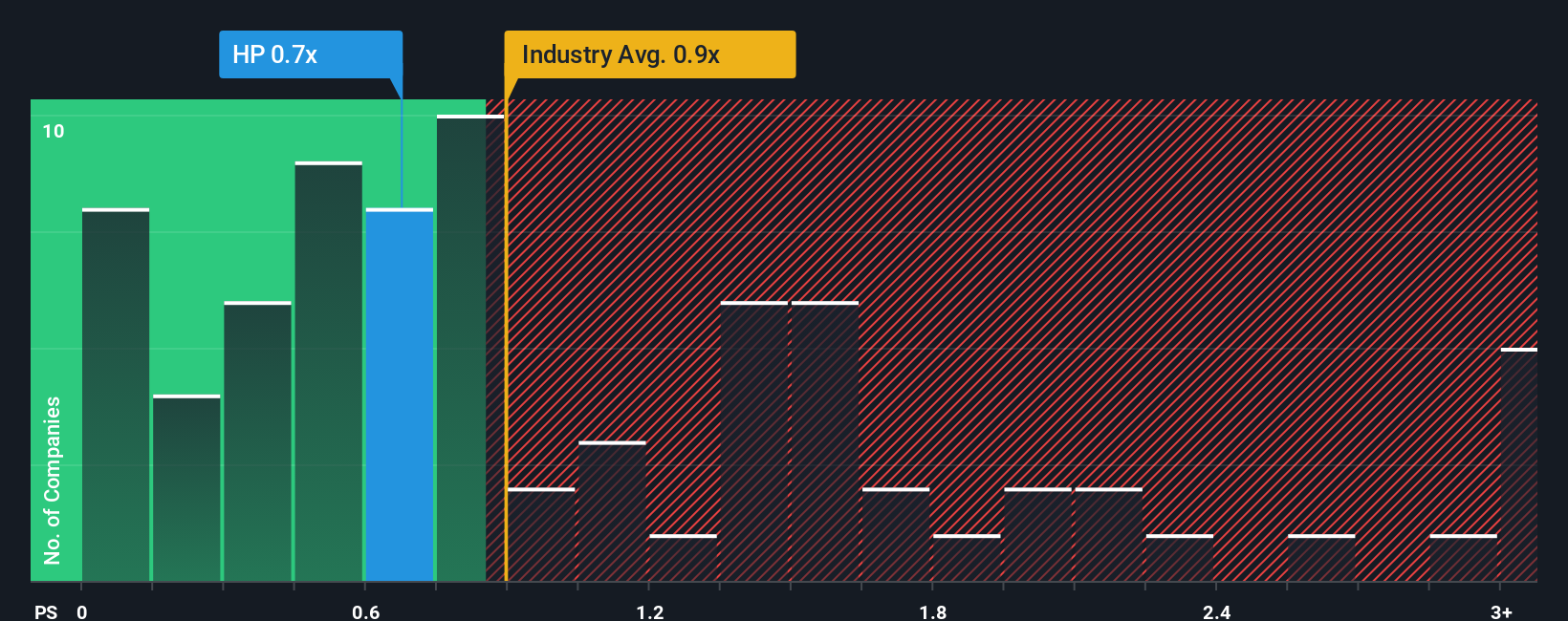

Approach 2: Helmerich & Payne Price vs Sales

For drilling and energy services companies, revenue tends to be less volatile than earnings, which can swing with day rates and utilization, so the price to sales ratio is often a more reliable yardstick than earnings based multiples. In general, investors are willing to pay a higher sales multiple for companies with stronger growth prospects and lower perceived risk, while slower growth or higher risk usually warrant a lower, more conservative multiple.

Helmerich & Payne currently trades on a price to sales ratio of about 0.79x, compared with the Energy Services industry average of roughly 1.11x and a peer group average near 1.26x. Simply Wall St’s proprietary Fair Ratio for the stock is 0.88x, which estimates what a normal sales multiple should be once factors like expected growth, profitability, risk profile, industry dynamics and market cap are all taken into account. This makes it more tailored than a simple industry or peer comparison, which can overlook meaningful differences in business quality and risk.

Since HP’s actual 0.79x sales multiple sits below the 0.88x Fair Ratio, the stock screens as modestly undervalued on this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Helmerich & Payne Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, which are simple stories investors create on Simply Wall St’s Community page. These Narratives link an investor’s view of Helmerich & Payne’s business to a specific forecast for future revenue, earnings and margins, and then to a Fair Value they can compare with today’s share price to help them decide whether to buy or sell. The platform dynamically updates those Narratives as new news or earnings emerge. One investor might build a bullish Narrative around Saudi rig reactivations, international growth and a Fair Value closer to $27 per share. A more cautious investor might focus on shale overcapacity, margin pressure and a Fair Value nearer $17. This gives you an easy, accessible way to see how different perspectives translate into different numbers and to choose the story that best matches your own expectations.

Do you think there's more to the story for Helmerich & Payne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helmerich & Payne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HP

Helmerich & Payne

Provides drilling solutions and technologies for oil and gas exploration and production companies.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026