- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron Corporation (NYSE:CVX) is Worthy of Your Energy Stock Watchlist

If everyone agrees on something – expect the opposite. Such is the case with oil, reaching multi-year highs despite being condemned as a source of many environmental problems.

Thus it is necessary to keep an eye on the key players in the industry, like Chevron Corporation (NYSE: CVX), which has just released the latest earnings report.

Click here for our latest analysis on Chevron

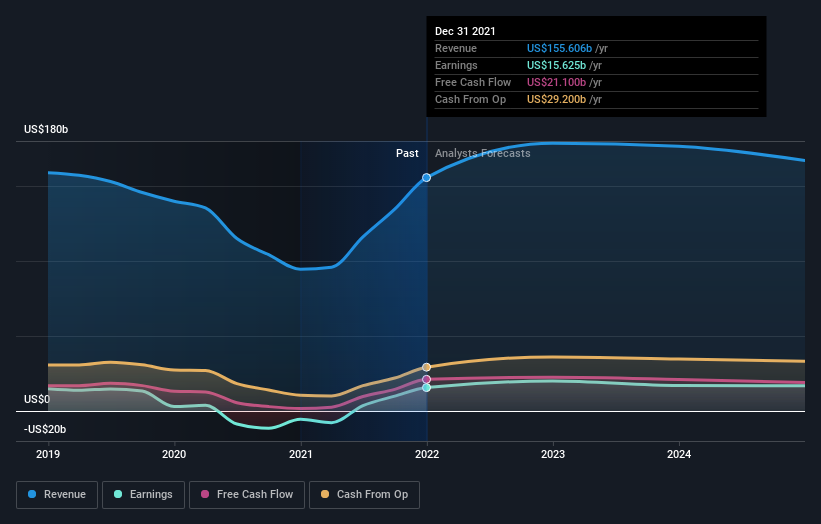

Full-year 2021 results:

- EPS: US$8.16 (up from US$2.96 loss in FY 2020).

- Revenue: US$155.6b (up 65% from FY 2020).

- Net income: US$15.6b (up US$21.2b from FY 2020).

- Profit margin: 10.0% (up from net loss in FY 2020). The move to profitability was driven by higher revenue.

Revenue exceeded analyst estimates by 2.2%. Earnings per share (EPS) missed analyst estimates by 2.9%. Over the next year, revenue is forecast to grow 15%, compared to a 25% growth forecast for the oil industry in the US.

Over the last 3 years, on average, earnings per share have fallen by 35% per year, but its share price has increased by 3% per year, which means it is well ahead of earnings.

The State of the Market

It is no secret that the energy sector is susceptible to geopolitical turbulences. The unstable political situation in Yemen with Houthi rebels being a threat to oil production is undoubtedly a factor.

Meanwhile, a crisis in Ukraine is influencing the prices of natural gas (Russia being the major exporter). Thus, a substitute effect drives the oil prices even higher, as evident from the oil futures that trade at a significant premium.

For example, Mar '22 futures trade at US$88, while Mar '23 futures trade at US$76.18. This premium is among the highest in the last 10 years.

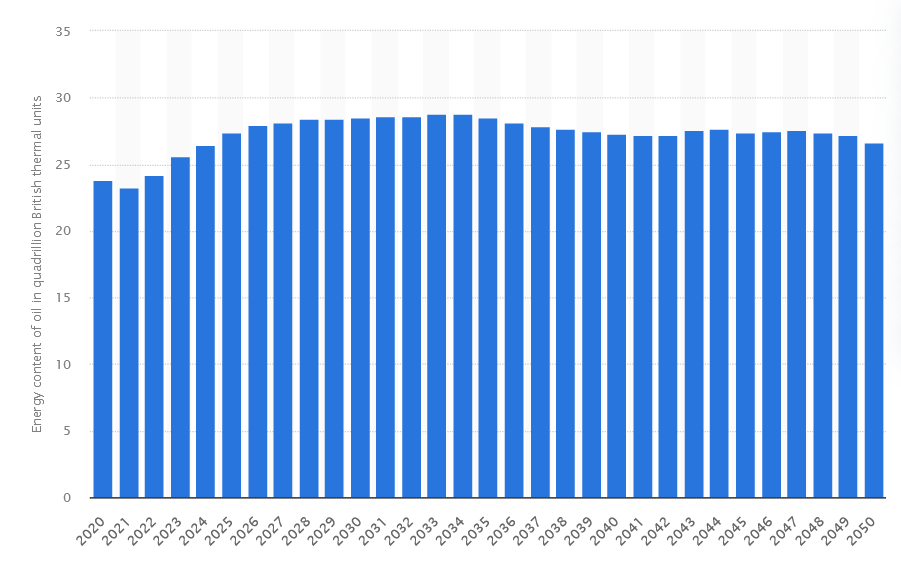

Finally, the oil industry is looking more and more like the tobacco trends in the 1990s. Criticized by the public, yet outperforming the market and paying solid dividends. According to projections, energy production from crude oil and light condensate in the U.S should remain constant for the next 30 years.

What's the opportunity in Chevron?

According to our valuation model, the stock seems fairly valued at the moment. It's trading around 7.7% below our intrinsic value, which means if you buy Chevron today, you'd be paying a reasonable price for it. And if you believe that the stock is worth $142.29, then there's not much of an upside to gain from mispricing. Is there another opportunity to buy low in the future?

Since Chevron's share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high Beta, which indicates how much the stock moves relative to the rest of the market.

What kind of growth will Chevron generate?

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Buying a great company with a robust outlook at a low price is always a good investment, so we need to consider the company's future expectations.

With a relatively muted profit growth of 7.4% expected over the next couple of years, growth doesn't seem like a key driver for a buy decision for Chevron, at least in the short term.

What this means for you:

Are you a shareholder? CVX's future growth appears to have been factored into the current share price, with shares trading around their fair value. But, there are also other essential factors that we haven't considered today, such as the company's financial strength. Have these factors changed since the last time you looked at the stock? Should the price drop below its fair value, will you have enough confidence to invest in the company?

Are you a potential investor? If you've been watching CVX, now may not be the most advantageous time to buy, given it is trading around its fair value. Yet, given the high Beta, it means that the volatility will likely give you a chance to buy at a lower price sometime in the future. The positive outlook means it's worth diving deeper into other factors, such as its balance sheet strength, to take advantage of the next price drop.

Diving deeper into the forecasts for Chevron mentioned earlier will help you understand how analysts view the stock from now on. So feel free to check out our free graph representing analyst forecasts.

If you are no longer interested in Chevron, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives