- United States

- /

- Oil and Gas

- /

- NYSE:CRC

California Resources' (NYSE:CRC) Dividend Will Be Increased To $0.3875

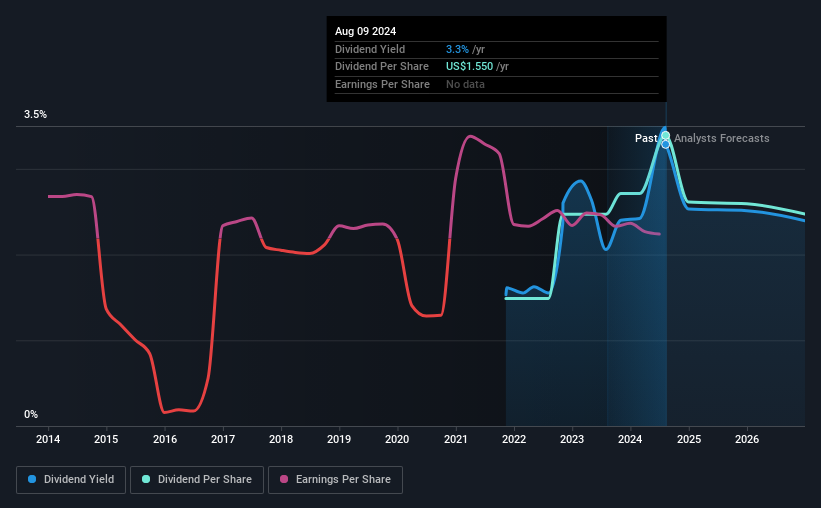

California Resources Corporation (NYSE:CRC) will increase its dividend from last year's comparable payment on the 16th of September to $0.3875. This takes the annual payment to 3.3% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for California Resources

California Resources' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Based on the last payment, California Resources was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 181.6%. If the dividend continues on this path, the payout ratio could be 30% by next year, which we think can be pretty sustainable going forward.

California Resources Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The annual payment during the last 3 years was $0.68 in 2021, and the most recent fiscal year payment was $1.55. This means that it has been growing its distributions at 32% per annum over that time. California Resources has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. California Resources' EPS has fallen by approximately 24% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We should note that California Resources has issued stock equal to 29% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think California Resources is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 5 warning signs for California Resources that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRC

California Resources

Operates as an independent energy and carbon management company in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives