- United States

- /

- Oil and Gas

- /

- NYSE:BSM

How Investors Are Reacting To Black Stone Minerals (BSM) Analyst Revisions After Q3 2025 Earnings

Reviewed by Sasha Jovanovic

- Black Stone Minerals LP recently reported its Q3 2025 earnings, following a prior quarter where the company significantly exceeded analyst earnings forecasts but missed slightly on revenue.

- Analysts have revised revenue projections lower for 2025 and 2026, even as 2025 earnings estimates have increased, highlighting a shift in market expectations around the company's financial outlook.

- We'll examine how growing anticipation around Black Stone Minerals' Q3 2025 results and shifting analyst forecasts shape its investment narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Black Stone Minerals Investment Narrative Recap

To be a shareholder in Black Stone Minerals, you need to believe in the long-term potential of its mineral and royalty model amid volatile energy markets, with catalysts hinging on operator activity and the successful ramp-up in drilling. The recent lowering of revenue outlook for 2025 and 2026, despite higher earnings estimates for 2025, does not materially alter the near-term focus, which remains on production growth and operator performance as the principal catalyst and risk, respectively.

One of the most relevant recent announcements is the expansion of Black Stone’s development agreement with Revenant Energy, intended to boost drilling in the Haynesville and Bossier acreage. This partnership feeds directly into the company’s main catalyst: increased operator activity to drive production and royalty income growth, especially with future LNG demand in mind, while investor attention stays fixed on actual delivery versus guidance.

However, even as drilling picks up, investors should be aware that if operators continue to reduce their obligations or face operational hurdles…

Read the full narrative on Black Stone Minerals (it's free!)

Black Stone Minerals is projected to reach $530.3 million in revenue and $283.0 million in earnings by 2028. This outlook relies on an anticipated 8.6% annual revenue growth rate and a $37.4 million increase in earnings from the current $245.6 million.

Uncover how Black Stone Minerals' forecasts yield a $13.00 fair value, in line with its current price.

Exploring Other Perspectives

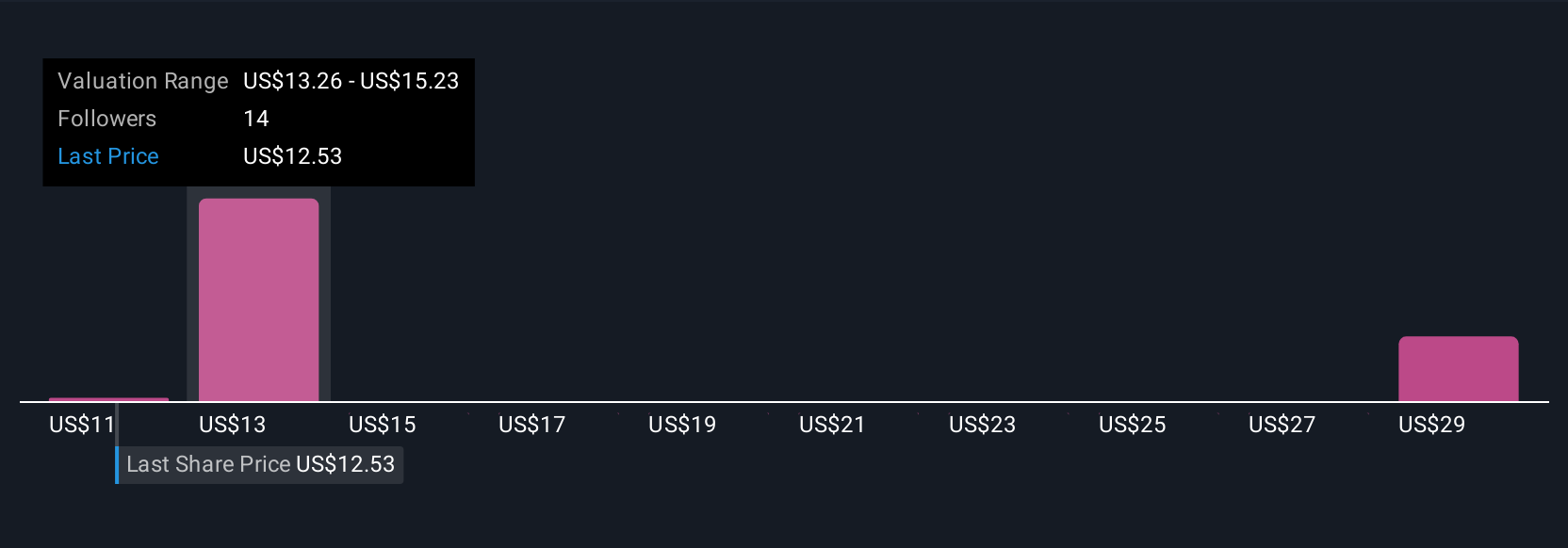

Fair value estimates from four Simply Wall St Community members range from US$11.51 to US$20.76 per unit. While investors focus on operator-driven production growth, these valuations show just how differently the company’s trajectory can be viewed across the market.

Explore 4 other fair value estimates on Black Stone Minerals - why the stock might be worth 13% less than the current price!

Build Your Own Black Stone Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Black Stone Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Stone Minerals' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives