- United States

- /

- Energy Services

- /

- NYSE:HLX

Will Helix Energy Solutions (HLX) Post‑Kratz Leadership Shape Its Next Phase Of Strategic Evolution?

Reviewed by Sasha Jovanovic

- Helix Energy Solutions Group has announced that long-time President and CEO Owen Kratz, who joined the company in 1984 and became CEO in 1997, has informed the Board of his intention to retire, while remaining in place until a successor is appointed to support a smooth leadership transition.

- His departure closes a decades-long chapter in which he helped transform Helix from a small diving operator into a global offshore energy services provider focused on well intervention, robotics, and decommissioning.

- Against this backdrop, we’ll examine how the planned retirement of Kratz could influence Helix’s investment narrative and future strategic priorities.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Helix Energy Solutions Group Investment Narrative Recap

To own Helix Energy Solutions Group, you need to believe in the long term build out of offshore well intervention, decommissioning and robotics, supported by a growing backlog and aging offshore fields. Owen Kratz’s planned retirement does not appear to change the immediate catalysts or the key near term risk, which remains project timing uncertainty and customer spending delays that can affect vessel utilization and margins.

The most relevant recent announcement alongside the leadership news is Helix’s updated 2025 revenue guidance of US$1.23 billion to US$1.29 billion, issued in October. That range already reflected softer Gulf of Mexico well intervention conditions and contract timing, which are central to the current risk and catalyst mix and provide a reference point as investors assess how a new CEO might execute on the existing backlog and growth opportunities.

But investors should also be aware that Helix’s exposure to spot markets means...

Read the full narrative on Helix Energy Solutions Group (it's free!)

Helix Energy Solutions Group's narrative projects $1.4 billion revenue and $103.0 million earnings by 2028. This requires 2.9% yearly revenue growth and about a $52.9 million earnings increase from $50.1 million today.

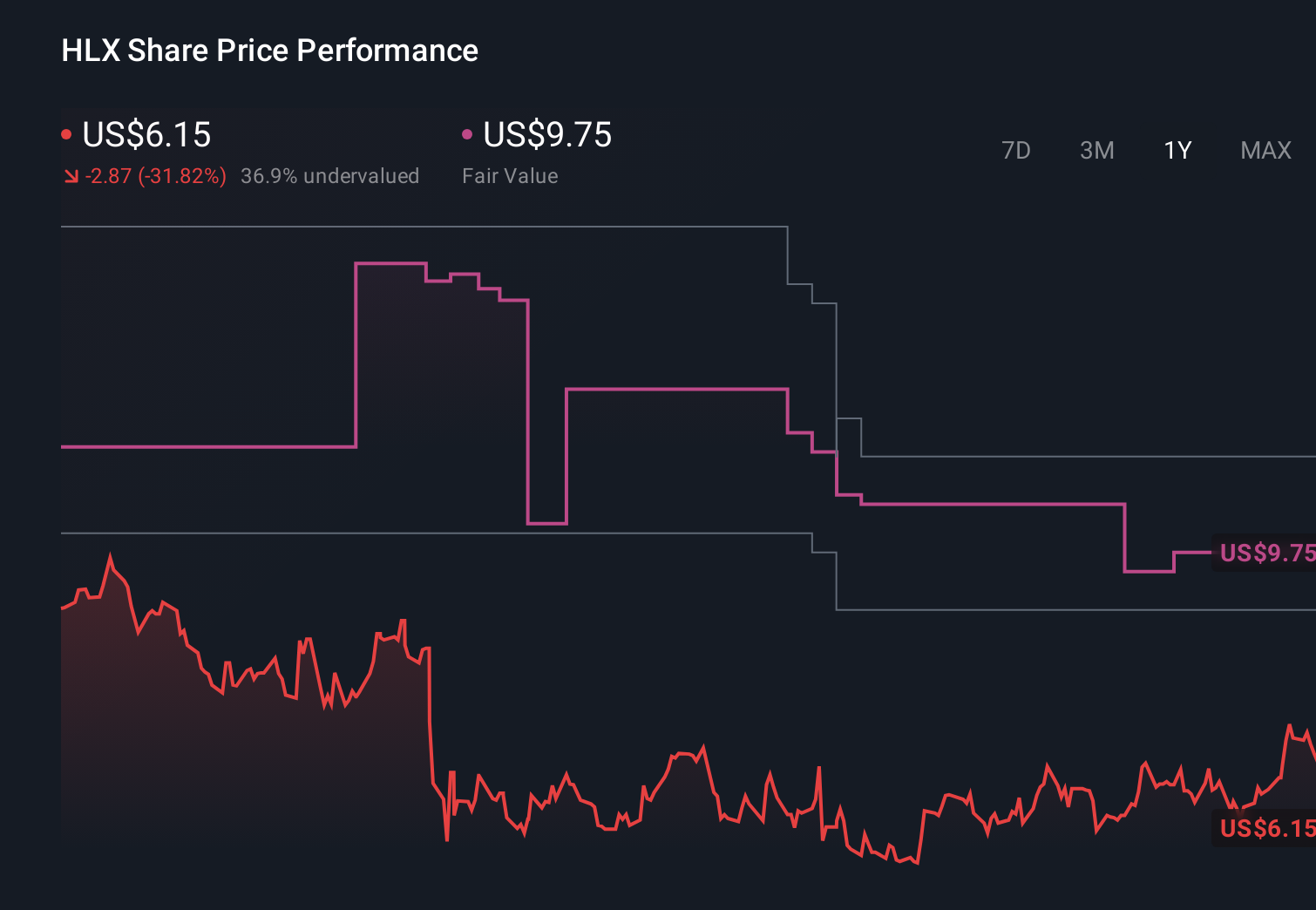

Uncover how Helix Energy Solutions Group's forecasts yield a $9.75 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place Helix’s fair value between US$7 and about US$26.46, underlining how far apart individual views can be. You can weigh those against the backlog driven growth story and the risk of project deferrals extending today’s revenue volatility.

Explore 4 other fair value estimates on Helix Energy Solutions Group - why the stock might be worth over 3x more than the current price!

Build Your Own Helix Energy Solutions Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Helix Energy Solutions Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Helix Energy Solutions Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Helix Energy Solutions Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Helix Energy Solutions Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLX

Helix Energy Solutions Group

An offshore energy services company, provides specialty services to the offshore energy industry in Brazil, the United States, North Sea, the Asia Pacific, West Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)