- United States

- /

- Oil and Gas

- /

- NYSE:CVI

There Is A Reason CVR Energy, Inc.'s (NYSE:CVI) Price Is Undemanding

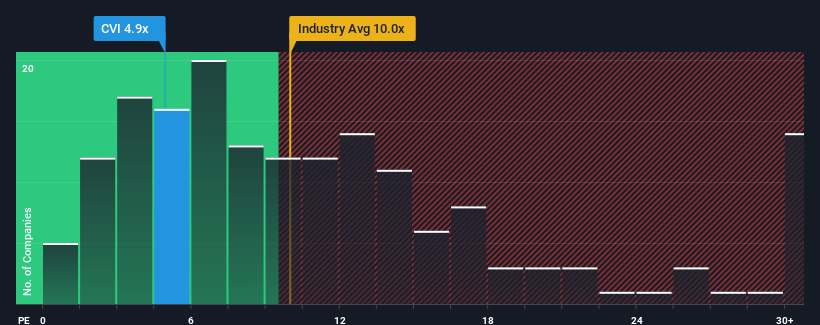

With a price-to-earnings (or "P/E") ratio of 4.9x CVR Energy, Inc. (NYSE:CVI) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

CVR Energy certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for CVR Energy

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as CVR Energy's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 66%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 46% per annum during the coming three years according to the five analysts following the company. Meanwhile, the broader market is forecast to expand by 10% each year, which paints a poor picture.

With this information, we are not surprised that CVR Energy is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On CVR Energy's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that CVR Energy maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - CVR Energy has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on CVR Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives