- United States

- /

- Oil and Gas

- /

- NYSE:CVX

How Investors May Respond To Chevron (CVX) Boosting Synergy Targets And Expanding Nigerian Offshore Stakes

Reviewed by Sasha Jovanovic

- In recent months, Chevron agreed to acquire a 40% stake in two offshore Nigerian petroleum prospecting licenses from TotalEnergies and raised its projected cost-saving synergies from the Hess acquisition by 50%, with full benefits expected by the end of 2026.

- Together, these moves deepen Chevron’s presence in low-cost, offshore resources while aiming to enhance cash generation and integration benefits from its expanding global portfolio.

- Next, we’ll examine how Chevron’s expanded Nigerian offshore position could influence its investment narrative around future cash flows and portfolio resilience.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Chevron Investment Narrative Recap

To own Chevron, you have to believe large scale oil and gas will remain central to the energy mix while the company steadily improves efficiency and allocates capital with discipline. The Nigerian offshore deal and higher Hess synergy target support this efficiency story, but they do not fundamentally change the near term catalyst, which still revolves around cash flow delivery and buybacks, nor the key risk of long term demand pressure from the energy transition.

The raised cost saving target from the Hess acquisition stands out here, because it directly ties into Chevron’s effort to keep its breakeven levels low and support its dividend and buyback program despite profit volatility. How well these integration benefits are realized, alongside new offshore projects like Nigeria, will likely influence how resilient Chevron’s cash generation looks if oil prices or demand soften.

Yet, even as Chevron doubles down on long lived upstream assets, investors should be aware of the longer term risk that...

Read the full narrative on Chevron (it's free!)

Chevron's narrative projects $196.0 billion revenue and $21.8 billion earnings by 2028. This requires 1.2% yearly revenue growth and about an $8.1 billion earnings increase from $13.7 billion today.

Uncover how Chevron's forecasts yield a $172.92 fair value, a 14% upside to its current price.

Exploring Other Perspectives

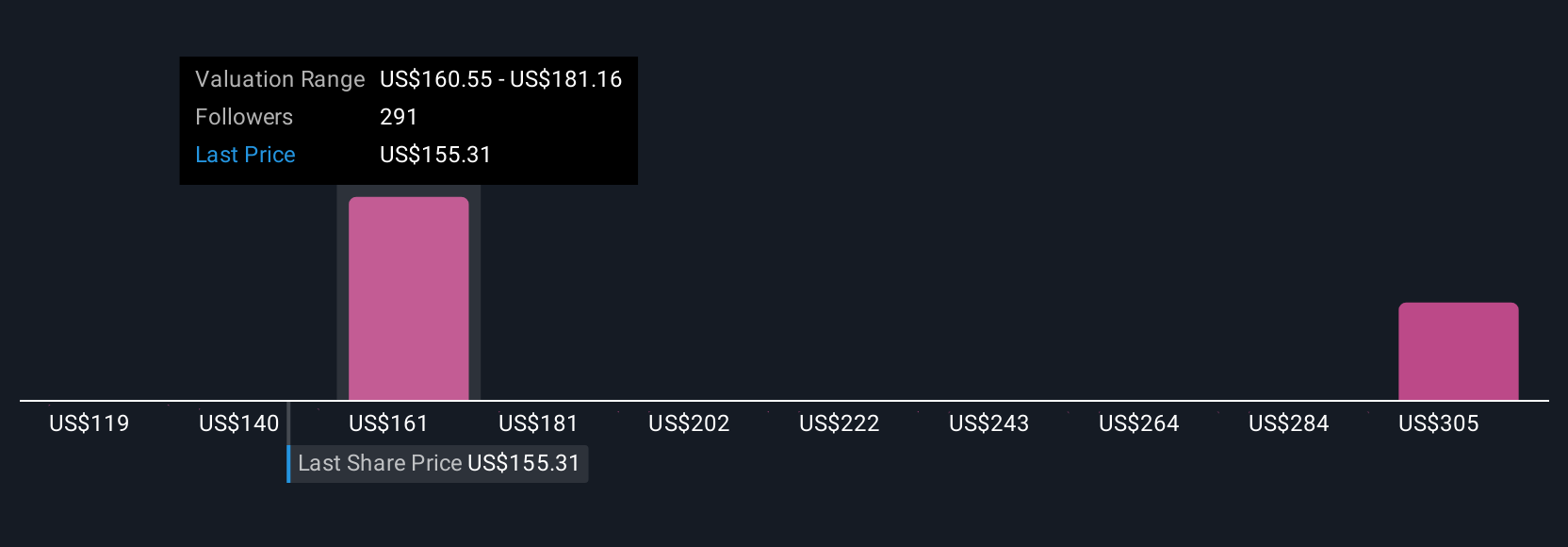

Across 28 fair value estimates from the Simply Wall St Community, Chevron’s assessed worth ranges widely from US$128.36 to US$335.32 per share. You are seeing those varied expectations meet concerns about long term oil demand, capital intensive projects and how much of today’s cash flows can truly offset those structural risks over time.

Explore 28 other fair value estimates on Chevron - why the stock might be worth over 2x more than the current price!

Build Your Own Chevron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Chevron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chevron's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026