- United States

- /

- Oil and Gas

- /

- NYSE:CPE

Callon Petroleum Company's (NYSE:CPE) Price Is Right But Growth Is Lacking

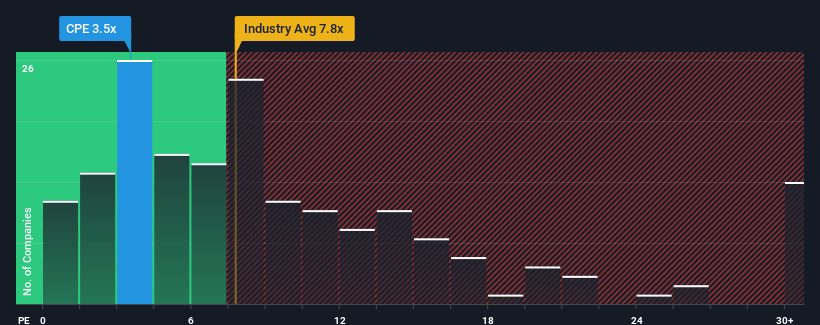

Callon Petroleum Company's (NYSE:CPE) price-to-earnings (or "P/E") ratio of 3.5x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Callon Petroleum has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Callon Petroleum

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Callon Petroleum's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 28% over the next year. With the market predicted to deliver 10% growth , that's a disappointing outcome.

In light of this, it's understandable that Callon Petroleum's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Callon Petroleum's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Callon Petroleum maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Callon Petroleum is showing 4 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Callon Petroleum, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CPE

Callon Petroleum

Callon Petroleum Company, an independent oil and natural gas company, focuses on the acquisition, exploration, and development of oil and natural gas properties in West Texas.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives