- United States

- /

- Oil and Gas

- /

- NYSE:CVI

Forecast: Analysts Think CVR Energy, Inc.'s (NYSE:CVI) Business Prospects Have Improved Drastically

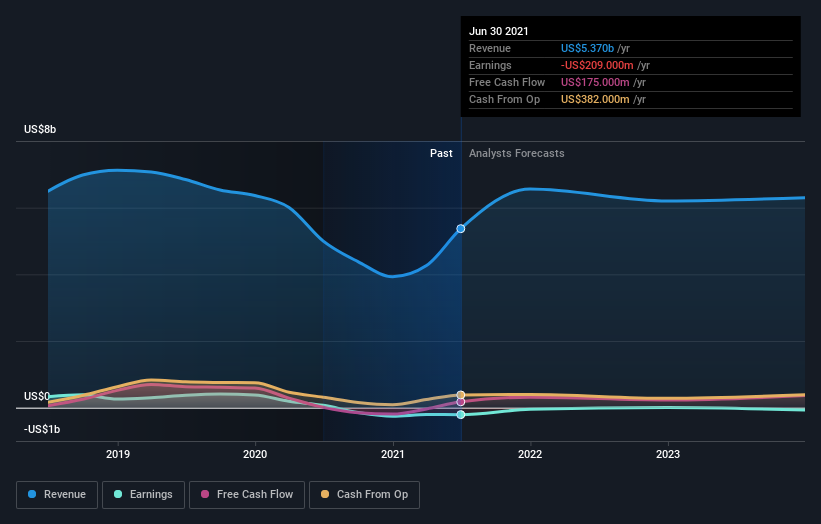

Celebrations may be in order for CVR Energy, Inc. (NYSE:CVI) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

After this upgrade, CVR Energy's six analysts are now forecasting revenues of US$6.6b in 2021. This would be a sizeable 23% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 76% to US$0.49. Yet before this consensus update, the analysts had been forecasting revenues of US$5.6b and losses of US$1.11 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

See our latest analysis for CVR Energy

The consensus price target fell 14%, to US$16.91, suggesting that the analysts remain pessimistic on the company, despite the improved earnings and revenue outlook. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic CVR Energy analyst has a price target of US$25.03 per share, while the most pessimistic values it at US$13.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. For example, we noticed that CVR Energy's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 51% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 0.5% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 1.4% per year. Not only are CVR Energy's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting CVR Energy is moving incrementally towards profitability. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. A lower price target is not intuitively what we would expect from a company whose business prospects are improving - at least judging by these forecasts - but if the underlying fundamentals are strong, CVR Energy could be one for the watch list.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple CVR Energy analysts - going out to 2023, and you can see them free on our platform here.

You can also see our analysis of CVR Energy's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

When trading CVR Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives