- United States

- /

- Oil and Gas

- /

- NYSE:CNX

What Do Recent Energy Price Swings Mean for CNX Resources in 2025?

Reviewed by Bailey Pemberton

If you have been watching CNX Resources, you are definitely not alone. The stock has seen its share of twists and turns, and deciding what to do next can feel like you are at a crossroads. Over the past year, CNX is down 8.3%, and its year-to-date return sits at a disappointing -13.2%. But step back just a little, and the longer-term numbers tell a very different story, with the share price up an impressive 214.4% over the past five years. That kind of growth tends to get noticed, even if the last few months have been a bit choppy. The stock is down 4.2% in the past week and up 7.7% over the last month.

What explains this volatility? Much of it comes down to broader market developments, shifting energy prices, and changing investor attitudes toward natural gas producers like CNX Resources. When the market sees opportunities or perceives less risk in the energy sector, stocks like CNX can swing strongly in either direction. For those trying to make an informed choice, valuation becomes front and center.

Right now, CNX Resources earns a valuation score of 2 out of 6. That means it looks undervalued by just two of the six major valuation checks, which suggests there may be opportunities here, but also that some caution is warranted. To help you see the full picture, let's break down the different ways to value CNX, and later on, I'll share an even better way to get a clear answer on the company's true worth.

CNX Resources scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CNX Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation technique that estimates a company's worth by projecting its future cash flows and then discounting them to reflect their value in today's dollars. By focusing on actual cash generated by the business, rather than profits or book value, the DCF method aims to gauge the true economic value of a company.

For CNX Resources, the most recently reported Free Cash Flow sits at $401.6 million. Analysts provide detailed forecasts up to 2028, when cash flows are expected to reach $780 million. Beyond the five-year analyst window, Simply Wall St extends projections, with estimated Free Cash Flow continuing to climb gradually into the next decade. The projections call for steady, but not explosive, growth in annual cash generation.

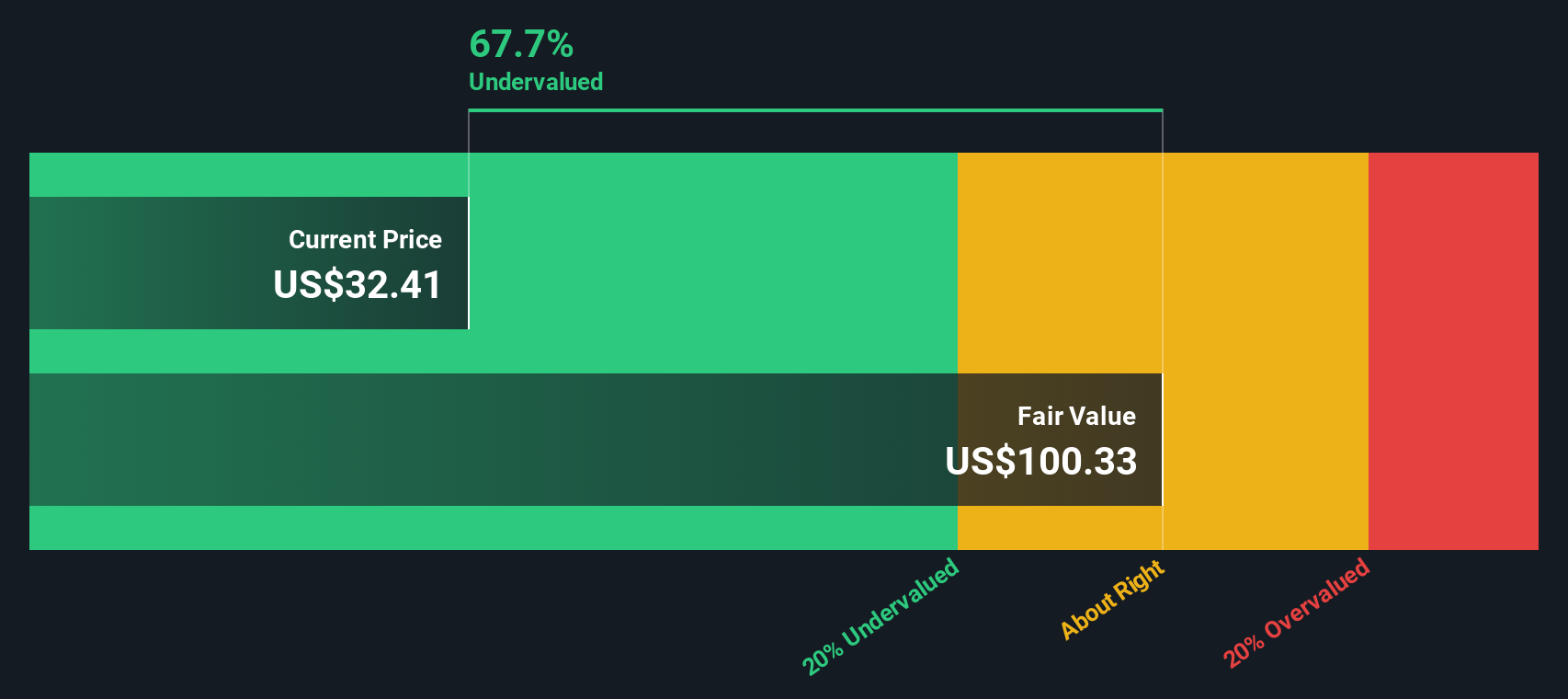

According to the DCF valuation using a 2 Stage Free Cash Flow to Equity model, CNX Resources has an estimated intrinsic value of $100.33 per share. This figure sits well above the current trading price and implies the stock is currently trading at a 67.7% discount to its calculated fair value.

In short, the DCF model suggests that CNX Resources is significantly undervalued at current levels if the cash flow projections hold up in practice.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CNX Resources is undervalued by 67.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CNX Resources Price vs Earnings

For profitable companies like CNX Resources, the Price-to-Earnings (PE) multiple is a widely accepted metric for valuation. The PE ratio represents how much investors are willing to pay for each dollar of a company's earnings, offering a quick way to assess whether a stock looks expensive or cheap relative to its profits.

Determining what counts as a "normal" or "fair" PE ratio depends on multiple factors. Companies with strong growth prospects, higher profitability, or lower risk profiles can often justify higher PE ratios. Conversely, riskier or slower-growing companies generally trade at lower PE multiples compared to their peers.

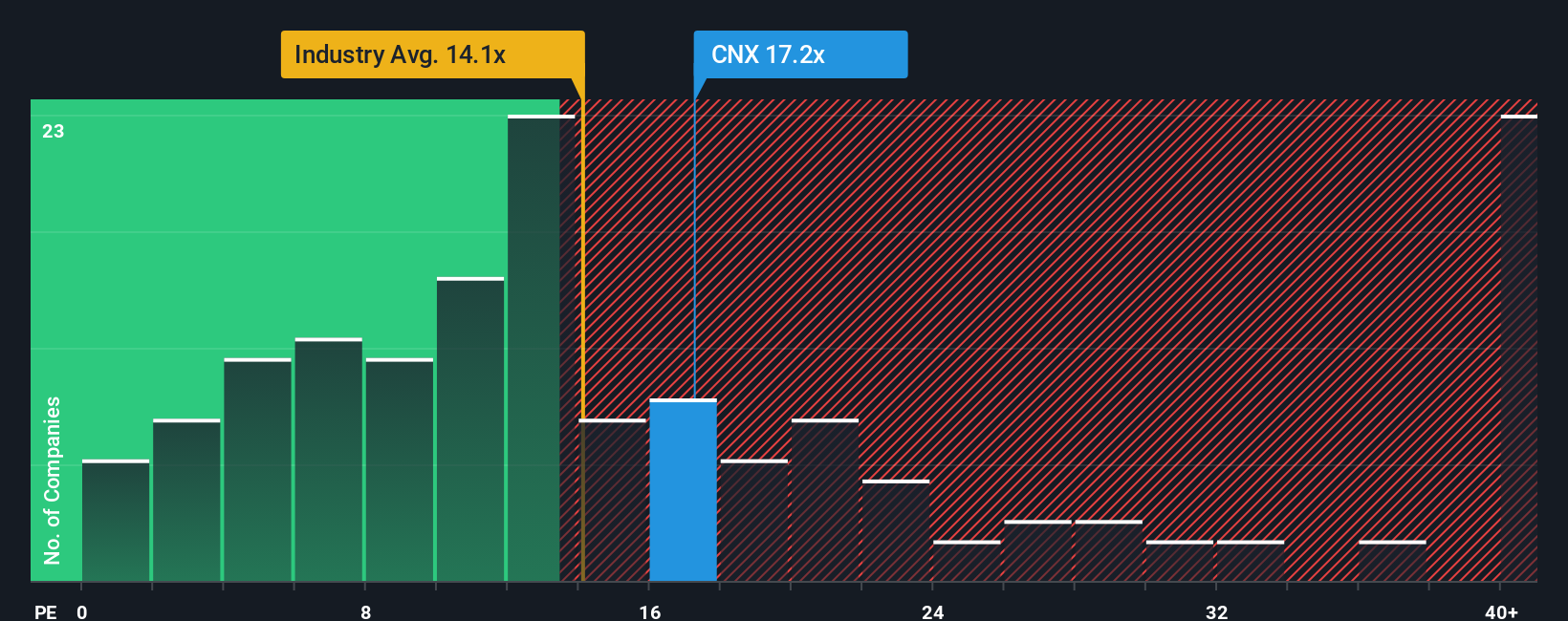

Currently, CNX Resources trades at a PE ratio of 29.43x. For context, the Oil and Gas industry average sits at 13.10x, while the average among its peers is 13.77x. This means CNX is trading at more than double the industry and peer averages, which might initially seem expensive.

This is where Simply Wall St's Fair Ratio comes into play. The Fair Ratio, calculated at 25.04x, is a proprietary metric that considers not just earnings, but also CNX's earnings growth outlook, profit margins, industry trends, market capitalization, and risk profile. This holistic approach provides a more nuanced benchmark than simply comparing multiples to peers or industry averages, as it adjusts for factors that are unique to each company.

Comparing the current PE ratio of 29.43x with the Fair Ratio of 25.04x, CNX Resources appears somewhat overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CNX Resources Narrative

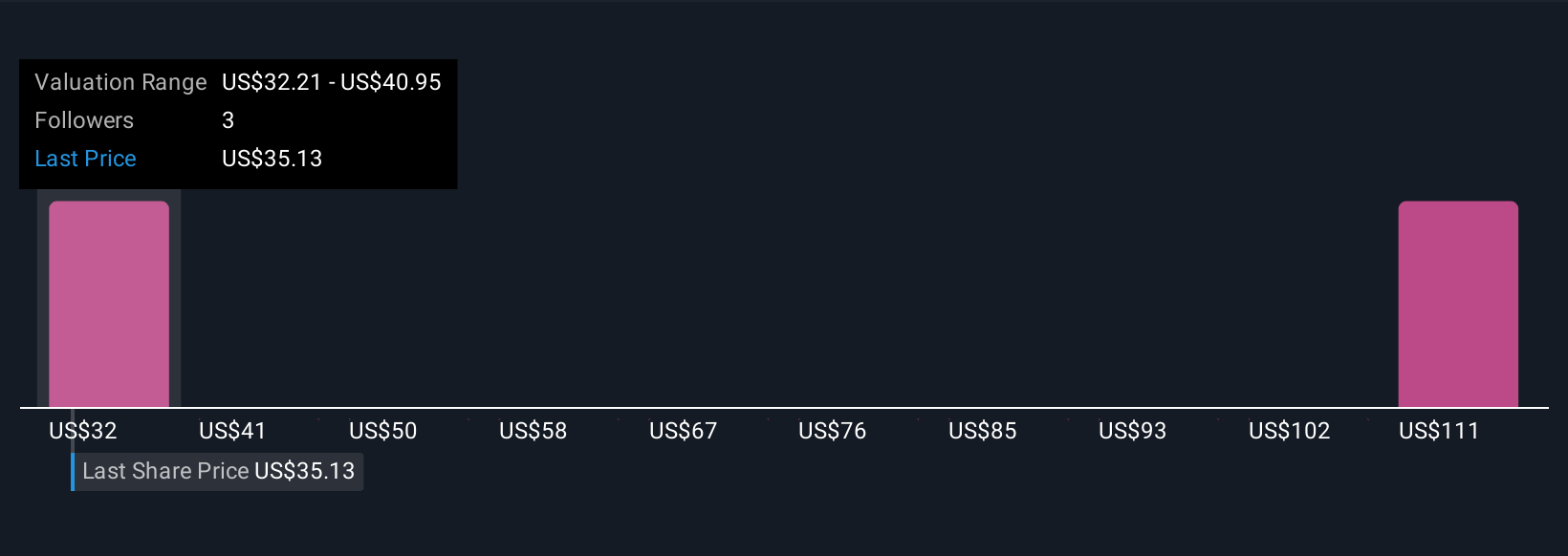

Earlier we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your personalized story behind a company. It reflects your perspective on what will drive its future, how its financials will evolve, and ultimately, what you think it’s really worth.

With Narratives, you connect CNX Resources’ business outlook directly to numbers by mapping your own expectations for revenue, earnings, and margins to a fair value. Narratives are easy to explore and update right on the Simply Wall St platform’s Community page, where millions of investors share, revise, and compare their perspectives dynamically as new news or earnings are released.

These interactive Narratives let you decide whether to buy, hold, or sell by comparing your calculated fair value against the current price. This gives you a living, decision-making tool as market realities shift. For example, one investor’s Narrative for CNX Resources might factor in rapid clean gas demand growth and predict a fair value as high as $41.00. A more cautious viewpoint might yield a target as low as $24.00, reflecting different takes on risk, growth, and industry change.

Do you think there's more to the story for CNX Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion