- United States

- /

- Oil and Gas

- /

- NYSE:DK

Delek US Holdings (DK): Exploring Valuation Following a 30% Three-Month Share Price Rally

Reviewed by Kshitija Bhandaru

Delek US Holdings (DK) shares have seen meaningful gains over the past 3 months, climbing nearly 30%. That upward trend stands out, especially given the company’s moderate annual revenue growth and the wider industry headwinds lately.

See our latest analysis for Delek US Holdings.

After a remarkable climb in the last three months, Delek US Holdings is now trading at $31.53 per share. The momentum is hard to ignore. Its 90-day share price return of nearly 30% has added to an impressive year-to-date gain of almost 71%. Looking further out, shareholders have enjoyed a hefty 70% total return over the past year and a substantial 223% over five years. This signals that optimism and renewed interest in the stock have taken hold despite industry challenges.

If you’re looking for more discovery opportunities beyond Delek’s surge, now’s a great time to check out fast growing stocks with high insider ownership.

With such a dramatic rally and recent price now exceeding analyst targets, the question is whether Delek US Holdings is undervalued at current levels or if the market has already accounted for future growth and optimism.

Most Popular Narrative: 6.5% Overvalued

Delek US Holdings’ current share price of $31.53 sits above the most popular narrative fair value of $29.62, fueling an ongoing debate about whether the recent rally has taken the stock beyond a justifiable level. As attention on Delek intensifies, it’s worth considering what’s really driving analysts’ fair value estimates and if there’s more to the story than meets the eye.

Delek's sustained operational improvements, driven by its enterprise optimization program (EOP), which targets structural changes in refinery operations, procurement, and product sales, are expected to deliver $130 to $170 million of annualized cash flow enhancements, with much of the benefit expected to flow through to net margins and free cash flow starting in the second half of 2025.

Curious how margin-boosting initiatives, shifting industry drivers, and bold cash flow projections collide in one ambitious valuation? Think you know what really underpins that fair value? The financial blueprint behind this price target may surprise you. Unlock the full narrative to see exactly what could be the catalyst behind Delek’s next move.

Result: Fair Value of $29.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing net losses and Delek’s heavy reliance on U.S. refining make the company especially vulnerable to accelerating industry transition and potential regulatory setbacks.

Find out about the key risks to this Delek US Holdings narrative.

Another View: The Market by the Numbers

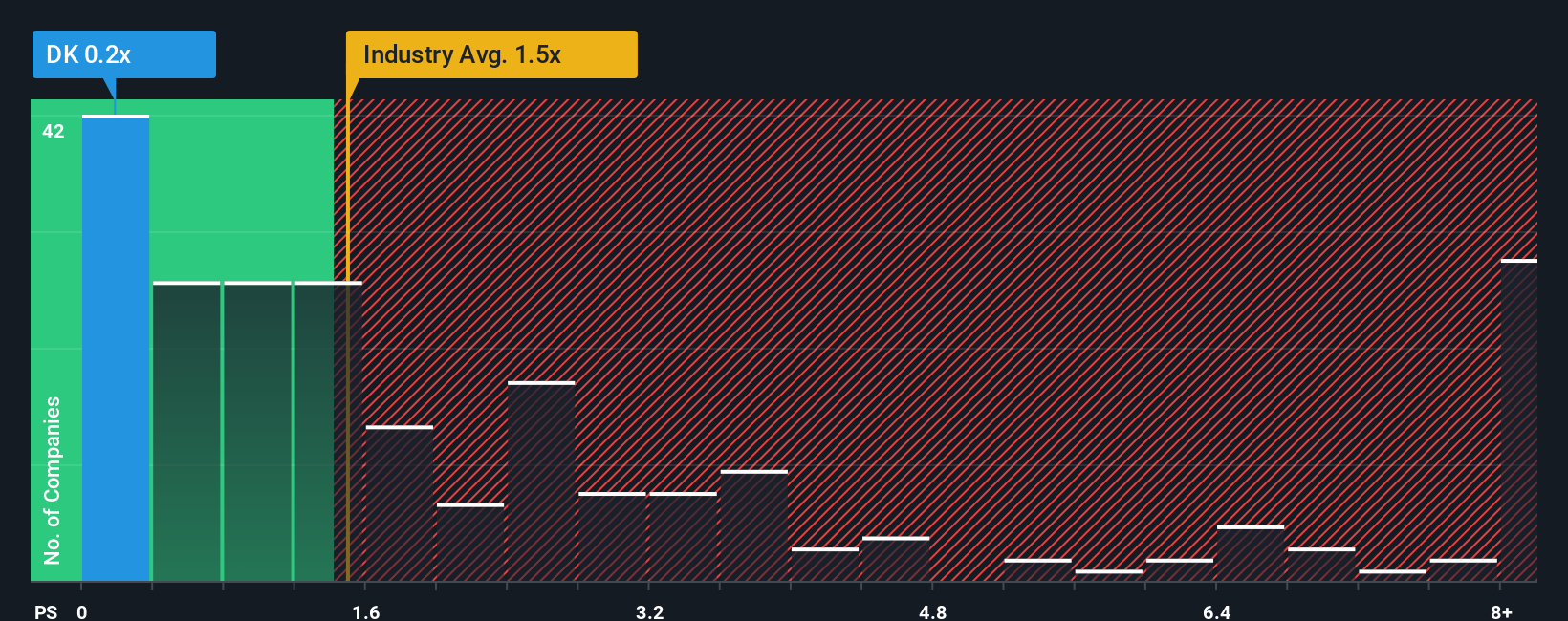

While the most popular narrative argues Delek’s price is stretched, the numbers tell a slightly different story. Compared to the industry, Delek’s current price-to-sales ratio stands at 0.2x, well below the US Oil and Gas industry average of 1.5x and the fair ratio of 0.4x. This suggests the market might be underestimating Delek’s future potential rather than overhyping it. Could this be where the real value lies, or does the gap signal hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Delek US Holdings Narrative

If the numbers or angles here don't quite fit your own point of view, it's fast and easy to run your own analysis and craft a personalized take in just a few minutes too. Do it your way.

A great starting point for your Delek US Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always a step ahead. Let Simply Wall Street’s powerful Screener help you uncover tomorrow’s winners and seize advantages others may miss.

- Accelerate your search for standout returns by scanning these 898 undervalued stocks based on cash flows set to outperform based on compelling cash flow fundamentals.

- Tap into the future of medicine with these 32 healthcare AI stocks transforming diagnostics, patient care, and biotech innovation right now.

- Power up your income strategy by targeting these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% to reward your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DK

Delek US Holdings

Engages in the integrated downstream energy business in the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives