- United States

- /

- Oil and Gas

- /

- NYSE:EPD

How the Williams Pipeline Joint Venture Could Change the Story for Enterprise Products Partners in 2025

Reviewed by Bailey Pemberton

If you’ve ever watched Enterprise Products Partners’ stock price glide along and wondered if now is the time to make a move, you’re definitely not alone. With a year-over-year return of 14.2%, it may surprise you that the stock has actually slipped by 0.6% over the past month and remains down 0.3% so far in 2024. For long-term investors, though, the three-year return of 57.4% and a five-year rally of 171.9% should definitely grab your attention.

Recent market shifts have prompted investors to revisit pipeline and energy infrastructure stocks, with Enterprise Products Partners standing out as a resilient name. While last week saw only a minor uptick of 0.1%, the real story is how the market perceives risk in the sector, especially as energy prices and economic signals keep shifting. Through it all, Enterprise’s share price seems to be quietly recalibrating.

But what about valuation? Looking at six key valuation checks, from earnings multiples to cash flow metrics, Enterprise Products Partners aces five of them and posts a value score of 5 out of 6. That strongly suggests the stock might be trading at a discount, at least by traditional standards.

Of course, numbers on a page only go so far. Let’s take a closer look at how each valuation method stacks up for Enterprise, and why sometimes, an even smarter way to judge if the stock is truly a bargain might be waiting at the end of this article.

Approach 1: Enterprise Products Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting those amounts back to today’s dollars. This approach aims to estimate the true value of a business by assessing the money it is expected to generate in the future.

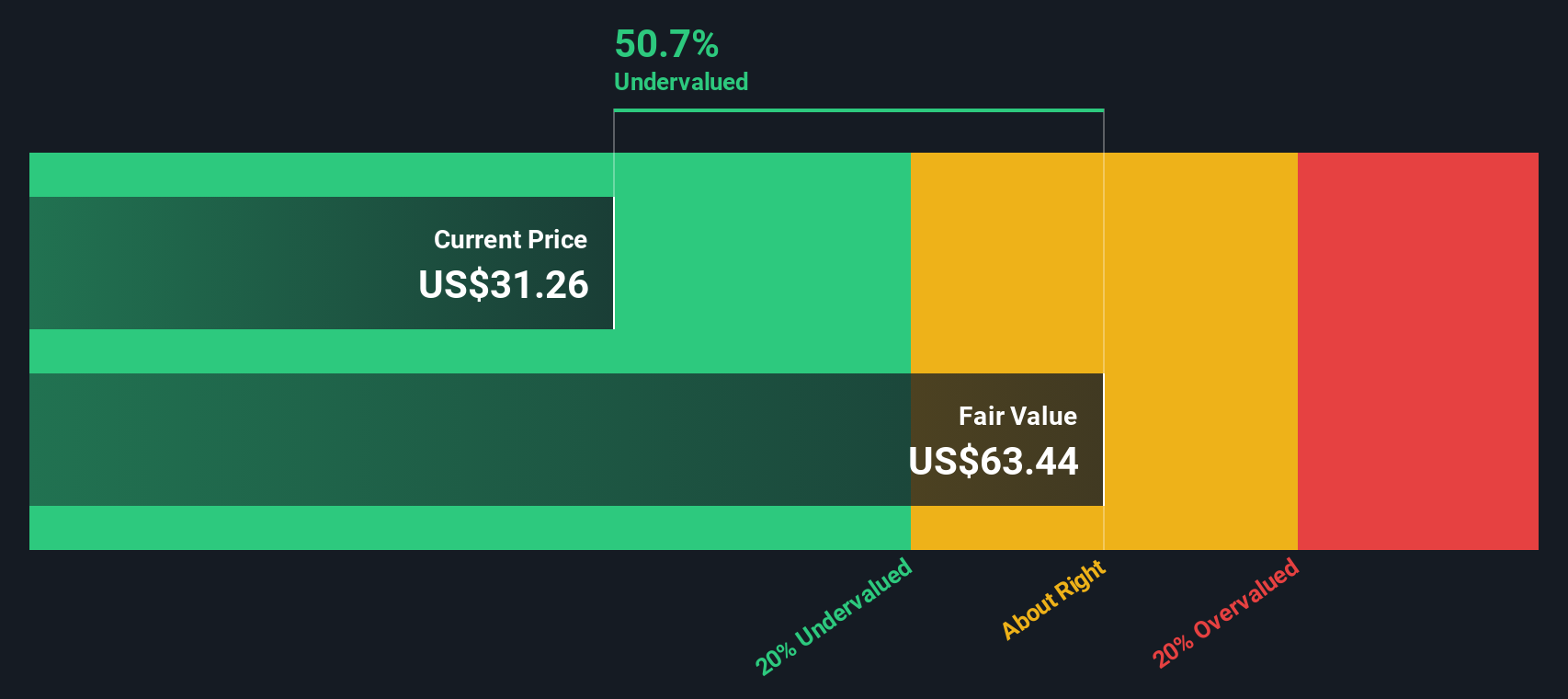

For Enterprise Products Partners, the latest twelve months’ Free Cash Flow is approximately $4.95 billion. Analyst forecasts indicate continued growth, with projected Free Cash Flow reaching about $7.22 billion by the end of 2029. Analysts provide detailed cash flow estimates for the next five years, and future projections beyond that are reasonably extrapolated.

According to this model, the estimated intrinsic value per share for Enterprise Products Partners is $63.43. When compared with the current share price, this suggests the stock is trading at a 50.1% discount to its calculated fair value. In other words, the DCF analysis indicates the market may be significantly undervaluing Enterprise Products Partners at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enterprise Products Partners is undervalued by 50.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Enterprise Products Partners Price vs Earnings (PE)

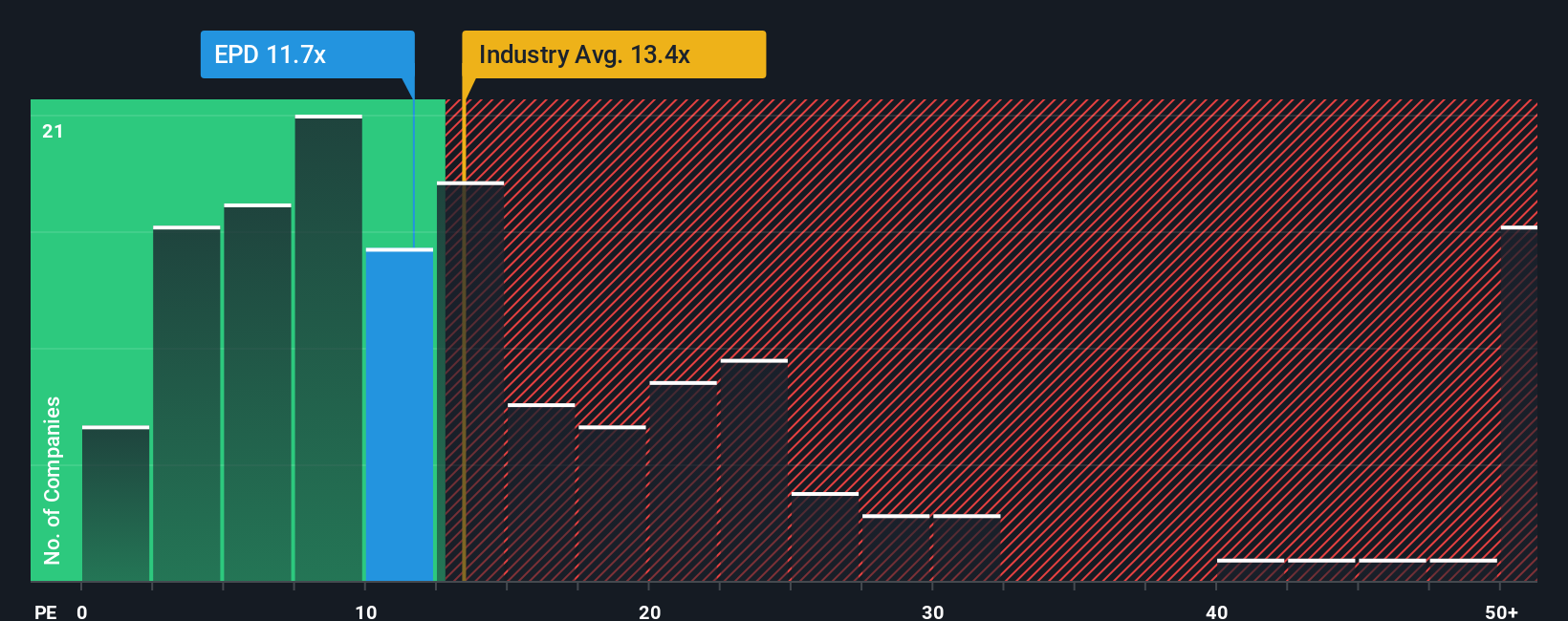

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like Enterprise Products Partners. It compares a company’s stock price to its earnings, giving investors a quick sense of how much they are paying for current profitability. For businesses that consistently generate solid bottom-line results, the PE ratio is often the go-to measurement for relative value.

It is important to note, though, that the “right” PE multiple is not fixed in stone. A higher PE can be justified if investors expect faster growth in the future or see lower risks. On the other hand, a lower PE may signal more uncertainty or slower anticipated growth. In other words, context matters when assessing whether a PE is fair or not.

Looking at the numbers, Enterprise Products Partners trades at a PE of 11.8x. For perspective, the average PE in the oil and gas industry stands at 13.1x, while the company’s peer average is a much loftier 20.1x. While this seems to suggest the stock could be undervalued, there is a more precise way to judge fairness: Simply Wall St’s “Fair Ratio.”

The Fair Ratio incorporates not just industry and peer benchmarks, but also Enterprise’s specific earnings growth outlook, profit margin, scale, and even the risks that come with the business. This tailored approach provides a truer sense of what multiple the stock deserves, rather than relying on broad averages.

Enterprise’s Fair Ratio comes in at 18.9x, notably higher than its actual PE of 11.8x. That significant gap indicates that, on this measure, Enterprise Products Partners appears undervalued relative to its potential and underlying fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Enterprise Products Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives connect the story you believe about a company with financial forecasts and an estimated fair value, letting you go beyond just the numbers and see the bigger picture.

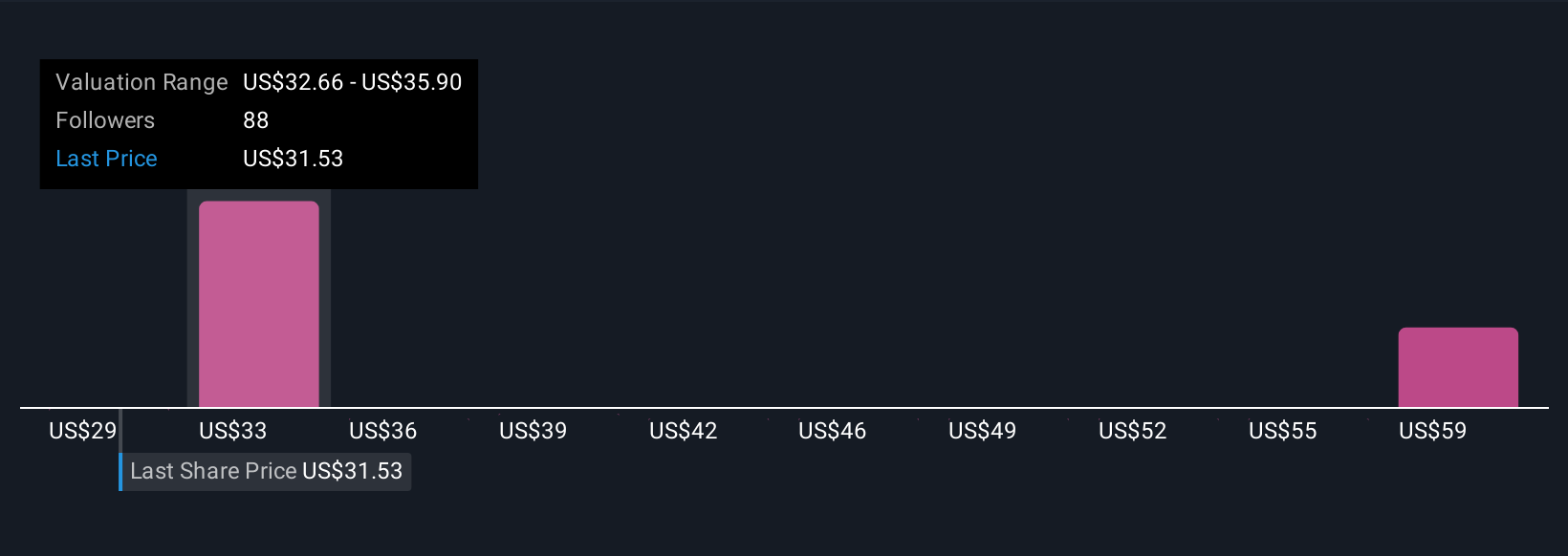

Simply put, a Narrative is your perspective on what will shape Enterprise Products Partners’ future, described clearly and matched with actual assumptions about its revenue, earnings, and margins. Narratives link where the business is headed, why, and how much it could be worth, making valuation easy and accessible, especially on Simply Wall St’s Community page, which millions of investors use.

By comparing Fair Value from your Narrative to the latest share price, you get a clear view of whether to buy or sell. Since Narratives update automatically whenever news or company results change, you always stay in the loop.

For example, some investors think recent infrastructure upgrades could support a price as high as $40.00 per share, while others believe ongoing risks could keep fair value closer to $32.00, so you get to see firsthand how the story you believe in really shapes your decision.

Do you think there's more to the story for Enterprise Products Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Products Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPD

Enterprise Products Partners

Provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives