- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron Corporation's (NYSE:CVX) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Chevron's (NYSE:CVX) stock is up by a considerable 14% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. In this article, we decided to focus on Chevron's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Chevron

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chevron is:

11% = US$17b ÷ US$157b (Based on the trailing twelve months to September 2024).

The 'return' is the income the business earned over the last year. That means that for every $1 worth of shareholders' equity, the company generated $0.11 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Chevron's Earnings Growth And 11% ROE

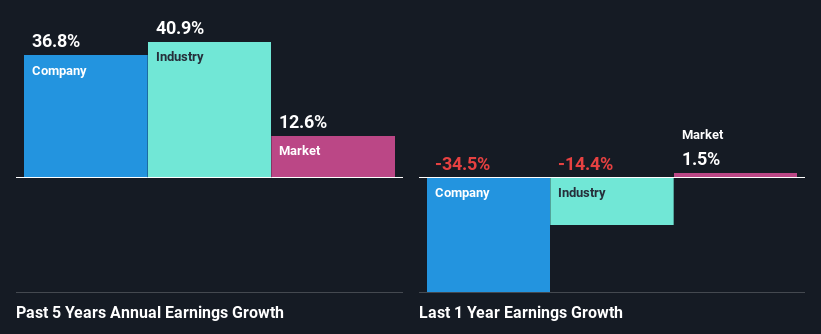

To begin with, Chevron seems to have a respectable ROE. Yet, the fact that the company's ROE is lower than the industry average of 15% does temper our expectations. That being the case, the significant five-year 37% net income growth reported by Chevron comes as a pleasant surprise. Therefore, there could be other causes behind this growth. Such as - high earnings retention or an efficient management in place. However, not to forget, the company does have a decent ROE to begin with, just that it is lower than the industry average. So this certainly also provides some context to the high earnings growth seen by the company.

Next, on comparing Chevron's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 41% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. What is CVX worth today? The intrinsic value infographic in our free research report helps visualize whether CVX is currently mispriced by the market.

Is Chevron Making Efficient Use Of Its Profits?

Chevron has a significant three-year median payout ratio of 51%, meaning the company only retains 49% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Moreover, Chevron is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 58% of its profits over the next three years. Still, forecasts suggest that Chevron's future ROE will rise to 13% even though the the company's payout ratio is not expected to change by much.

Conclusion

Overall, we feel that Chevron certainly does have some positive factors to consider. Specifically, its respectable ROE which likely led to the considerable growth in earnings. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.