- United States

- /

- Oil and Gas

- /

- NYSE:EPD

How Leadership Changes and Analyst Downgrade May Reshape the Growth Narrative at Enterprise (EPD)

Reviewed by Sasha Jovanovic

- Enterprise Products Partners L.P. announced that Michael C. “Tug” Hanley will assume the roles of executive vice president and chief commercial officer, overseeing all commercial operations, effective December 1, 2025.

- This leadership move came amid analyst concerns about Enterprise's growth outlook and a recent downgrade from J.P. Morgan, which highlighted industry competition and lower earnings growth expectations relative to peers.

- We’ll explore how these heightened concerns about future growth prospects may prompt a reassessment of Enterprise’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Enterprise Products Partners Investment Narrative Recap

To be a shareholder in Enterprise Products Partners today is to believe in the company’s ability to maintain and steadily grow its midstream energy infrastructure while managing industry competition and operational complexity. The recent appointment of Michael C. “Tug” Hanley as EVP and chief commercial officer, while a significant leadership change, does not materially alter the most immediate catalyst, the ramp-up of new processing plants in the Permian Basin, or address the pressing risk from slowing earnings growth and heightened competition.

Among recent announcements, the October decision to increase the share buyback authorization by US$3,000 million stands out, as accelerated repurchases have emerged as a key support for the share price. However, given current analyst skepticism around the ability of buybacks to offset industry growth pressures, this move brings renewed attention to how capital allocation might impact investor outcomes in the near term.

By contrast, it’s the potential for further weakness in earnings growth that investors should be aware of, especially if...

Read the full narrative on Enterprise Products Partners (it's free!)

Enterprise Products Partners' outlook anticipates $53.5 billion in revenue and $6.6 billion in earnings by 2028. This scenario assumes revenues will decrease by 0.8% annually, with earnings increasing by $0.8 billion from the current $5.8 billion.

Uncover how Enterprise Products Partners' forecasts yield a $35.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

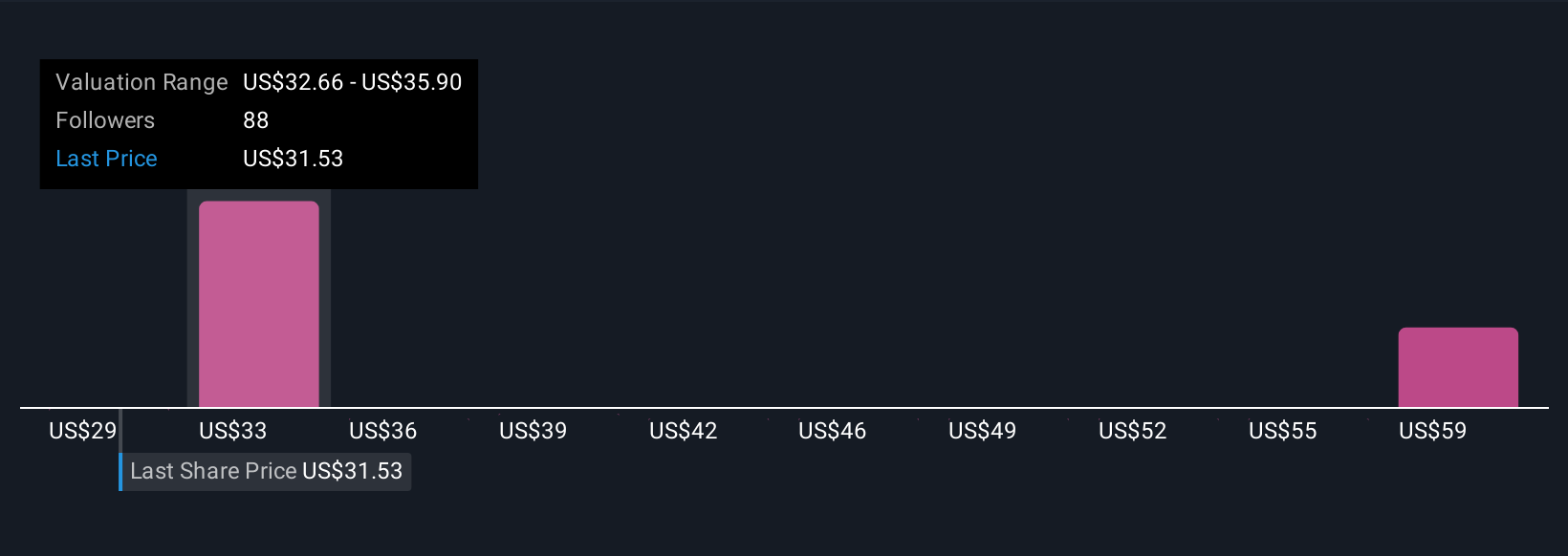

Ten members of the Simply Wall St Community have posted fair value estimates for Enterprise Products Partners, ranging from US$29.42 to US$66.26 per share. While opinions differ, many remain focused on execution risks tied to lagging earnings growth in this competitive sector, inviting you to weigh multiple viewpoints on the company’s future.

Explore 10 other fair value estimates on Enterprise Products Partners - why the stock might be worth over 2x more than the current price!

Build Your Own Enterprise Products Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enterprise Products Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enterprise Products Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enterprise Products Partners' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Products Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPD

Enterprise Products Partners

Provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026