- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron’s $5.5 Billion Debt Raise Might Change the Case for Investing in CVX

Reviewed by Simply Wall St

- Earlier this week, Chevron U.S.A. Inc., a subsidiary of Chevron Corporation, issued US$5.5 billion in notes with maturities ranging from 2027 to 2035 to secure long-term funding, with the notes guaranteed by its parent company.

- This financing move coincides with Chevron's focus on production expansion in the Permian Basin and commitment to efficiency and sustainability initiatives.

- We'll explore how Chevron's US$5.5 billion debt raise could bolster investment in its Permian Basin operations and long-term business outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Chevron Investment Narrative Recap

To be a Chevron shareholder, you need confidence in the company’s ability to sustain and grow oil and gas production while adapting to long-term industry shifts like the energy transition. The recent US$5.5 billion note issuance supports Chevron’s operating flexibility but is unlikely to materially change the most pressing short-term catalyst, its Permian Basin production ramp, or moderate the biggest current risk: exposure to commodity price swings and ongoing decarbonization headwinds.

Chevron’s second quarter 2025 results, highlighted by record upstream output and the completed Hess acquisition, stand out as particularly relevant. These developments reinforce Chevron’s growth ambitions, and the Permian milestone of surpassing 1 million barrels of oil equivalent per day exemplifies its focus on scale and efficiency as key drivers of future performance. But not all factors are aligned, investors should also be aware that...

Read the full narrative on Chevron (it's free!)

Chevron's outlook anticipates $196.1 billion in revenue and $21.8 billion in earnings by 2028. This assumes a 1.2% annual revenue growth rate and a $8.1 billion increase in earnings from current levels of $13.7 billion.

Uncover how Chevron's forecasts yield a $167.78 fair value, a 7% upside to its current price.

Exploring Other Perspectives

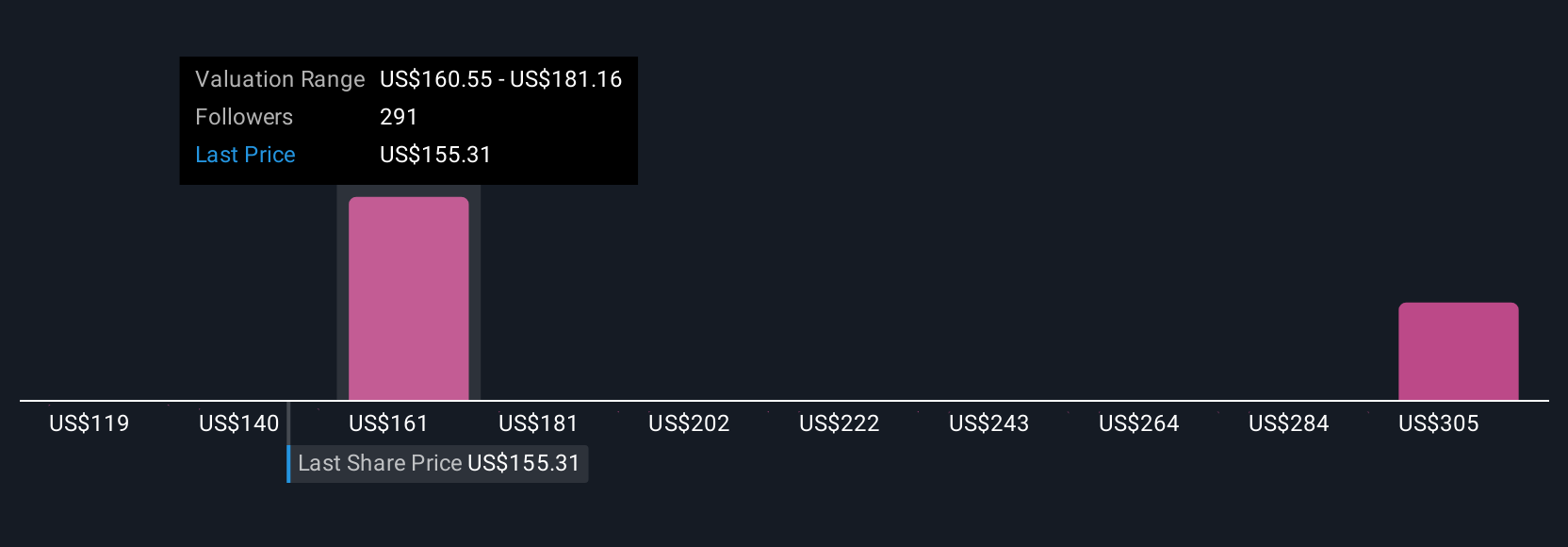

Across 28 fair value estimates from the Simply Wall St Community, targets ranged from US$119.34 to US$433.39 per share. With so many viewpoints, consider how Chevron’s growth push in the Permian may shape performance outcomes, and why shifts in energy demand could still matter.

Explore 28 other fair value estimates on Chevron - why the stock might be worth over 2x more than the current price!

Build Your Own Chevron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chevron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Chevron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chevron's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives