- United States

- /

- Oil and Gas

- /

- NYSE:CNX

CNX Resources (CNX) Is Up 5.5% After Q3 Earnings Beat And Announcing New CEO Transition

Reviewed by Sasha Jovanovic

- CNX Resources recently posted Q3 2025 results that surpassed expectations, with earnings per share of US$1.21 on revenue of US$583.8 million, and announced that Everett Good will become CFO while Alan Shepard will take over as President and CEO from 1 January 2026.

- This combination of stronger-than-expected operating performance and upcoming leadership changes has sharpened investor focus on how management will shape CNX Resources' next phase of growth and capital allocation.

- Next, we’ll examine how the strong earnings surprise, alongside the incoming CEO transition, reshapes CNX Resources’ broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CNX Resources Investment Narrative Recap

To own CNX Resources, you need to believe in its ability to convert Appalachian gas reserves and emerging environmental credits into resilient free cash flow, despite cyclical pricing and regulatory uncertainty. The Q3 2025 earnings beat and 52 week high support the near term catalyst of stronger cash generation, but the sharp rise in short interest and ongoing questions around the reliability of tax credit and attribute revenue remain key risks.

The upcoming transition to Alan Shepard as President and CEO, alongside Everett Good as CFO from 1 January 2026, ties directly into this story, because execution on capital allocation and project pacing will shape how effectively CNX turns current production gains into sustainable returns. With the stock trading above the consensus analyst price target, leadership’s ability to manage volatility in environmental credit markets will likely be watched even more closely.

Yet behind the strong quarter and leadership changes, investors should still be aware of how dependent parts of the CNX thesis are on evolving tax credit and environmental attribute rules...

Read the full narrative on CNX Resources (it's free!)

CNX Resources' narrative projects $2.3 billion revenue and $859.1 million earnings by 2028. This implies 8.9% yearly revenue growth and an earnings increase of about $703 million from $155.7 million today.

Uncover how CNX Resources' forecasts yield a $33.57 fair value, a 17% downside to its current price.

Exploring Other Perspectives

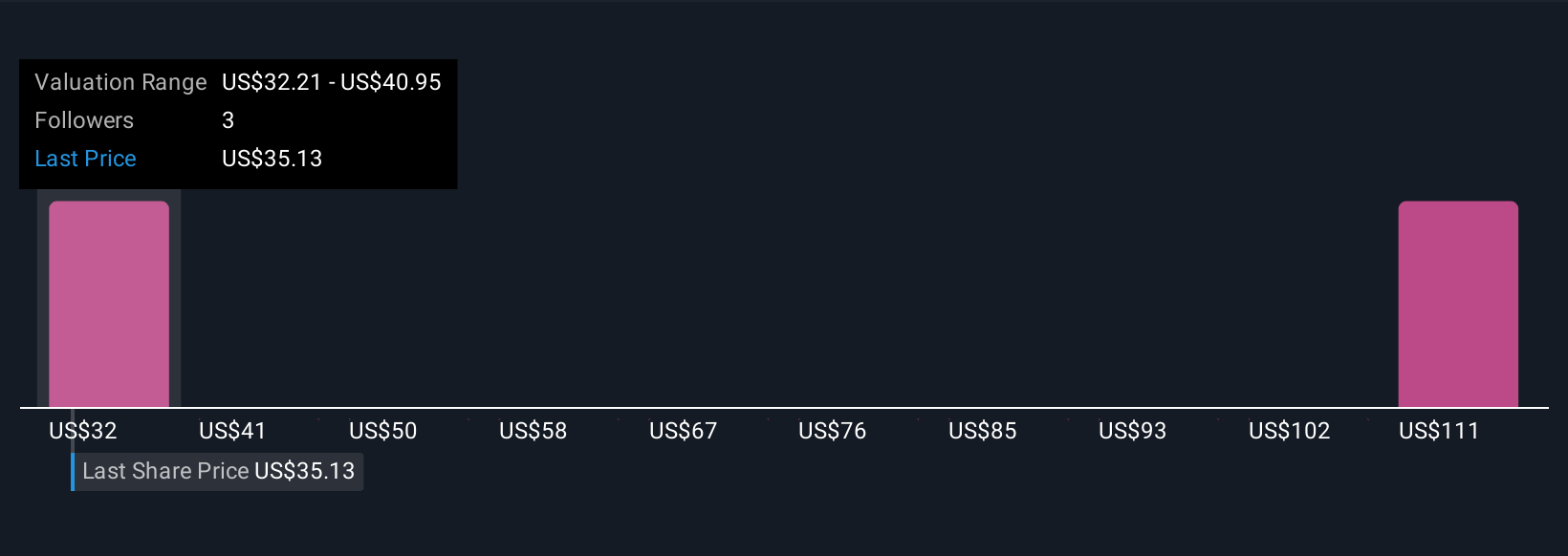

Two members of the Simply Wall St Community value CNX Resources between US$33.57 and US$205.63 per share, showing how far apart individual views can be. Against that backdrop, the growing role of tax credits and environmental attributes in CNX’s story gives you another reason to compare several different scenarios before deciding how you see its longer term performance.

Explore 2 other fair value estimates on CNX Resources - why the stock might be worth 17% less than the current price!

Build Your Own CNX Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CNX Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNX Resources' overall financial health at a glance.

No Opportunity In CNX Resources?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026