- United States

- /

- Oil and Gas

- /

- NYSE:EQT

EQT (NYSE:EQT) Completes US$3 Billion Debt Exchange For New Notes Until 2048

Reviewed by Simply Wall St

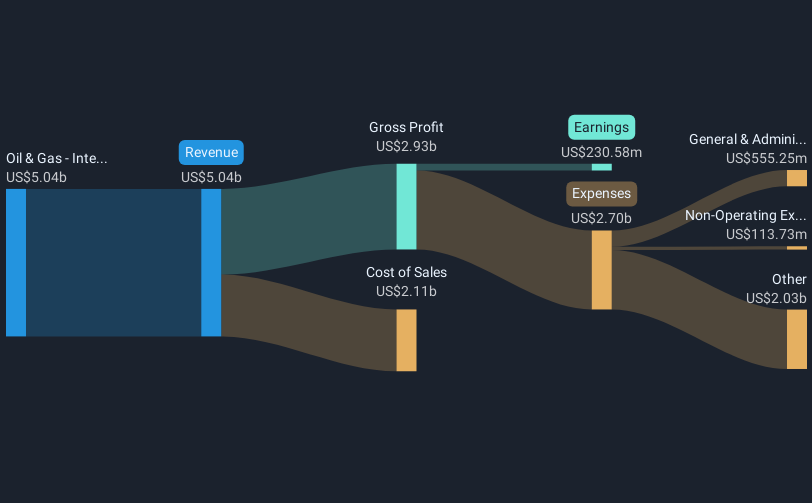

EQT Corporation (NYSE:EQT) experienced a 10.78% price increase over the last quarter, which coincided with significant financial restructuring. The company completed various debt financing moves, exchanging EQM Notes for new EQT Notes and cash, totaling billions in new issuances. These actions reflect a proactive approach to managing debt, potentially boosting investor confidence. Despite broader market declines, including a 5.6% drop in indices like the Nasdaq due to fears of a global trade war, EQT’s strategic financial maneuvers and robust guidance strengthened its position, contributing to positive shareholder returns contrasting the overall market downturn.

Over the last five years, EQT Corporation's total shareholder return, including share price and dividends, reached a very large 407.89%. This performance reflects several key developments. Notably, EQT's strategic integration of Equitrans with a focus on operational synergies has been crucial, reducing costs and improving margins. Additionally, significant midstream investments have enhanced production efficiency, allowing the company to cut capital expenses while bolstering free cash flow.

The announcement of a strategic partnership with Context Labs in April 2023, aimed at commercializing low-carbon intensity natural gas, underscores EQT’s forward-thinking approach in adapting to industry trends. Furthermore, its recent inclusion in the FTSE All-World Index signifies growing recognition in the global market. EQT's financial resilience is also reinforced by debt restructuring initiatives, which included the issuance of billions in new EQT notes. Collectively, these factors have strengthened EQT’s standing, outperforming industry peers over the past year with remarkable shareholder returns.

Unlock comprehensive insights into our analysis of EQT stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EQT, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives