- United States

- /

- Oil and Gas

- /

- NYSE:CVI

CVR Energy (CVI): Exploring Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

CVR Energy (CVI) has drawn fresh attention as its stock saw meaningful swings in recent trading sessions. Investors are taking note of both company fundamentals and shifting sector sentiment as they look for clues about where it might head next.

See our latest analysis for CVR Energy.

After a significant run-up throughout the year, CVR Energy’s recent share price gains suggest investor optimism is still strong, with shares up 93% year-to-date and climbing another 5.8% this week alone. The company’s one-year total shareholder return of nearly 52% highlights its status as a standout in a volatile market, helping to fuel momentum as investors re-evaluate its long-term potential in light of sector shifts.

If the pace of these moves has you asking what other opportunities are out there, now's a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

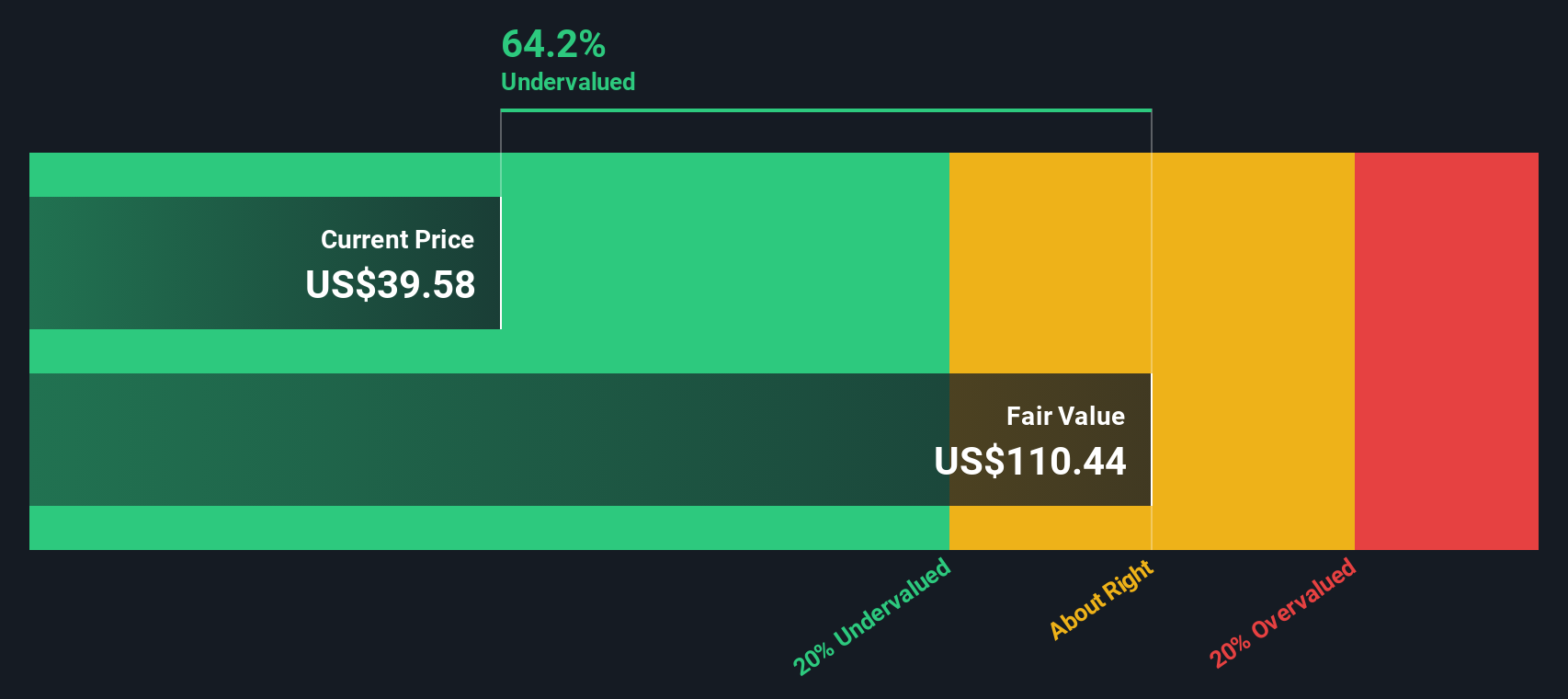

But with shares soaring past analyst price targets and gains outpacing earnings growth, the big question now is whether CVR Energy remains undervalued or if the market is already pricing in the company’s future growth prospects.

Most Popular Narrative: 35.2% Overvalued

Based on the most followed narrative, CVR Energy’s estimated fair value sits far below its current closing price. This points toward aggressive market optimism that may be tough to sustain. This gap invites a closer look at what could be fueling such an ambitious outlook.

The completion of the Coffeyville refinery's distillate recovery project is expected to boost distillate yield by approximately 2% by the end of the third quarter. Increased production capabilities could enhance revenue and profitability through higher product yields and lower RIN obligations.

Want to know the logic behind a price tag soaring above today's market level? The narrative hinges on bold future earnings, rising profit margins, and a bet that efficiency gains will defy industry trends. Which key forecasts are driving this calculation? Read on for the behind-the-scenes financial story that is creating this valuation shock.

Result: Fair Value of $26.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent quarterly losses and uncertain regulatory conditions could quickly alter growth projections and challenge the positive narrative. This could potentially shift market sentiment.

Find out about the key risks to this CVR Energy narrative.

Another View: Discounted Cash Flow Upside

While analysts see CVR Energy as overvalued based on market multiples, our SWS DCF model presents a different perspective. By projecting future cash flows, this method estimates a fair value of $108.24, which is significantly above the current share price. Does this suggest the market is missing something, or is it being cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CVR Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CVR Energy Narrative

If the popular narrative does not match your perspective, take the opportunity to dig into the data and develop your own angle in just a few minutes. Do it your way

A great starting point for your CVR Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Get ahead of the curve by checking out handpicked opportunities that could add fresh momentum to your strategy.

- Capture big yield potential as you browse these 17 dividend stocks with yields > 3% for robust returns in income-focused portfolios.

- Tap into tomorrow’s breakthroughs by reviewing these 26 AI penny stocks that could benefit from advances in machine learning, automation, and artificial intelligence.

- Boost your search for value plays by sifting through these 871 undervalued stocks based on cash flows with attractive prospects based on future cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVI

CVR Energy

Engages in renewable fuels and petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives