- United States

- /

- Energy Services

- /

- NYSE:FTI

TechnipFMC (FTI) Valuation Check as New Chevron and Ithaca Subsea Contracts Boost Growth Story

Reviewed by Simply Wall St

TechnipFMC (FTI) just added two meaningful wins to its backlog, landing Chevron’s Gorgon Stage 3 Subsea 2.0 systems and Ithaca Energy’s flexible riser work on the Captain field in the U.K. North Sea.

See our latest analysis for TechnipFMC.

The market seems to agree these wins matter, with TechnipFMC’s latest share price at $44.38 and a strong year to date share price return of around 50 percent. This feeds into a powerful three year total shareholder return above 270 percent and suggests momentum is still very much on TechnipFMC’s side.

If this kind of contract driven story has your attention, it could be a good moment to explore aerospace and defense stocks for more complex, project based businesses riding similar spending trends.

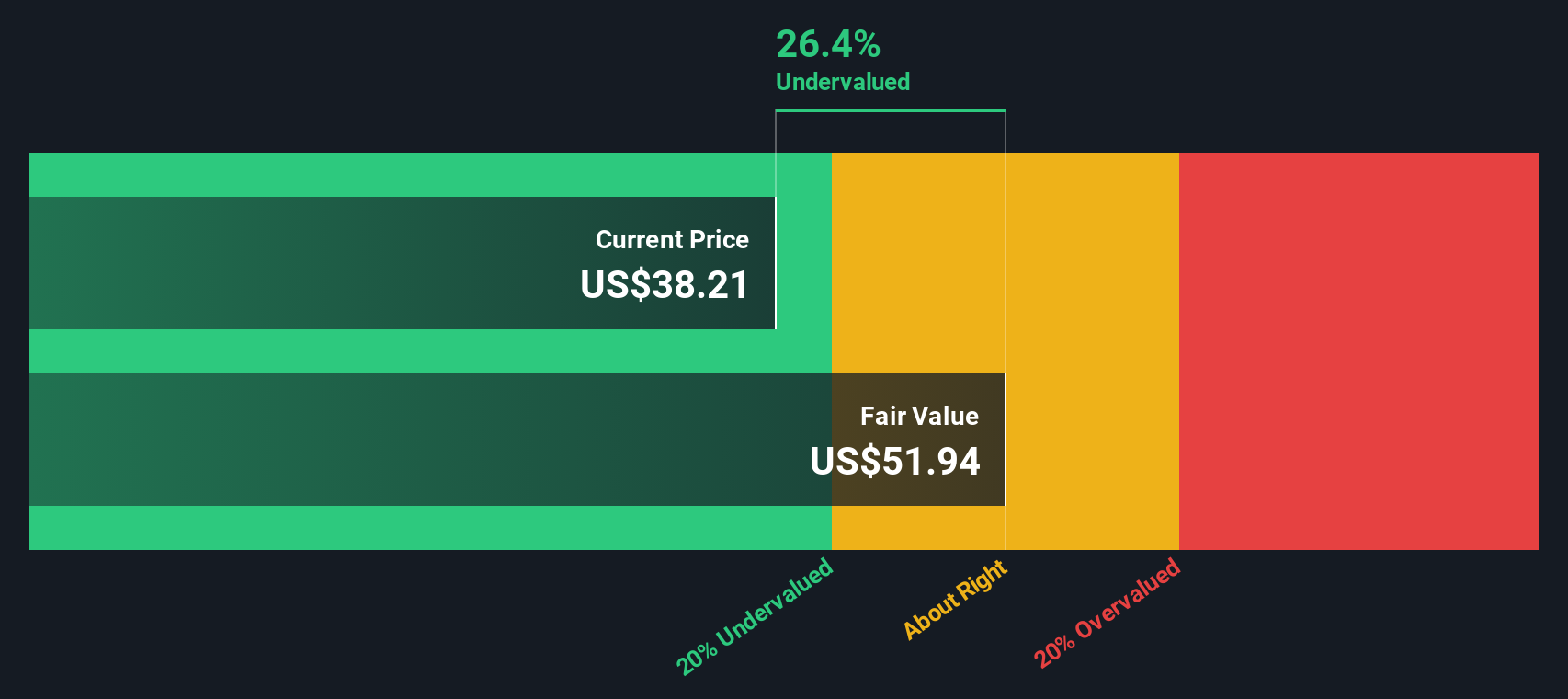

But with the shares already up sharply, trading near analyst targets yet still showing a hefty intrinsic discount, is TechnipFMC a mispriced cash generator in waiting, or is the market already baking in years of subsea growth?

Most Popular Narrative Narrative: 3% Undervalued

With TechnipFMC trading at $44.38 against a narrative fair value of $45.75, the story leans modestly positive and leans heavily on subsea momentum.

Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long duration contracts (20 to 35 years), provide predictable, high margin income streams that underpin long term earnings stability and net margin improvement.

Curious how steady, contract backed subsea cash flows, rising margins and a richer future earnings multiple all fit together. The full narrative connects the dots in surprising ways.

Result: Fair Value of $45.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat story could unravel if oil price volatility delays offshore projects or if TechnipFMC is slow to pivot toward energy transition opportunities.

Find out about the key risks to this TechnipFMC narrative.

Another Angle on Valuation

Our SWS DCF model paints a far punchier picture than the narrative fair value, putting TechnipFMC’s worth closer to $67.96, about 35 percent above today’s $44.38 share price. If the cash flows are right and the market is wrong, how long can that gap last?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TechnipFMC Narrative

If you are not fully on board with this view, or simply prefer hands on research, you can build a tailored narrative yourself in minutes: Do it your way.

A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one compelling story when Simply Wall Street’s screener can surface multiple opportunities aligned with your goals, strategy and risk appetite in minutes.

- Capture potential multi baggers early by scanning for these 3636 penny stocks with strong financials that pair tiny market caps with real balance sheet strength and improving fundamentals.

- Position your portfolio for the next productivity wave by targeting these 24 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence across industries.

- Lock in quality at a discount by tracking these 913 undervalued stocks based on cash flows where present prices sit meaningfully below estimated cash flow based fair values.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion