- United States

- /

- Oil and Gas

- /

- NYSE:BTU

Evaluating Peabody Energy (BTU): Is There More Upside After the Recent 80% Share Price Surge?

Reviewed by Kshitija Bhandaru

Peabody Energy (NYSE:BTU) stock has seen fluctuations lately, which has prompted some investors to take a closer look at its valuation and underlying business trends. Performance over the past month and 3 months may offer new insights.

See our latest analysis for Peabody Energy.

Peabody Energy’s share price has surged 80% over the last 90 days, with momentum really picking up recently. Its one-year total shareholder return sits at 29%. The combination of rising energy prices and renewed interest in coal producers has added fuel to the rally. However, these rapid gains hint that investors’ risk perceptions could shift just as quickly if sentiment changes.

If you’re interested in companies showing this kind of strong momentum, it’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With recent gains and optimistic numbers, investors now face the critical question: is Peabody Energy still trading below its true value, or has the market already priced in most of its future growth prospects?

Most Popular Narrative: 3.5% Undervalued

Peabody Energy’s last close of $31.31 sits just below the narrative’s fair value estimate, reflecting cautious optimism about its future profit engine. Unpacking the rationale behind this premium means reviewing a set of bold quantitative assumptions, including margin leaps and top-line acceleration.

*Rapidly increasing U.S. electricity demand driven by industrial expansion and data center growth, alongside deferrals of coal plant retirements and record-low customer stockpiles, are tightening the domestic coal supply-demand balance. This supports higher sales volumes, additional long-term contracts, and improved revenue visibility for Peabody's U.S. thermal coal business.*

Curious what triggers this valuation? It’s not just momentum or energy prices. The narrative hinges on assumptions of margin lifts, volume deals, and accelerated operational wins. The numbers fueling this call might surprise even long-term coal market watchers, especially when you see what’s driving those outsized expectations. Ready to discover which aggressive projections are behind the story?

Result: Fair Value of $32.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy reversals or a significant acceleration in renewable adoption could quickly undercut Peabody Energy's bullish outlook and long-term growth assumptions.

Find out about the key risks to this Peabody Energy narrative.

Another View: Market Multiples Raise Fresh Questions

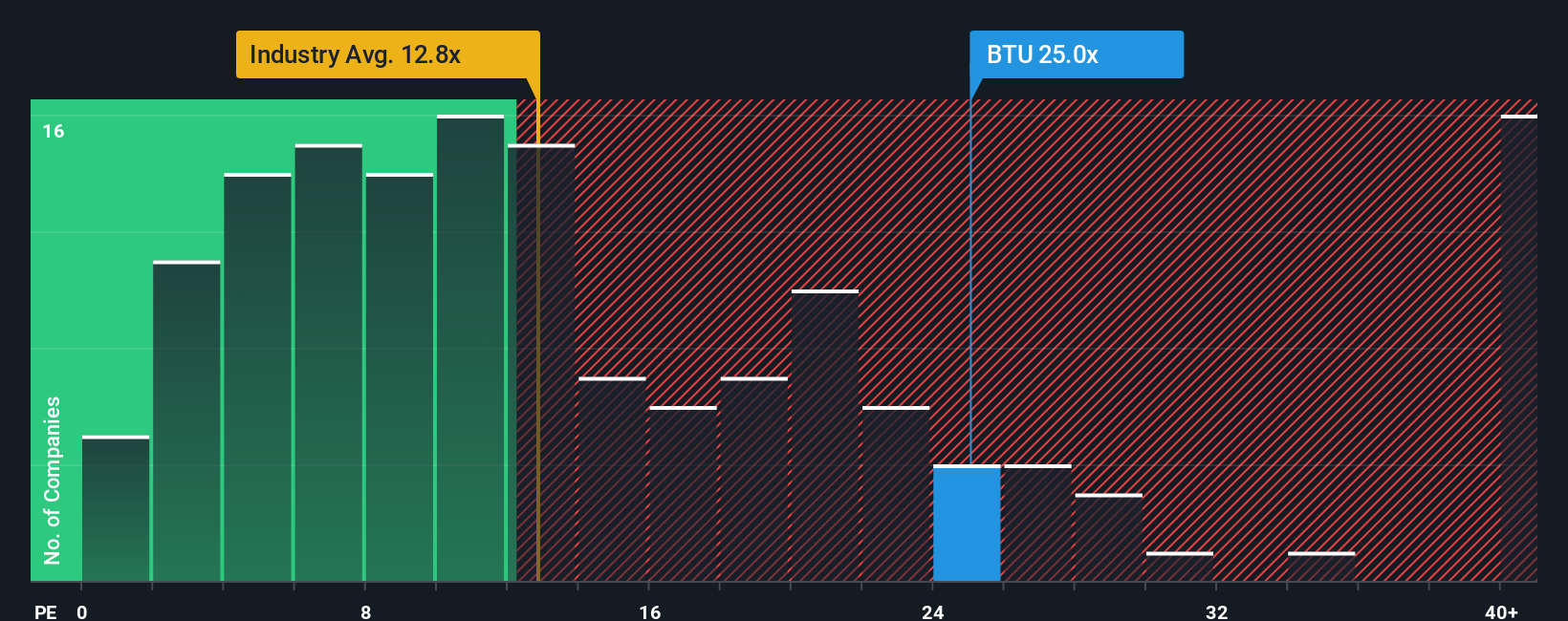

While the narrative points to undervaluation, Peabody Energy’s price-to-earnings ratio of 27x stands notably higher than both its peers at 24.9x and the US Oil and Gas industry average at 12.6x. Even compared to its fair ratio of 24.6x, the premium suggests the market could be overestimating growth or underpricing risk. Is the optimism fully justified? Could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peabody Energy Narrative

Not convinced by this view, or want to dive into the numbers yourself? It only takes a few minutes to generate your own perspective. Why not Do it your way.

A great starting point for your Peabody Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to one story when you could capture opportunities across booming sectors and emerging tech trends. Act now before these exciting opportunities pass you by.

- Tap into the potential of digital assets and join the revolution with these 79 cryptocurrency and blockchain stocks as it changes the global financial landscape.

- Unlock long-term growth and steady income by checking out these 18 dividend stocks with yields > 3% which offers yields above 3% and resilient cash flows.

- Stay ahead of the innovation curve and capitalize on breakthroughs in healthcare with these 33 healthcare AI stocks leading advancements in medical technology and AI-driven treatments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BTU

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives