- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Comstock Resources (CRK): Assessing Valuation as Market Sees Undervaluation and Net Income Recovery

Reviewed by Kshitija Bhandaru

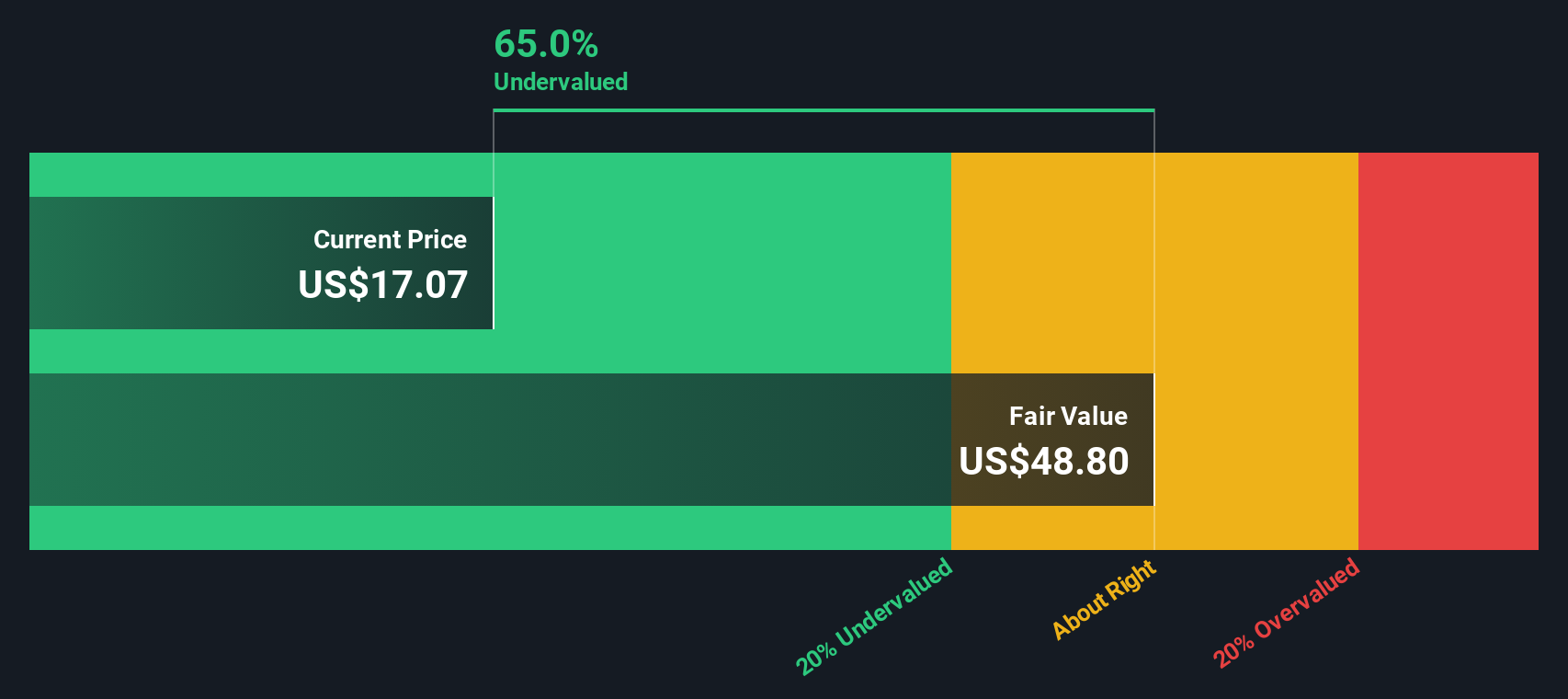

Comstock Resources (CRK) has caught some attention lately, with its stock movement reflecting renewed interest as investors weigh its significant undervaluation, strong annual revenue growth expectations, and a noticeable recovery in net income this year.

See our latest analysis for Comstock Resources.

After a relatively muted few months, Comstock Resources’ share price is starting to show signs of renewed interest, supported by optimism around its improving financial performance and undervalued status. While recent returns have not made headlines, its 1-year total shareholder return of 0.78% and impressive rebound in net income point to momentum building beneath the surface for long-term investors.

If you’re tracking companies that might be flying under the radar, now is a good opportunity to expand your search and uncover fast growing stocks with high insider ownership

With shares trading below fair value estimates and growth forecasts on the rise, the key question for investors is whether Comstock Resources is truly undervalued, or if the market is already factoring in these positive trends. This may leave little room for a buying opportunity.

Most Popular Narrative: 16% Overvalued

Comstock Resources’ most followed narrative prices the stock meaningfully above its latest closing price, projecting robust underlying potential that remains hotly debated by analysts and market watchers. This valuation is anchored on aggressive growth assumptions and efficiency improvements, raising real questions about what could fuel such premium pricing.

The company's proactive development of Western Haynesville-specific midstream infrastructure (such as a major new gas treating plant) will allow for higher production levels, improved price realizations, and increased ability to capitalize on expanding U.S. LNG export capacity, thereby supporting revenue growth.

Where does all this growth optimism come from? This narrative hides a bold bet on margin expansion and explosive earnings acceleration that could transform Comstock’s financial story. Curious how ambitious operational upgrades and future market demand got baked in? Peek under the hood to see which blockbuster financial assumptions are driving that premium fair value and what it says about the stock’s outlook.

Result: Fair Value of $18.46 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing drops in production volumes and the company’s singular reliance on the Haynesville shale could quickly shift the outlook for Comstock Resources.

Find out about the key risks to this Comstock Resources narrative.

Another View: Discounted Cash Flow Model

Looking at valuation from another angle, the SWS DCF model comes to a much different conclusion. By forecasting the company’s future cash flows, it suggests Comstock Resources is trading well below its intrinsic value. This indicates the stock might offer a significant opportunity if these assumptions are realized.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comstock Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comstock Resources Narrative

If you think the story looks different through your own research or want to dig deeper into the numbers, you can craft a personalized view of Comstock Resources in just a few minutes. Do it your way

A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart opportunities?

Don’t miss your chance to upgrade your portfolio. Simply Wall Street’s screeners are packed with winning investment ideas that can help you get ahead.

- Get ahead of the wave by scanning these 896 undervalued stocks based on cash flows and pinpoint companies trading below their true worth before the market catches on.

- Tap into unstoppable innovation with these 24 AI penny stocks that are harnessing artificial intelligence for rapid growth and industry transformation.

- Capture consistent income potential by reviewing these 19 dividend stocks with yields > 3% offering attractive yields and a track record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives