- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Are Shifting Natural Gas Prices Reshaping Comstock Resources' (CRK) Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent days, Comstock Resources has attracted attention after one analyst maintained a hold rating, with no significant changes in company fundamentals or major new initiatives reported.

- The company's recent volatility appears tied to shifts in natural gas prices and broader market pressures stemming from renewed US-China trade tensions.

- We'll look at how recent natural gas price swings and global trade tensions weigh on Comstock's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Comstock Resources Investment Narrative Recap

For investors considering Comstock Resources, the key conviction centers on the long-term value of its Western Haynesville acreage and its ability to scale production to meet rising natural gas demand. The recent analyst hold rating, along with the sharp drop in share price tied to volatile gas prices and market uncertainty from US-China trade tensions, does not materially change the near-term outlook. Comstock’s primary short-term catalyst remains sensitivity to natural gas pricing, while the greatest risk is the company’s heavy concentration in the Haynesville region.

With no major new initiatives recently announced, the upcoming Q3 2025 earnings release stands out as potentially the most relevant event for investors, especially as recent volatility puts greater focus on the company's ability to manage production headwinds and cost controls. This report will likely be scrutinized for updates on production volumes and capital allocation, which directly affect Comstock’s exposure to commodity price swings and execution risks.

Yet, despite recent volatility, investors should be aware that a single region focus can expose results to sudden shifts in...

Read the full narrative on Comstock Resources (it's free!)

Comstock Resources' narrative projects $2.5 billion revenue and $733.2 million earnings by 2028. This requires 14.6% yearly revenue growth and a $805.8 million increase in earnings from the current $-72.6 million.

Uncover how Comstock Resources' forecasts yield a $18.46 fair value, a 6% downside to its current price.

Exploring Other Perspectives

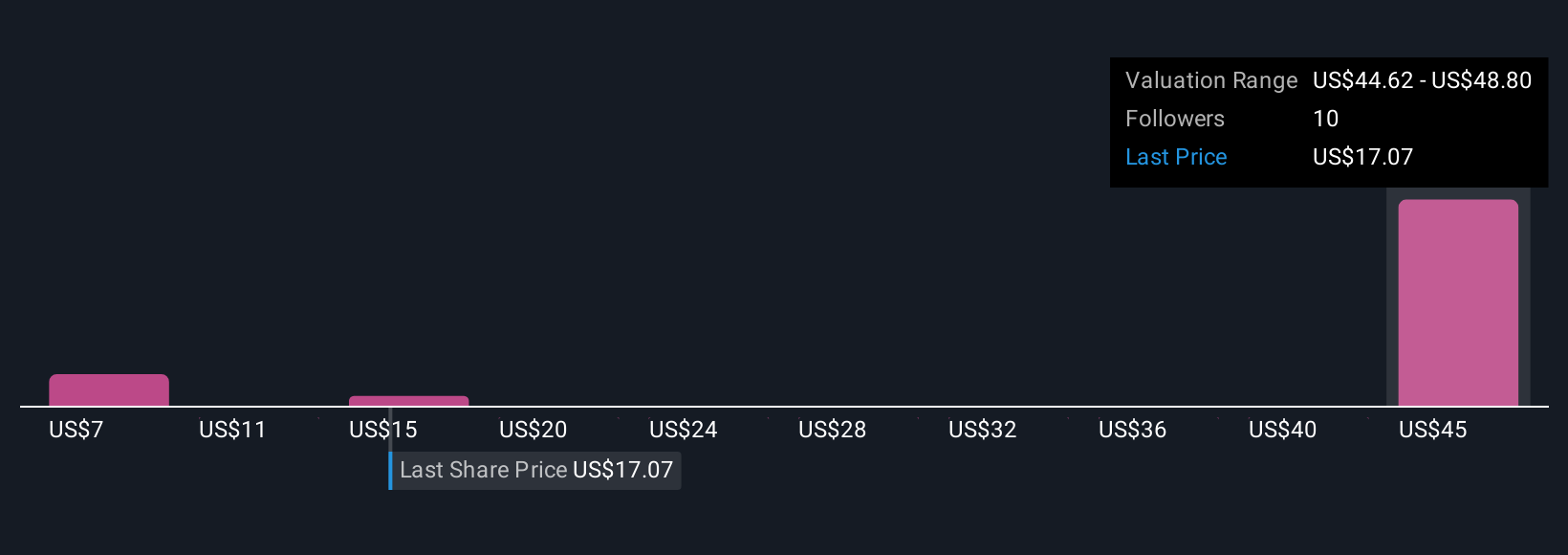

Four community-sourced estimates of Comstock’s fair value range widely from US$6.97 to US$32.43 per share, reflecting sharply varied individual outlooks. While some see strong upside, many investors remain focused on the risk that heavy regional production concentration could amplify earnings swings as market forces change.

Explore 4 other fair value estimates on Comstock Resources - why the stock might be worth as much as 66% more than the current price!

Build Your Own Comstock Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comstock Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comstock Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives