- United States

- /

- Oil and Gas

- /

- NYSE:COP

ConocoPhillips (COP) Is Up 6.9% After Potential Citgo Auction Windfall News Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- A U.S. judge previously approved the sale of shares in Citgo Petroleum’s parent, PDV Holding, to an Elliott Investment Management affiliate, subject to U.S. Treasury approval and ongoing legal challenges from Venezuela-linked parties.

- If the transaction ultimately proceeds, ConocoPhillips could receive meaningful proceeds from the Citgo-related auction, potentially adding incremental financial flexibility on top of its already strengthened portfolio.

- We’ll now examine how the potential Citgo auction windfall might influence ConocoPhillips’ investment narrative around free cash flow and capital allocation.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ConocoPhillips Investment Narrative Recap

To own ConocoPhillips, you need to be comfortable tying your returns to long-lived oil and gas projects and disciplined cash returns, while accepting commodity and execution risk. The potential Citgo auction proceeds would be a welcome boost to financial flexibility, but they likely do not change the key near term swing factors: progress on large projects like Willow and LNG, and sensitivity to any period of weaker oil and gas prices.

The most relevant backdrop to this Citgo development is ConocoPhillips’ visible cash return profile, including its growing ordinary dividend and ongoing buybacks. Recent dividend increases and continued repurchases show how management has been using existing free cash flow; any Citgo-related windfall would simply add another lever alongside earnings from its core portfolio, rather than replace the importance of successful delivery on high capital intensity projects and planned asset sales.

But while the upside from extra cash is appealing, investors should also be aware of how heavily the company’s long term plan still leans on large, capital intensive projects that...

Read the full narrative on ConocoPhillips (it's free!)

ConocoPhillips' narrative projects $57.6 billion revenue and $10.4 billion earnings by 2028. This implies revenue will decrease by 1.0% per year and requires roughly a $1.2 billion earnings increase from $9.2 billion today.

Uncover how ConocoPhillips' forecasts yield a $112.91 fair value, a 21% upside to its current price.

Exploring Other Perspectives

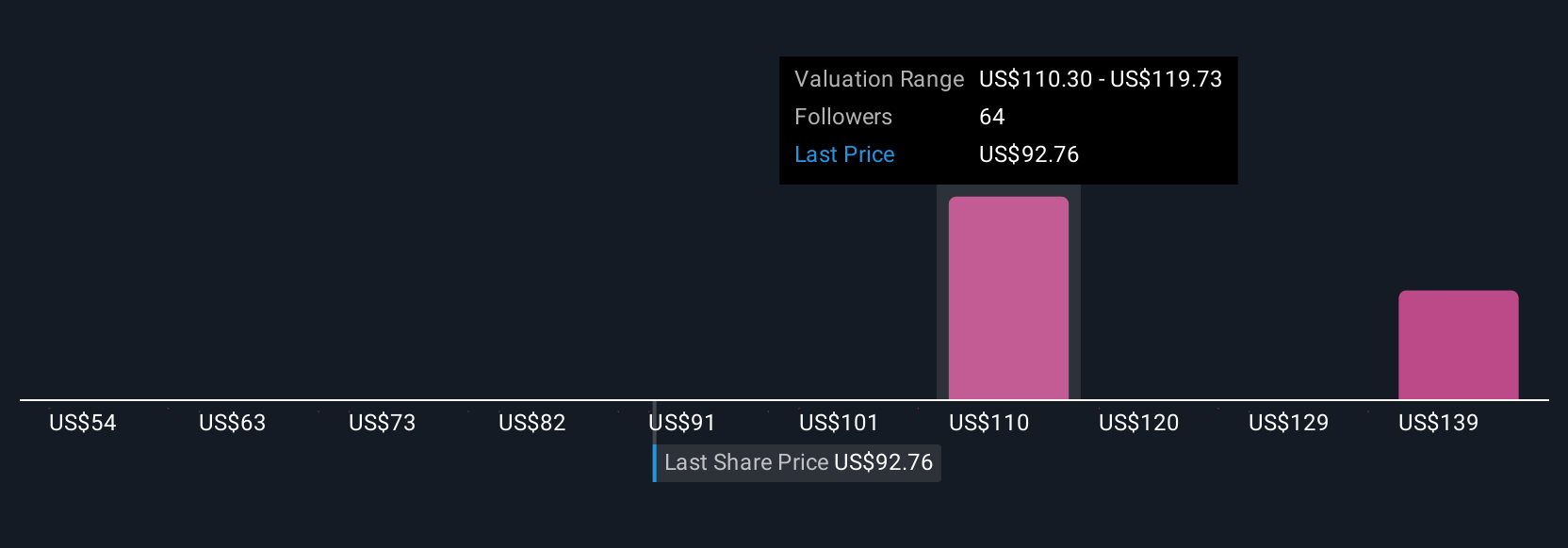

Five fair value estimates from the Simply Wall St Community span roughly US$110 to US$214 per share, underscoring how far apart individual views can be. Against that wide range, the heavy reliance on large, capital intensive projects and the execution risk around them may be a key reason to compare several different viewpoints on ConocoPhillips’ future performance.

Explore 5 other fair value estimates on ConocoPhillips - why the stock might be worth over 2x more than the current price!

Build Your Own ConocoPhillips Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ConocoPhillips research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ConocoPhillips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ConocoPhillips' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026