- United States

- /

- Energy Services

- /

- NYSE:FLOC

Flowco Holdings (FLOC) Profit Margin Compression Tests Bullish Growth Narrative

Reviewed by Simply Wall St

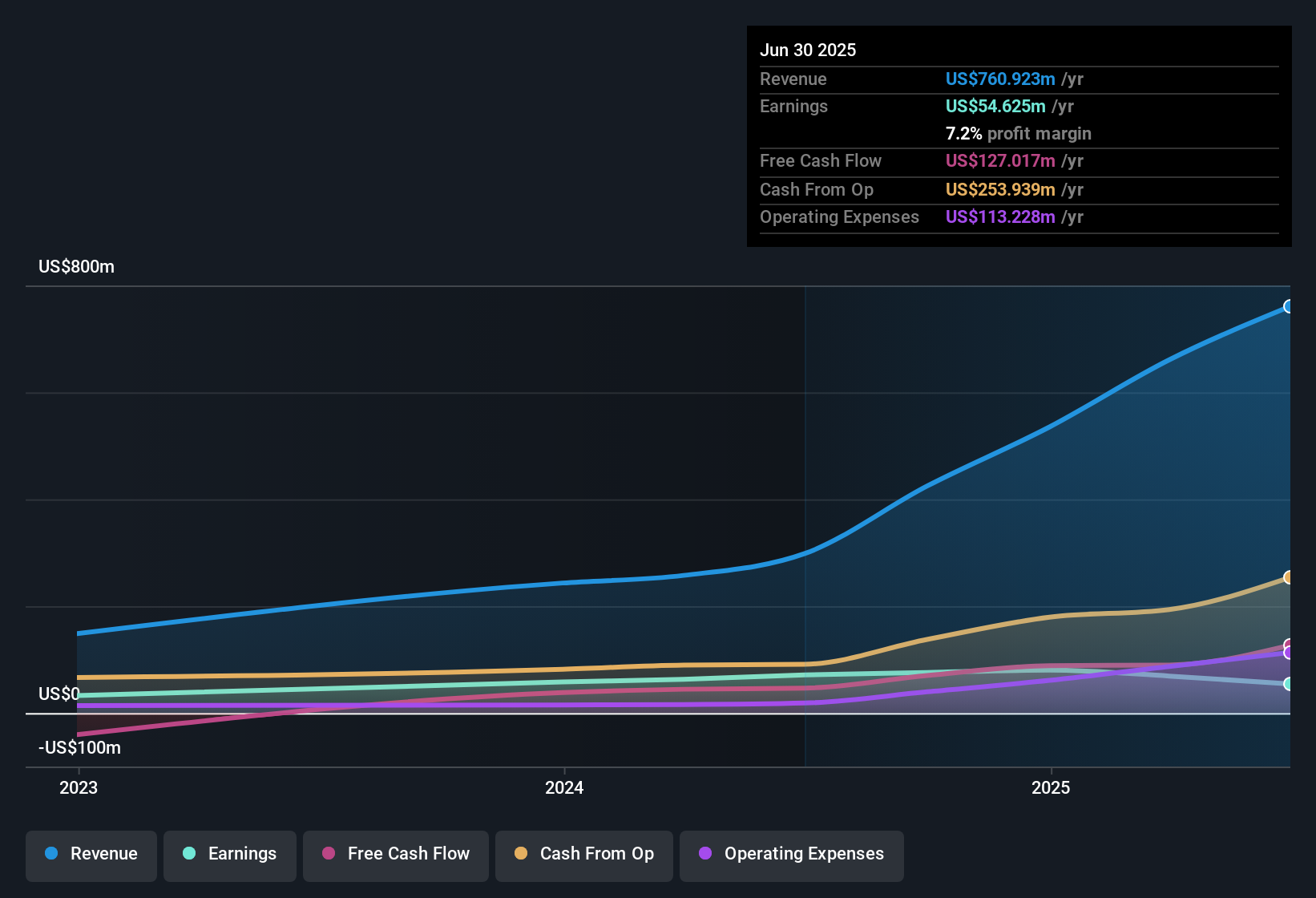

Flowco Holdings (FLOC) posted a net profit margin of 7.2%, a significant drop from last year’s 23.9%, and also reported negative earnings growth over the past year. Despite the margin squeeze, the company’s earnings quality remains high, and forward guidance calls for 24.2% annual earnings growth, outpacing the US market’s projected 16% per year. With shares currently trading at $18.58, well below the estimated fair value and peer valuations, the market may be weighing near-term margin pressure against a strong outlook for growth and value.

See our full analysis for Flowco Holdings.Next up, we look at how these earnings results measure against the dominant market narratives. Expect some surprises as numbers meet expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compression Deepens

- Net profit margin fell to 7.2% from last year’s 23.9%, underscoring continued pressure on profitability as high upfront costs or shifting operating conditions weigh on results.

- Guidance calls for 24.2% annual earnings growth, which heavily supports the case that future performance could rebound despite current margin softness.

- Projected earnings growth pace beats the US market’s estimated 16% per year, suggesting faster recovery potential.

- High earnings quality, as noted in the filing, provides additional comfort that today’s lower margins may not persist if forecasts materialize.

Growth Outlook Trails Sector Leaders

- Revenue is expected to rise by 7.4% per year, but that trails the broader US market’s 10.5% annual revenue growth forecast.

- While bulls often focus on strong forward earnings expansion, what is surprising is that top-line growth lags sector averages, raising questions about whether sufficient scale or new business lines are in place.

- This gap in expected sales momentum could limit the company’s ability to deliver on ambitious profit targets if market share gains do not accelerate.

- Steady revenue pace signals reliability, but does not create the same enthusiasm as businesses outpacing industry trends.

Discounted Valuation Versus Peers

- At $18.58, shares trade at a price-to-earnings ratio of 8.8x, well below both the peer average of 14.2x and the industry’s 16.1x, and far under the DCF fair value of $57.62.

- Prevailing market view highlights tension: the deep valuation discount suggests skepticism about near-term profits, yet also provides room for outsized gains if profit expansion or margin recovery occurs.

- A current market price that is more than 60% below estimated fair value leaves open the risk that negative sentiment is overdone, creating potential for mean reversion.

- Conversely, persistent margin pressure could keep the stock cheap, unless evidence of a turnaround appears in future filings.

Want to see how this valuation gap and growth forecast could reshape Flowco’s next move? See what the community is saying about Flowco Holdings

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Flowco Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Flowco’s declining profit margins and slower-than-industry sales growth may signal challenges in maintaining consistent performance as sector leaders race ahead.

If you’d prefer companies that reliably deliver steady expansion, use our stable growth stocks screener (2074 results) to focus on businesses with more consistent revenue and earnings growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLOC

Flowco Holdings

Through its subsidiaries, provides production optimization, artificial lift, and methane abatement solutions for the oil and natural gas industry in the United States.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion