- United States

- /

- Energy Services

- /

- NYSE:FTI

TechnipFMC (NYSE:FTI): A Fresh Look at Valuation as Investor Momentum Cools

Reviewed by Kshitija Bhandaru

See our latest analysis for TechnipFMC.

TechnipFMC’s share price has delivered a robust run this year, reflecting steady momentum as broader energy sector sentiment remains positive. While recent days have seen minor fluctuations, the company’s one-year total shareholder return of 43% highlights meaningful long-term growth, even as momentum cools from earlier peaks.

If you’re curious about what other energy names are showing strong trends and investor interest, now is a great time to discover See the full list for free.

With TechnipFMC’s steady gains and signs of robust financial performance, the question now is whether there is still untapped value to be found or if the market has already factored in the company’s growth outlook.

Most Popular Narrative: 6.6% Undervalued

TechnipFMC's current share price sits below the most popular narrative's fair value, hinting that persistent optimism around subsea growth is yet to be fully priced in. Investors are watching to see if core trends can drive further upside against a backdrop of solid fundamentals.

Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long-duration contracts (20 to 35 years), provide predictable, high-margin income streams that underpin long-term earnings stability and net margin improvement.

The secret to TechnipFMC’s valuation? It’s not just earnings growth or margin expansion, but a powerful combination of recurring revenue, industry exclusivity, and game-changing contract wins. These assumptions hold the key to how the fair value is calculated. Curious about the numbers? Unlock the full narrative to discover which forecasted financial levers matter most.

Result: Fair Value of $41.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on traditional oil and gas demand, along with heightened geopolitical risks, could challenge TechnipFMC's long-term growth story.

Find out about the key risks to this TechnipFMC narrative.

Another View: Are Multiples Sending a Different Signal?

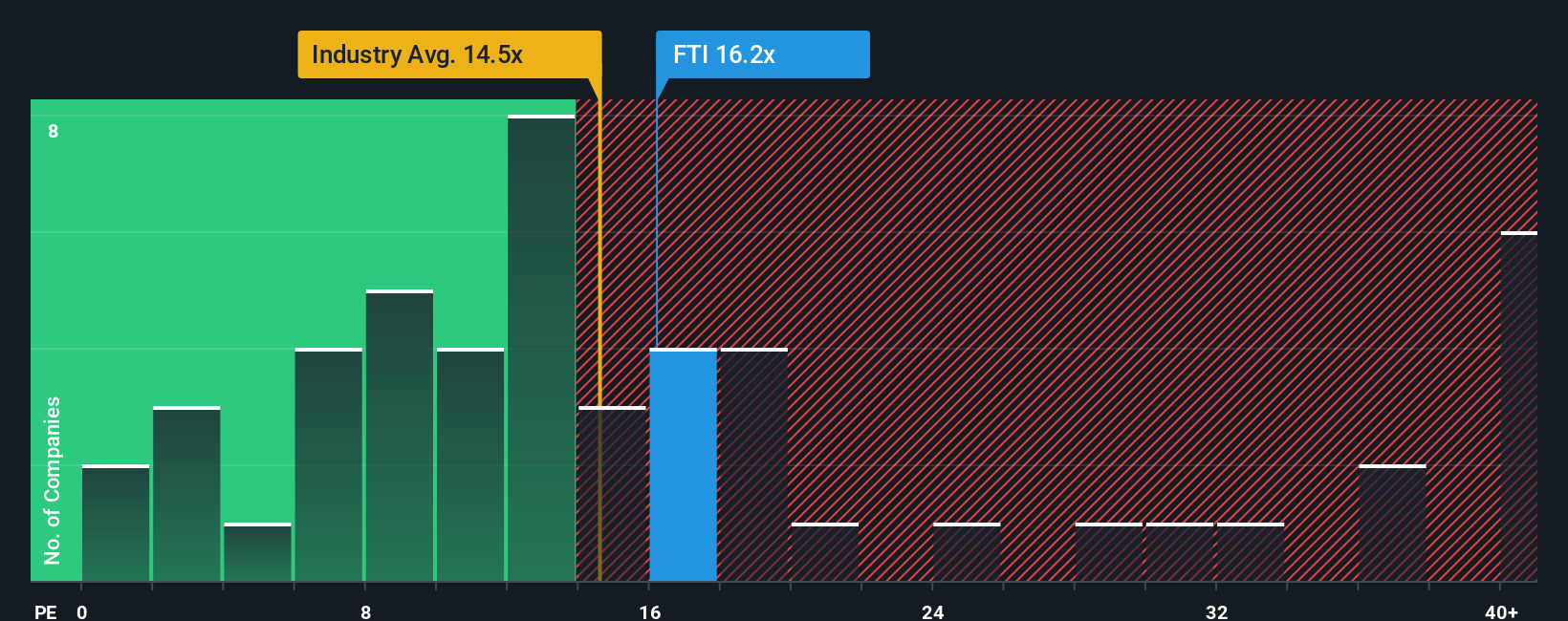

Looking beyond fair value estimates, TechnipFMC currently trades at a price-to-earnings ratio of 16.8x. This is higher than both the US Energy Services industry average of 15.1x and the peer average of 12.4x. In practical terms, it means the market may be pricing in more growth than its sector rivals or demanding a premium for perceived quality. Will that premium narrow as the story unfolds, or is it justified by what is ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TechnipFMC Narrative

If you see things differently or want to draw your own conclusions from the data, you can shape your perspective in just minutes. Do it your way

A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter investing by jumping into fresh opportunities tailored for today’s market. Miss these, and you could miss tomorrow’s leaders.

- Boost your search for tomorrow’s tech revolutionaries by zeroing in on these 24 AI penny stocks tipped for exponential innovation.

- Maximize your income potential by checking out these 19 dividend stocks with yields > 3% delivering standout yields above 3% from financially healthy companies.

- Seize deep value early by targeting these 909 undervalued stocks based on cash flows positioned for serious upside based on their cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives