- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Kazakhstan Production Disruption Might Change The Case For Investing In Chevron (CVX)

Reviewed by Sasha Jovanovic

- In recent days, Chevron and Shell reduced oil and gas production at Kazakhstan's Karachaganak field after a Ukrainian drone strike damaged the Orenburg gas processing plant in Russia, impacting a key energy asset for the region.

- This disruption has highlighted the ongoing operational risks faced by international energy companies due to geopolitical tensions and infrastructure vulnerabilities.

- We'll examine how the temporary production cut in Kazakhstan could affect Chevron's investment outlook and resilience to external shocks.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Chevron Investment Narrative Recap

To be a shareholder in Chevron, you need to believe in the company's ability to generate substantial cash flow from its expansive upstream projects and disciplined capital allocation, despite volatility in energy markets. The recent production cut in Kazakhstan, following damage to a key gas processing plant, may temporarily affect regional supply but is not likely to materially impact Chevron’s biggest near-term catalyst: cash flow generation from major growth assets. However, it does highlight the ongoing importance of geopolitical and operational risks to the business.

One recent announcement worth mentioning is Chevron’s significant increase in its upstream capital expenditure, with a focus on the Permian Basin, Kazakhstan, and Guyana. These investments are positioned to reinforce the company’s production base, even as short-term operational disruptions occur, supporting Chevron's efforts to maximize free cash flow and maintain its attractive dividend profile.

But while cash flow resilience is top of mind for many investors, the risks posed by unexpected geopolitical events like this remain essential for shareholders to understand...

Read the full narrative on Chevron (it's free!)

Chevron's narrative projects $196.0 billion revenue and $21.8 billion earnings by 2028. This requires 1.2% yearly revenue growth and a $8.1 billion increase in earnings from $13.7 billion today.

Uncover how Chevron's forecasts yield a $168.78 fair value, a 8% upside to its current price.

Exploring Other Perspectives

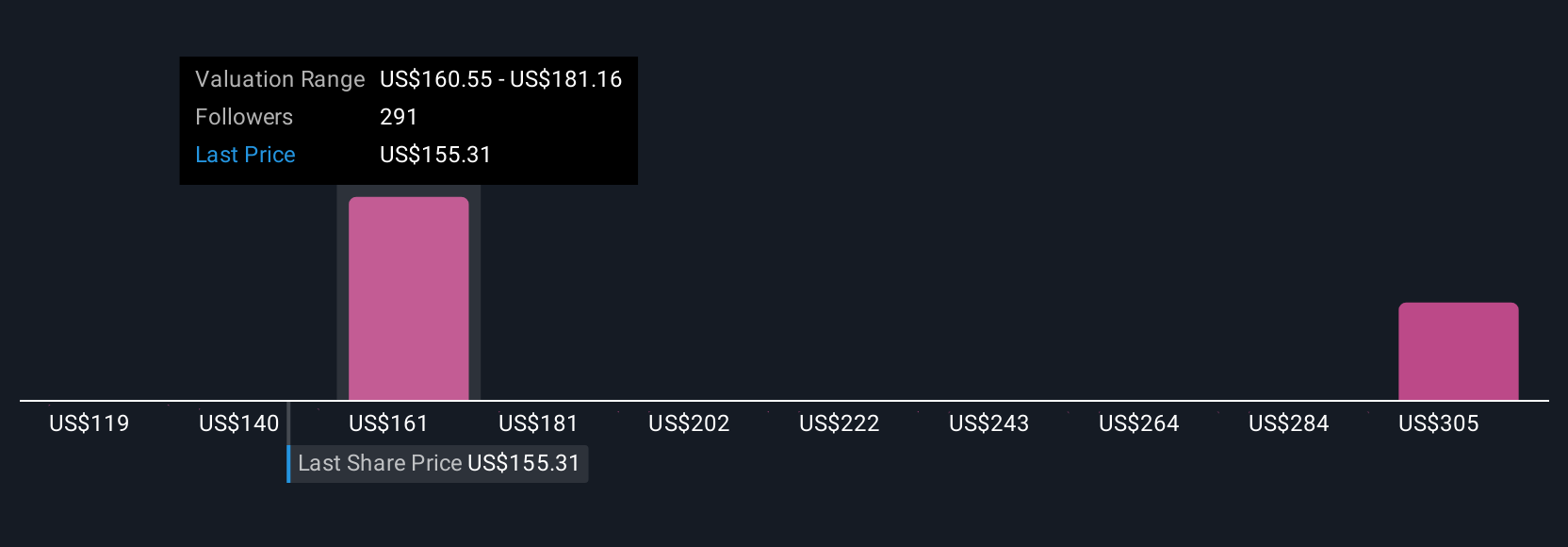

Simply Wall St Community members offered 28 fair value estimates for Chevron ranging from US$125.69 to US$390.41. In light of recurring project execution and geopolitical risks, differing views reflect the multiple variables shaping long-term outcomes for this energy major.

Explore 28 other fair value estimates on Chevron - why the stock might be worth over 2x more than the current price!

Build Your Own Chevron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chevron research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chevron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chevron's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives