- United States

- /

- Oil and Gas

- /

- NYSE:CTRA

Persistent Analyst Optimism Ahead of Q3 2025 Earnings Could Be a Game Changer for Coterra Energy (CTRA)

Reviewed by Sasha Jovanovic

- In recent days, multiple Wall Street analysts reiterated their positive outlook on Coterra Energy, emphasizing high expectations ahead of the company's Q3 2025 earnings report scheduled for November 3, with forecasts of significant profit growth over the prior year. An interesting takeaway is that despite downward adjustments in price targets by some analysts, the majority consensus continues to favor a bullish stance on the company.

- We'll examine how persistent analyst optimism ahead of earnings could further validate or challenge Coterra's projected growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Coterra Energy Investment Narrative Recap

To be a shareholder in Coterra, you need to believe that its diversified production, cost discipline, and capital returns will deliver solid value through commodity cycles, even as natural gas price volatility and operational risks remain front of mind. The recent wave of analyst price target adjustments and ratings changes does not materially alter the key near-term catalyst: the upcoming Q3 earnings report, with the main risk still centered on sustained weak natural gas prices potentially compressing margins. Among the latest announcements, UBS’s revised price target of US$29, while maintaining a Buy rating, stands out. UBS cited operational challenges early in the year but also emphasized the outlook for improved oil volumes in the second half of 2025, directly relating to Coterra’s ability to meet full-year guidance and drive near-term performance. However, investors should be aware that...

Read the full narrative on Coterra Energy (it's free!)

Coterra Energy's outlook anticipates $9.6 billion in revenue and $1.9 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 15.5% and an increase in earnings of $0.3 billion from current earnings of $1.6 billion.

Uncover how Coterra Energy's forecasts yield a $32.29 fair value, a 42% upside to its current price.

Exploring Other Perspectives

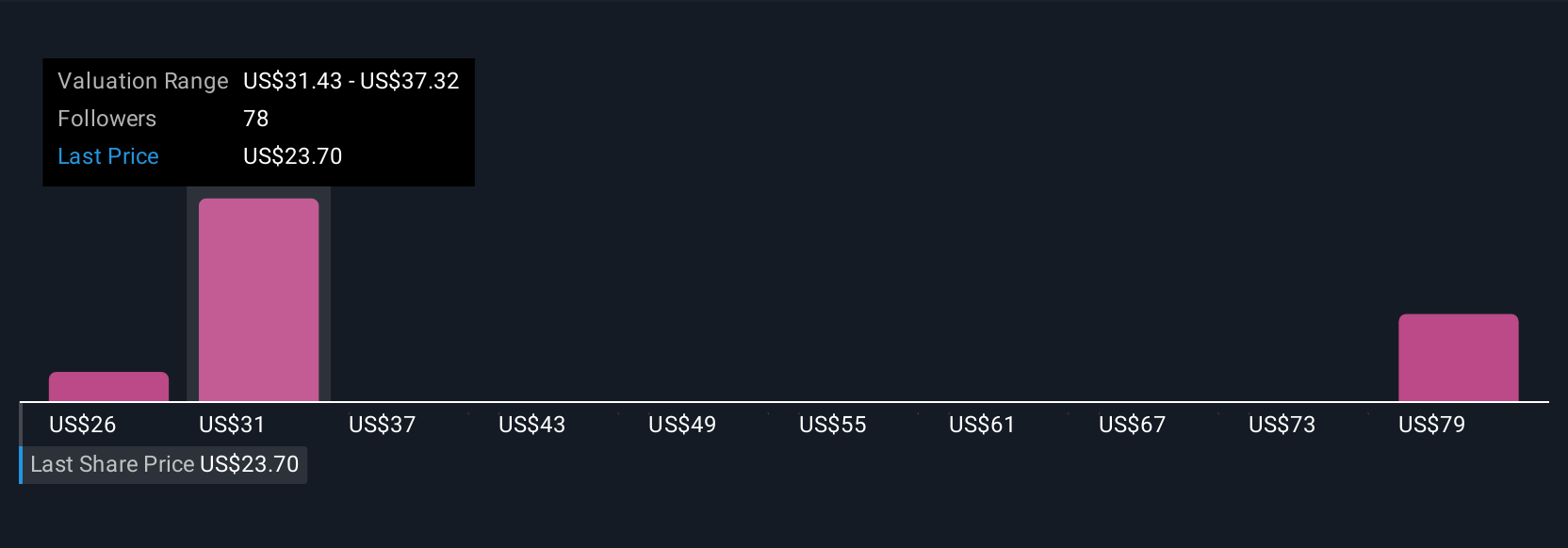

Simply Wall St Community members assigned fair values to Coterra ranging from US$25.55 to US$87.41, with seven unique viewpoints included. Strong production growth and disciplined capital allocation are front of mind for many, yet concerns over natural gas price weakness continue to influence sentiment and outlook.

Explore 7 other fair value estimates on Coterra Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Coterra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coterra Energy research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coterra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coterra Energy's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRA

Coterra Energy

An independent oil and gas company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives