While unquestionably propelled by the current oil prices, Chevron Corporation (NYSE: CVX) just announced some of the best earnings results in recent years.

Yet, the stock remains over 15% below the highs from 2018 and just closing in on the levels before the 2020 downturn.

Check out our latest analysis for Chevron

Earnings Results

- Q3 Non-GAAP EPS: US$2.96 (beat by US$0.77)

- GAAP EPS: US$3.19 (beat by US$1.06)

- Revenue: US$44.71 (beat by US$3.82b)

CEO Mike Wirth quoted improving market conditions and strong operational performance, and a lower cost structure as a reason for the highest quarterly earnings since Q1 2013. The company is firm in its stance to boost the capital investments plan to US$10b through 2028, intending to become a lower carbon business through boosts in renewable natural gas and hydrogen production.

Furthermore, with the profits surging, CFO Pierre Berber noted that Chevron's net debt-to-capital ratio is falling, opening up the possibility of increasing the stock buybacks.

Currently, the company aims to spend around US$3b per year on repurchases. Finally, with a free cash flow of US$6.7b, the current dividend yield of 4.8% is well-covered.

What's the opportunity in Chevron?

Our valuation model shows that the intrinsic value for the stock is $161.05, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. However, given that Chevron's share is relatively volatile (i.e., its price movements are magnified relative to the rest of the market), this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

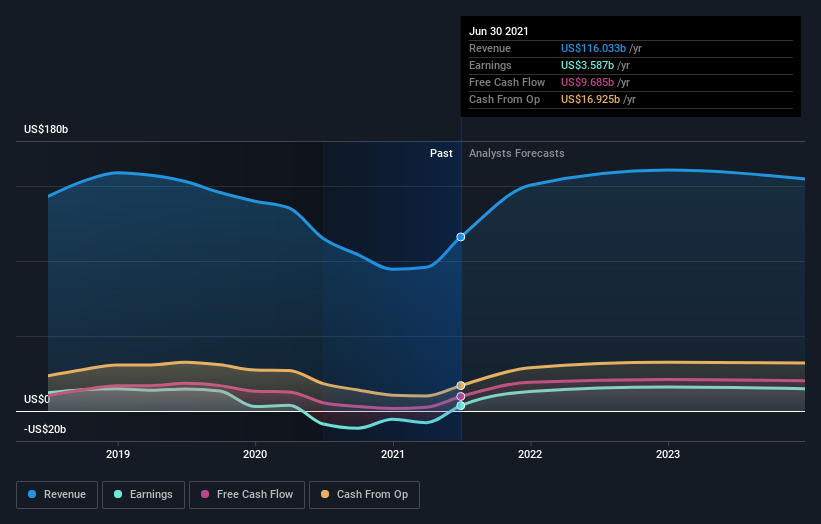

What kind of growth will Chevron generate?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price. With profit expected to more than double over the next couple of years, the future seems bright for Chevron. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Chevron is taking advantage of the current energy market situation and looking forward to the low-carbon future. Here are the two stances to consider toward the stock:

Are you a shareholder? Since CVX is currently undervalued, it may be a great time to accumulate more of your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current undervaluation.

Are you a potential investor? If you've been keeping an eye on CVX for a while, now might be the time to enter the stock. Its prosperous future outlook isn't fully reflected in the current share price yet, which means it's not too late to buy CVX. But before you make any investment decisions, consider other factors such as the track record of its management team to make a well-informed investment decision.

So while earnings quality is essential, it's equally important to consider the risks facing Chevron at this point. You'd be interested to know that we found 2 warning signs for Chevron, and you'll want to know about them.

If you are no longer interested in Chevron, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives