- United States

- /

- Oil and Gas

- /

- NYSE:DVN

Devon Energy (NYSE:DVN) Sees 2% Dip As John Krenicki Jr. Steps Down From Board

Reviewed by Simply Wall St

Devon Energy (NYSE:DVN) recently announced a significant board change with John Krenicki Jr. stepping down, marking a noteworthy transition in leadership. This shift comes as the energy sector faces challenging market conditions, reflected in the company's 2% share price decline last quarter. During this period, broader market factors, such as President Trump's tariffs announcement, exacerbated market turbulence and affected stock indices, inducing a 5% drop in the market over the last week. Concurrently, despite Devon's revenue increase, a 45% year-on-year decline in net income may also have played a role in the company's weaker performance.

Over the past five years, Devon Energy's total shareholder return, including dividends, rose by 357.52%. During this period, Devon Energy focused on enhancing its operational efficiencies and improving its asset portfolio. The dissolution of the joint venture with BPX, particularly in the Eagle Ford region, contributed to significant cost savings, improving well returns. Additionally, the strategic acquisition of Grayson Mill Energy in May 2024 for US$2 billion boosted Devon’s asset base, supporting future growth avenues.

In 2024, Devon demonstrated confidence in its valuation by repurchasing shares worth over US$3 billion and increasing dividend payouts, reflecting a shareholder-focused approach. Despite underperforming the US Oil and Gas industry over the past year, Devon's robust capital return program and operational improvements have laid a foundation that contributed to its substantial total return over the long term. These actions highlight the company's commitment to both investing in growth and returning capital to its shareholders.

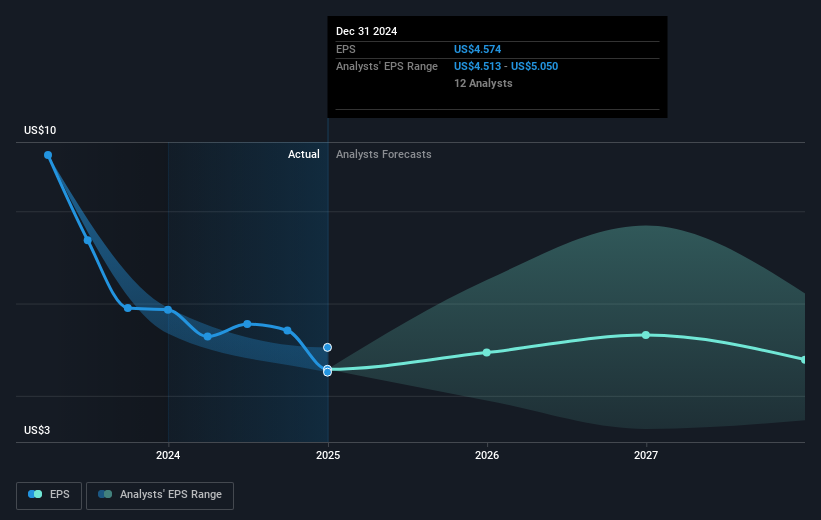

Examine Devon Energy's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives