Stock Analysis

Exploring Undervalued Small Caps With Insider Actions In July 2024

Reviewed by Simply Wall St

As global markets exhibit mixed responses with a notable shift towards small-cap and value shares, investors are keenly observing these segments for potential opportunities. Amidst this landscape, understanding the intrinsic qualities that contribute to a stock being labeled as undervalued becomes crucial, especially when insider actions suggest confidence in the company's prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tokmanni Group Oyj | 14.2x | 0.4x | 45.94% | ★★★★★★ |

| THG | NA | 0.4x | 43.65% | ★★★★★☆ |

| AtriCure | NA | 2.8x | 46.76% | ★★★★★☆ |

| Bytes Technology Group | 25.3x | 5.7x | -0.24% | ★★★★☆☆ |

| Nexus Industrial REIT | 2.8x | 3.4x | 13.93% | ★★★★☆☆ |

| CVS Group | 21.3x | 1.2x | 40.97% | ★★★★☆☆ |

| Norcros | 7.7x | 0.5x | -10.63% | ★★★☆☆☆ |

| PowerCell Sweden | NA | 4.5x | 40.66% | ★★★☆☆☆ |

| NSI | NA | 4.5x | 40.70% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

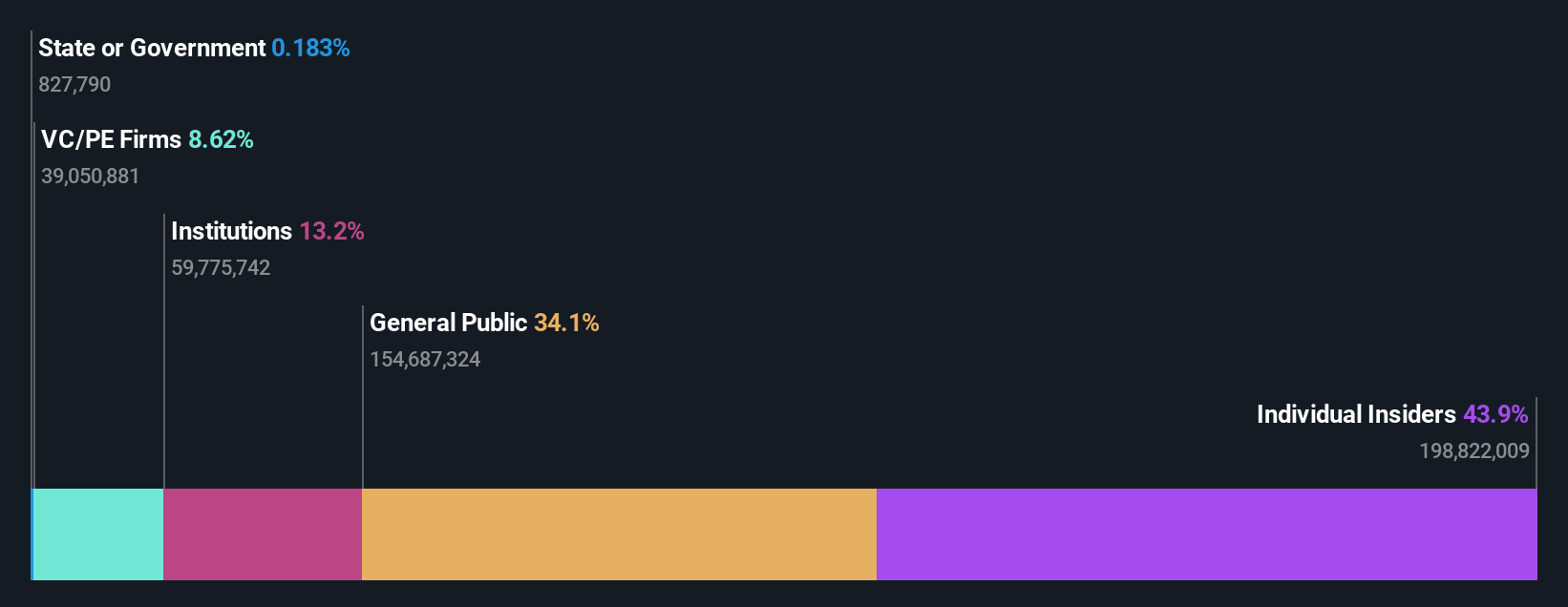

Overview: Codan is a diversified technology company specializing in communications equipment and metal detection, with a market capitalization of approximately A$1.09 billion.

Operations: The company generates its revenue primarily from communications and metal detection, contributing A$291.50 million and A$212.20 million respectively. Over recent periods, it has observed a gross profit margin trend around 54% to 57%.

PE: 30.5x

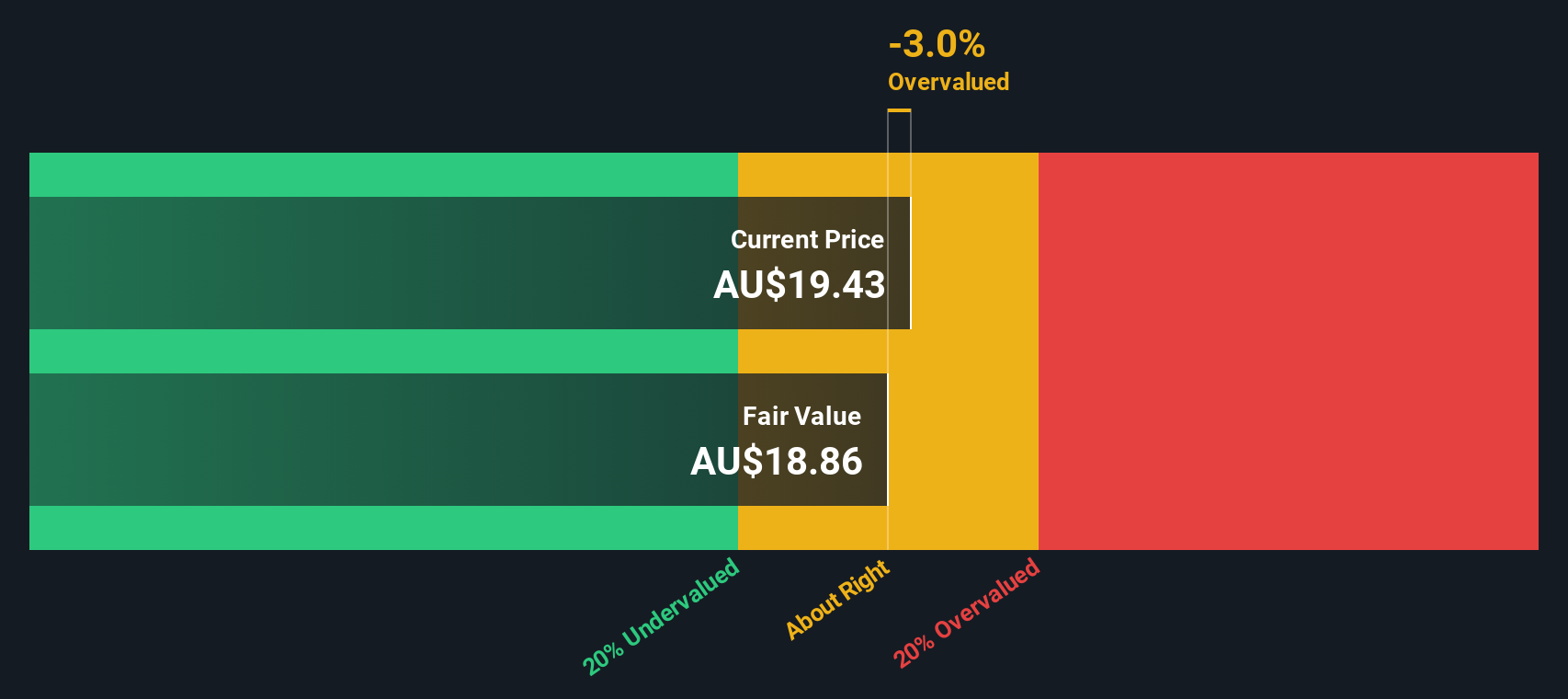

Codan, a notable player in the small-cap market, has recently shown signs of being undervalued. With earnings projected to increase by 16.2% annually, financial robustness is indicated despite its reliance on external borrowing—its sole funding source, which presents a higher risk profile. Insider confidence is evident as they have recently purchased shares, signaling belief in the company's future prospects and current market position. This blend of financial growth and insider activity suggests potential for appreciation in Codan’s market value.

- Click to explore a detailed breakdown of our findings in Codan's valuation report.

Understand Codan's track record by examining our Past report.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company primarily engaged in the manufacturing and marketing of formulation products, with a market capitalization of approximately ₹21.77 billion.

Operations: The company generates a significant portion of its revenue from pharmaceutical sales, which amounted to ₹21.77 billion in the most recent reporting period. It achieved a gross profit margin of 52.32% during the same timeframe, reflecting the cost efficiency in its production processes relative to revenue.

PE: 28.9x

Recently, Marksans Pharma demonstrated a notable increase in sales and revenue for the fiscal year ending March 2024, with revenues climbing to INR 22.28 billion from INR 19.11 billion the previous year. This financial uptick is paired with a promising earnings forecast, suggesting an annual growth rate of approximately 20%. Additionally, insider confidence is evident as they have recently purchased shares, signaling trust in the company's future prospects amidst its reliance on external borrowing for funding. The board's recommendation for a dividend increase further underscores their positive outlook on sustained profitability and financial health.

- Click here to discover the nuances of Marksans Pharma with our detailed analytical valuation report.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings is an energy company primarily engaged in petroleum refining, with additional operations in retail fuel and logistics, boasting a market capitalization of approximately $1.07 billion.

Operations: The company's primary revenue streams are from refining, contributing $15.72 billion, followed by logistics at $1.03 billion and retail at $871.2 million. Gross profit margin has shown variability over the observed periods, with a notable figure of 13.06% in early 2019, reflecting fluctuations in operational efficiency and market conditions.

PE: -19.1x

Recently added to several Russell indexes, Delek US Holdings reflects growing market recognition amidst challenging financials, with a Q1 sales drop to US$3.23 billion and a shift to a net loss of US$32.6 million. Despite these hurdles, insider confidence is evident as they have not engaged in recent share repurchases, focusing instead on operational adjustments and modest dividend growth to US$0.25 per share. This strategic pivot hints at potential resilience and recovery prospects for the company within its sector.

- Delve into the full analysis valuation report here for a deeper understanding of Delek US Holdings.

Examine Delek US Holdings' past performance report to understand how it has performed in the past.

Taking Advantage

- Get an in-depth perspective on all 212 Undervalued Small Caps With Insider Buying by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations worldwide.

Flawless balance sheet with reasonable growth potential.