- United States

- /

- Oil and Gas

- /

- NYSE:BSM

Are Black Stone Minerals’ Recent Land Acquisitions a Signal for Investors in 2025?

Reviewed by Bailey Pemberton

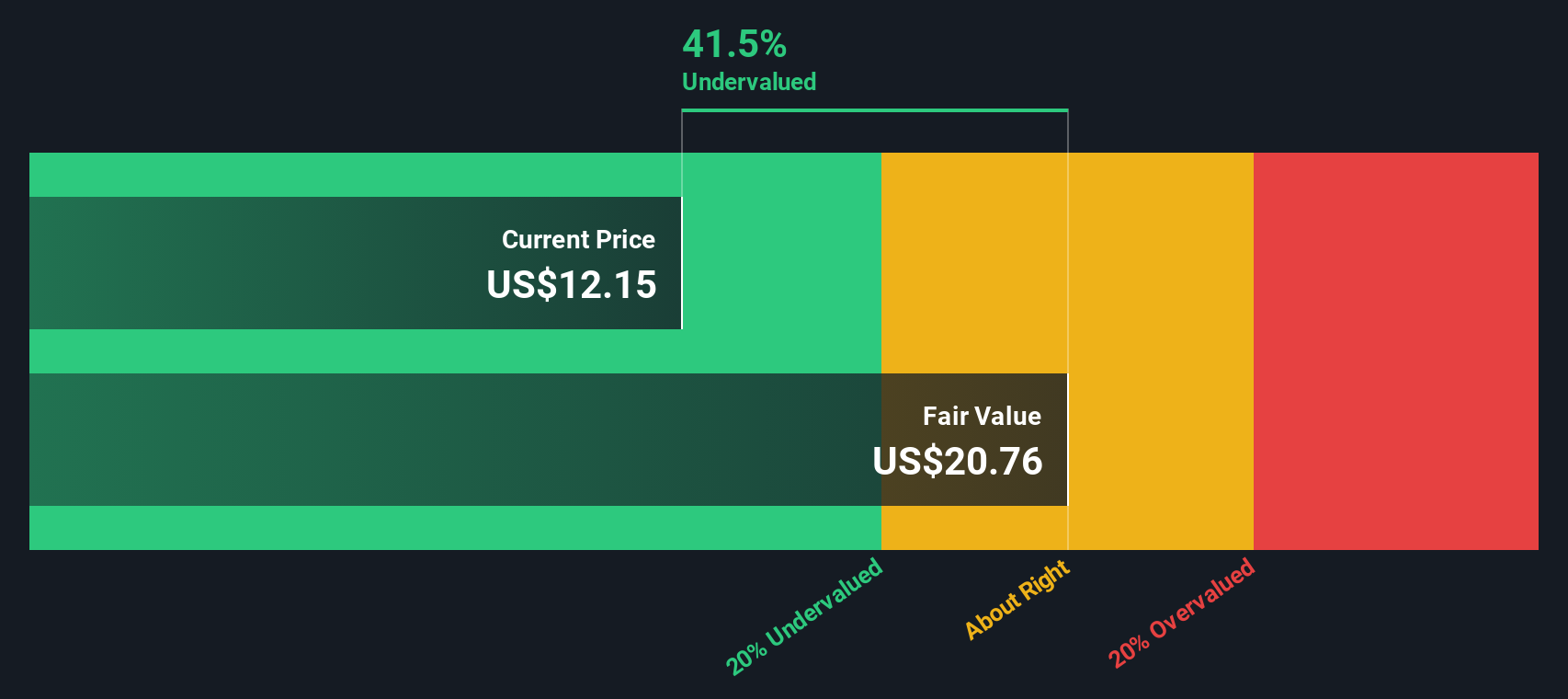

- Wondering if Black Stone Minerals is a hidden gem or just fairly priced? You’re not alone, as valuation is on a lot of investors’ minds right now.

- The stock has seen some ups and downs lately, with a -0.2% move over the past week and -10.1% year to date, despite boasting an impressive 214.6% return over the last five years.

- While headlines continue to highlight shifting energy prices and broader market uncertainty, Black Stone Minerals has drawn attention for its recent strategic land acquisitions and announced partnership developments. Both of these developments have sparked fresh debates around its long-term prospects and value.

- Right now, the company scores a 4 out of 6 on our valuation checks. This means Black Stone Minerals looks undervalued by several measures, but there is more than one way to figure out a fair price. Let’s walk through some of the most useful valuation approaches, and stick around for a look at an even smarter way to judge value at the end of the article.

Find out why Black Stone Minerals's -3.4% return over the last year is lagging behind its peers.

Approach 1: Black Stone Minerals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s expected future cash flows and then discounts them back to the present value using a required rate of return. This gives an estimate of what the business is worth if you owned all of its future cash flows today. For Black Stone Minerals, analysts use a 2 Stage Free Cash Flow to Equity model, which separates near-term and long-term cash flow growth estimates.

Currently, Black Stone Minerals generates about $277.6 Million in Free Cash Flow. While analysts provide detailed projections for as far as five years, Simply Wall St extrapolates these estimates out to a decade. By 2035, the company’s Free Cash Flow is projected to rise to $382.5 Million. Overall, the model estimates steady growth in annual cash flows, with most years showing gains of just over 3%.

Based on these projections, the implied intrinsic value of Black Stone Minerals comes in at $36.60 per share. Given the latest share price, this suggests the stock is around 64.1% undervalued according to the DCF outcome. Investors should note that all values are in US Dollars.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Black Stone Minerals is undervalued by 64.1%. Track this in your watchlist or portfolio, or discover 847 more undervalued stocks based on cash flows.

Approach 2: Black Stone Minerals Price vs Earnings (PE)

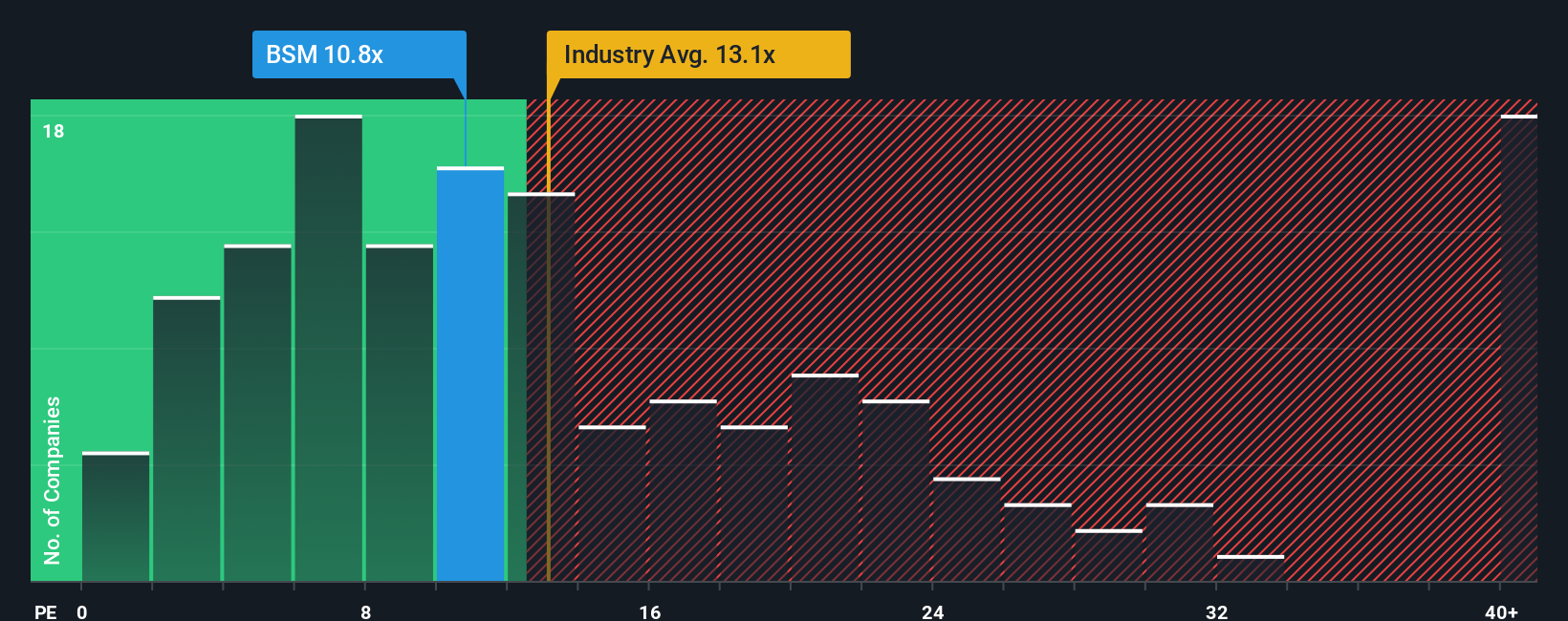

The Price-to-Earnings (PE) ratio is a staple metric for analyzing established, profitable companies like Black Stone Minerals. This multiple helps investors gauge how much they are paying for each dollar of earnings and is a reliable tool when profits are both significant and consistent.

Generally, a higher PE ratio is justified for companies with strong growth prospects or lower risk profiles. In contrast, slower growth and greater uncertainty often warrant a lower PE. Industry context matters as well. Energy sector companies often have different PE norms compared to technology or consumer sectors.

Currently, Black Stone Minerals trades at an 11.39x PE ratio. This is below the average PE of its industry, which stands at 12.84x, and also below the peer group average of 14.54x. These comparisons suggest the stock has a relatively modest valuation compared to both similar businesses and the broader sector.

However, Simply Wall St’s “Fair Ratio” for Black Stone Minerals is 16.34x. Unlike a simple industry or peer comparison, the Fair Ratio takes into account factors like earnings potential, risk, profit margin, and company size, offering a more nuanced view for long-term investors.

Putting it all together, Black Stone Minerals’ current PE is well below its Fair Ratio. This indicates the stock may be undervalued based on its earnings profile and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Black Stone Minerals Narrative

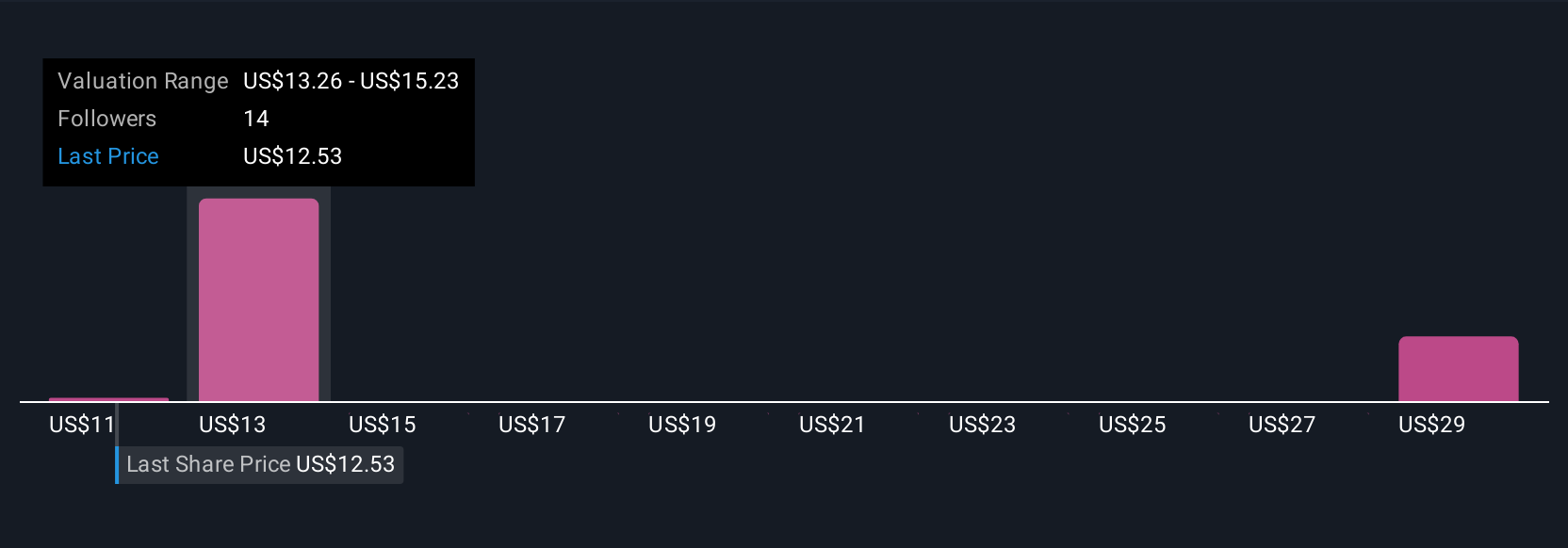

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company. It is where you connect your research, experience, and expectations to the company’s financial future. On Simply Wall St’s Community page, millions of investors use Narratives as an easy tool to set their own assumptions about Black Stone Minerals’ future revenue, dividend, and margins, tying those to a “fair value” for the stock.

Narratives help you make practical buy or sell decisions by directly comparing your fair value (based on your story and forecast) to the actual share price. The power of Narratives is that they update dynamically whenever the business or markets change. For example, new earnings releases or production guidance instantly impact your model, helping you stay in control.

For Black Stone Minerals, investors can take very different views: one Narrative might assume continued drilling expansion, operator diversification, and revenue growth, forecasting a fair value well above today’s $12.12 share price. A more cautious perspective, factoring in slower production guidance and market headwinds, could lead to a fair value closer to the $13.00 analyst consensus. Even small differences in assumptions make a big impact. Narratives let every investor reflect their own expectations, turning valuations into actionable, personal insights.

Do you think there's more to the story for Black Stone Minerals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives