- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron (CVX): Assessing Valuation After Investor Day Highlights Growth, Exploration, and Operational Resilience

Reviewed by Simply Wall St

Chevron (CVX) is drawing attention after its investor day, where the company laid out ambitious goals for ramping up oil and gas production, boosting exploration, and creating more cash flow and dividends through 2030.

See our latest analysis for Chevron.

Chevron’s steady commitment to ramping production and boosting shareholder returns comes as the stock shakes off recent volatility. While shares have edged up 1.9% year-to-date, the 1-year total shareholder return is -3.4%. This indicates that momentum is still rebuilding after short-term challenges. Long-term holders have seen a striking 98% total shareholder return over five years, which reflects Chevron’s capacity to deliver value even through uncertainty.

If you want to expand your search beyond Chevron and see what’s trending across energy, now’s a good time to discover fast growing stocks with high insider ownership

Yet given the stock’s muted returns this year and ambitious long-term targets, the question remains: is Chevron undervalued at current levels, or is the market already accounting for its future growth potential?

Most Popular Narrative: 13.5% Undervalued

Chevron’s most widely followed narrative suggests the fair value is $172.80, well above the latest close of $149.51, pointing to meaningful upside if analyst projections hold true. Investor optimism hinges on cash accretion from strategic deals and capital efficiencies, setting the stage for a re-rating.

The integration of Hess synergies, new low-cost assets, and share buybacks will be cash flow accretive and boost EPS, even as Chevron sustains high shareholder returns regardless of commodity price cycles.

Want to know the math behind this bold price target? The core driver is a rare combination of capital discipline, margin expansion, and aggressive share buybacks. The narrative hints at transformative moves and surprising projections. Find out what’s fueling Chevron’s next leap.

Result: Fair Value of $172.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Chevron’s reliance on hydrocarbons and project execution challenges could create pressure on future earnings if the global energy transition accelerates or operational setbacks occur.

Find out about the key risks to this Chevron narrative.

Another View: Is Chevron Really Undervalued?

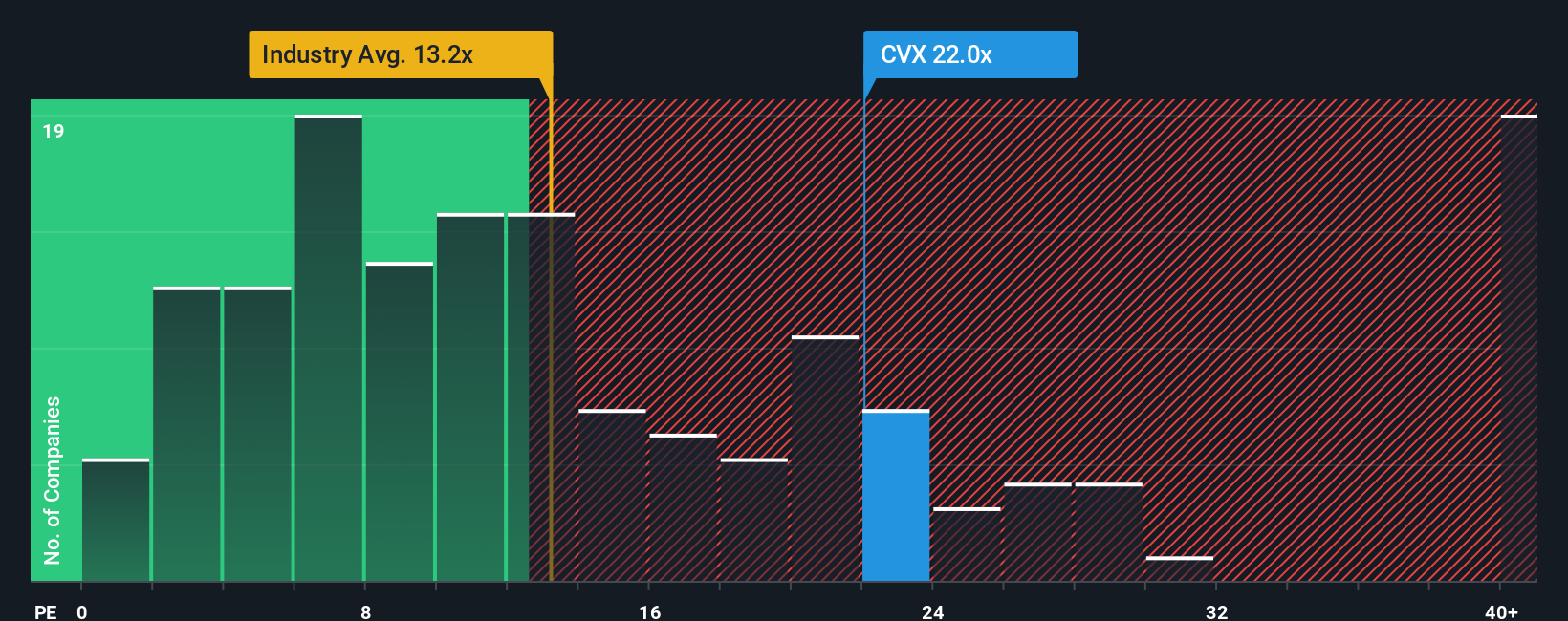

While the most popular view calls Chevron undervalued, a look at the key price-to-earnings ratio paints a different picture. Chevron trades at 23.6x earnings, making it pricier than both the US Oil and Gas industry average of 13.3x and the peer average of 21.8x. The fair ratio is calculated at 23.7x, suggesting the market price could still catch up, or that risks linger if earnings do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chevron Narrative

If you want to dive deeper or think the story should take another direction, you can explore the numbers yourself and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle; there are always fresh opportunities to seize. Level up your portfolio by checking out these forward-thinking stock strategies before the next rally starts without you:

- Tap into the next wave of high-yield opportunities by reviewing these 15 dividend stocks with yields > 3%, built to spot companies with consistently strong payouts and impressive track records.

- Stay ahead of industry disruption and see which game-changers are making moves in artificial intelligence with these 25 AI penny stocks, featuring cutting-edge innovators.

- Position yourself for potential long-term gains and uncover value gems with these 922 undervalued stocks based on cash flows, focused on stocks trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.